As an asset class, real estate should be a part of every balanced investment portfolio. That's because real estate investments generally have a low correlation to stocks, can offer lower risk and provide greater diversification.

Today, about 65% of Americans own a home, but that means that tens of millions of Americans have no exposure to real estate. Making matters worse, becoming a homeowner today is harder than in previous generations, with one in five millennials believing they will never be able to afford a home. Is there a way to get exposure to the real estate market for as little as $100?

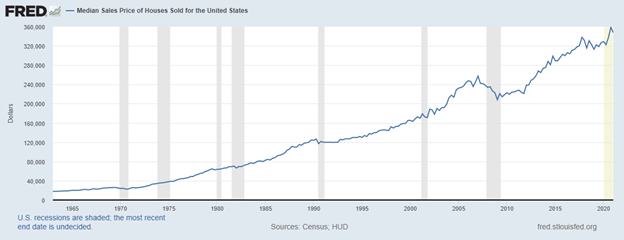

Residential Real Estate Market Trend

From the chart below, we can see that the residential real estate market continues to climb and the median price of houses sold in the U.S. is near recent all-time highs of $347,500. Even though mortgage rates remain near all-time lows, the appreciation of prices in certain pockets of the country are making many cities and areas simply unaffordable for most. Things look much the same for industrial, commercial, agricultural and most other specialized real estate sub-sectors.

How Can You Invest In Real Estate Through The Stock Market?

The stock markets offer three different ways you can invest in real estate, and today we will be looking at three of them: REITs, ETNs and ETFs.

A REIT is a real estate investment trust. Generally, it owns, manages,and/or finances income-producing real estate assets. REITs are generally highly liquid (trading like stocks) and are known to produce steady income through dividends as opposed to focusing on capital appreciation.

There are hundreds of REITs, with the most popular focused on retail, residential, health care, office and mortgages. Having REIT status enables those companies to avoid paying taxes at the corporate level, as taxes are paid by the investors when they receive distributions of income in the form of dividends.

A real estate ETN is unsecured debt of real estate assets, essentially a type of bond with a maturity date (but without interest payments). ETNs do not provide ownership of the underlying assets, but their performance is directly correlated to the performance of those assets.

Investors need to be wary that they can lose all of their ETN investment if the underlying debt goes into default. They also face closure risk if the issuer closes the ETN before maturity by paying the prevailing price in the market (potentially creating a loss for the investor). Despite these risks, some investors prefer ETNs because of the tax treatment for long-term ETN holdings.

A real estate ETF is the same as any ETF, being a basket of securities in the real estate sector that can be bought and sold on the stock market. Real estate ETFs often focus on a collection of REITs, offering investors a way to diversify their real estate bets without the torture of researching hundreds of REITs. REIT ETFs offer investors to earn dividend income like REITS while also benefiting from higher diversification and greater market liquidity, which are the hallmarks of all ETFs.

What Makes A Good REIT ETF?

First, you need to decide if you want a mortgage or equity REITs, as well as if you are looking for an objective-specific REIT (like storage facilities) or something more broad and big-picture (like residential real estate). Your REIT ETF should also have a good amount of assets under management in order to keep expense ratios down, and always check to see if the ETF you are interested in has sufficient liquidity.

The charts below show you the performance of the three largest real estate ETFs. Each of these ETFs have more than $5 billion of assets, are highly liquid and a slightly different focus in either the index they track or the real estate assets they are comprised of.

Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ)

Vanguard focuses on U.S. equity REITs with a small allocation to specialized REITs and real estate firms.

iShares U.S. Real Estate ETF (NYSE:IYR)

The iShares REIT, above, follows the Dow Jones U.S. Real Estate Index, whereas the Schwab U.S. REIT ETF™ (NYSE:SCHH) (below) follows the smaller Dow Jones U.S. Select REIT Index.

Real estate triggered a signal more than a month ago, indicating the sector to be in an uptrend. Real estate continues to be a top-performing sector, with all three of the biggest ETFs gaining more than 15% so far in 2021. In fact, more than 90% of all real estate ETFs have outperformed the S&P 500 this year. When you add in the fact that some of the REIT ETFs are also producing annual dividend rates as high as 7-8%, it becomes clear that real estate ETFs should be part of your portfolio.