- The momentum equity factor ETF underperformed sharply through early July following ill-timed rebalances

- Now, however, its biggest sector weights are the top of the class in the S&P 500

- Another small-sized momentum fund sports 17-month relative highs

A laughingstock on Wall Street was the momentum factor earlier this year. The sometimes famous, occasionally infamous, iShares MSCI USA Momentum Factor ETF (NYSE:MTUM) notched multi-year lows against the S&P 500 early in the third quarter as investors shunned areas like Energy and even parts of Health Care. Another sore spot in the broad equity space at times was Apple (NASDAQ:AAPL), the ETF’s now second-biggest position.

For background, MTUM is one of a host of so-called factor funds designed to focus on a specific niche of the stock market thought to have a track record of producing outsized risk-adjusted returns over years and decades. Like any strategy, momentum, value, size, quality, and low volatility can all go through stretches of significant underperformance. Moreover, some analysts and academics suggest now that these ETFs have hit the mainstream, any alpha they might generate will be fleeting.

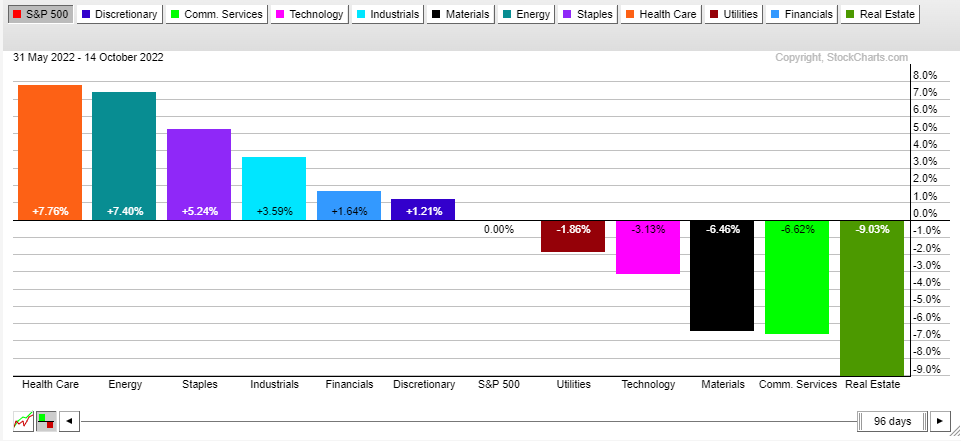

MTUM certainly caught its share of skeptics in the last year-plus due to what were seen as poorly timed rebalances. The fund shifts its holdings based on recent winning stocks at the end of each May and November. The last pair of rebalances meant weighting more to the Energy and Health Care sectors. While those groups performed softly at times in June, they have come rip-roaring back.

Source: Stockcharts.com

What’s more, MTUM has a severe underweight to the Information Technology, Communication Services, and Consumer Discretionary sectors at the moment – just 11.1% in aggregate compared to the S&P 500’s massive 45.3% weight in the growth TMT (tech, media, telecom) grouping.

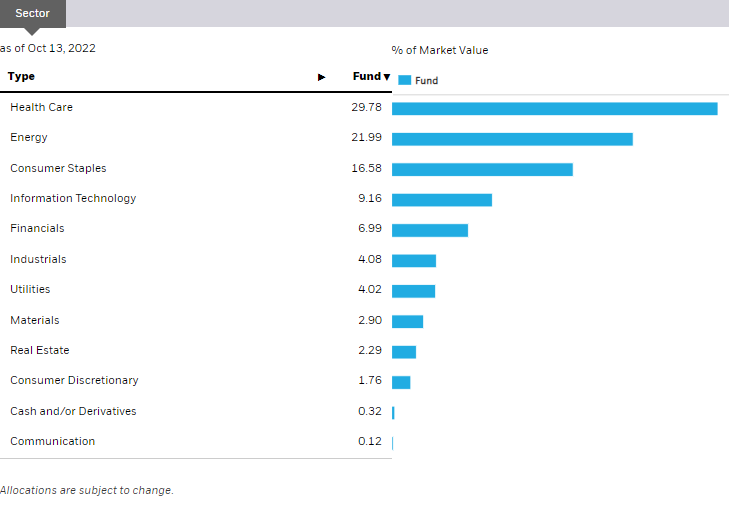

Energy And Health Care Are More Than 40% of MTUM’s Portfolio

Source: iShares

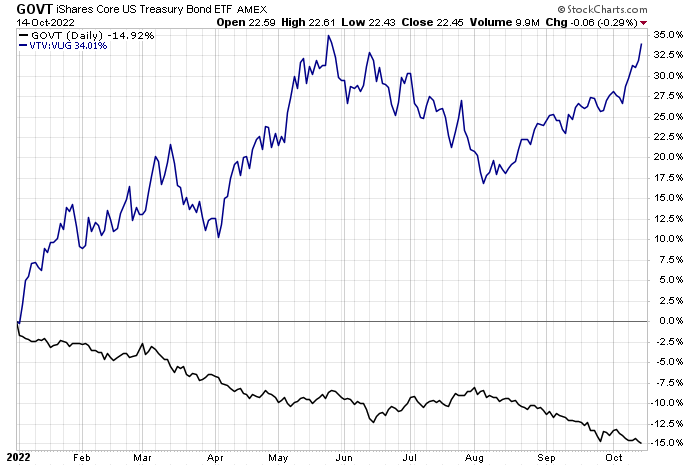

That has been the recipe for major relative success for MTUM in the last few months. Consider that the value style has stealthily rallied back near its 2022 highs since early August. There’s no doubt that rising interest rates with inflation running stubbornly high and a Fed hell-bent on crushing the rate of increase in consumer prices has brought about a renewed demand for cash flow today and not in some distant future.

Rates Rise, Value Shines

Source: Stockcharts.com

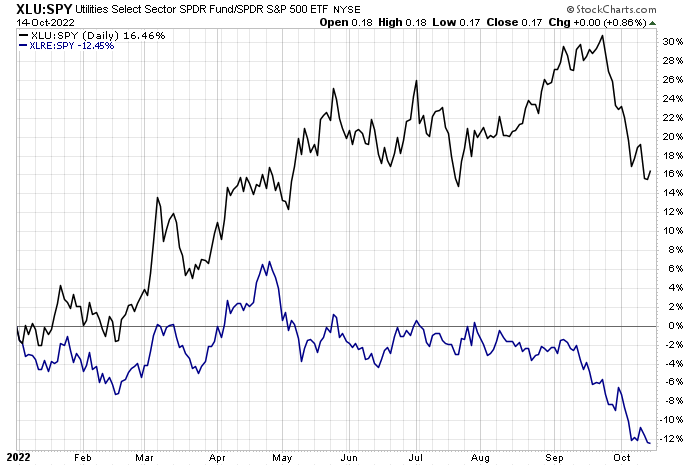

While still early, don’t look for much in the way of change in MTUM’s portfolio come late next month since value sectors continue to show strong relative momentum. What could be dumped from MTUM’s basket are shares from the struggling Real Estate and Utilities sectors. Those spots were seen as part of the safety trade periodically in 2022 but have recently gotten slaughtered in this latest spurt of higher rates.

Utilities, Real Estate Have Taken A Beating Lately

Source: Stockcharts.com

MTUM is not the only momentum game in town. You can also own the Invesco DWA Momentum ETF (NASDAQ:PDP), the SPDR® Russell 1000 Momentum Focus ETF (NYSE:ONEO), or the Vanguard U.S. Momentum Factor (NYSE:VFMO). Vanguard’s fund, for example, is more of a small-cap tilt with its nearly equal-weight approach. Last week, that fund made fresh relative highs dating back to June 2021.

The Bottom Line

This year has been all about preserving capital. While staying in cash with a bit of energy spiced in would've been a winning move throughout much of 2022, the momentum factor has had decent relative strength so far this half. Look for more upside should rates keep rising and value continue to be in favor.

Disclaimer: Mike Zaccardi holds a long position in the VFMO but does not have a position in any other securities mentioned in this article.