American stocks fell more than 1 percent on Tuesday. What does it mean for the gold market?

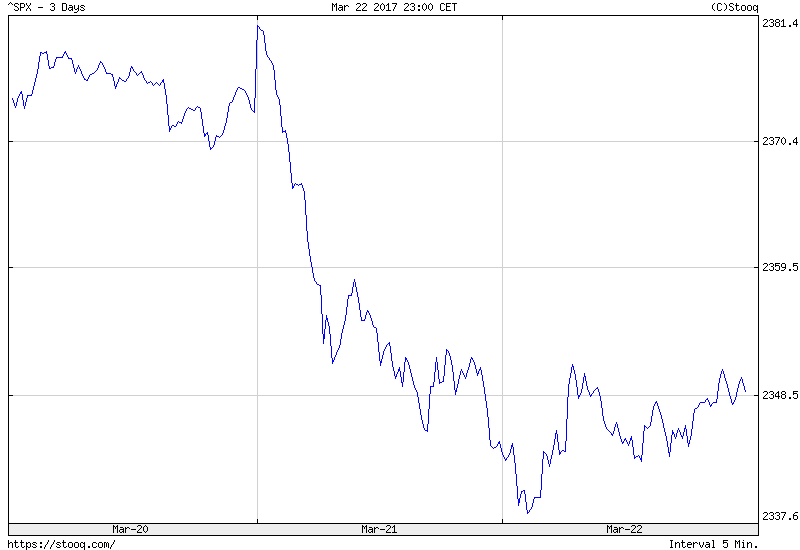

The day before yesterday, Wall Street suffered its worst day since the presidential election. After the impressive rally , the U.S. equities plunged more than 1.2 percent, as one can see in the chart below. It has been the first such loss in 110 trading days.

Chart 1: S&P 500 Index over the last three days.

What happened? Well, it seems that the main reason were concerns about whether Trump will be able to pass his reforms. Last week, the new administration published its budget plan. It quickly turned out that the proposal is probably dead on arrival. And the budget blueprint suggests that infrastructure spending may be much less than expected. Moreover, Trump had some problems to gain support for his health care bill. Hence, investors started to worry if this fight could delay other key elements of Trump’s pro-growth agenda, such as tax cuts. These fears led to a weakening of the dollar and a rally in gold.

Now, it seems that Thursday's vote in the House of Representatives on the American Healthcare Act, which repeals some elements of Obamacare, will be a litmus test of Trump’s ability to legislate in Congress. It may also trigger an important move in the gold market. If the bill passes, the reflation trade may return, which could send gold prices down. On the other hand, if the bill fails, the faith in reflation and Trump’s pro-growth actions should deteriorate, pushing the price of gold up.

To sum up, U.S. stocks and the dollar declined on Tuesday due to the waning Trump rally. Investors fear that the expected pro-growth moves will come later and softened, if at all. The vote on Trumpcare is scheduled for Thursday – if it does not pass, the other parts of the new administration’s agenda will be delayed. Gold should shine then. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.