Wal-Mart Stores Inc. (NYSE:WMT) has decided to streamline its U.S. operations to understand the evolving needs of customers better. Per sources, the restructuring will involve reduction in its divisions from six to four, while the number of U.S. regions will be slashed from 44 to 36.

Reportedly, the restructuring will be completed in October, which will help the company to perform better during the holiday season The latest move pushed shares up by almost 1% yesterday.

We believe the consolidation of U.S. operations will simplify its business structure and facilitate communication as well as improve execution. The move will also help the company to reduce its sky-high expenses, which have resulted from higher e-commerce activities and wage hikes. This will further help in increasing the efficiency at stores.

We note that Walmart has been reorganizing its business for the last few quarters. Per Reuters, the company announced to consolidate its buying operations in February 2017 to compete with Amazon.com Inc. (NASDAQ:AMZN) . The retailer has also reshuffled its food leadership teams in July. These initiatives have helped in improving operations.

Initiatives to Boost Sales

Notably, the company has undertaken several initiatives to boost sales, the results of which can be seen in the positive comps at Walmart U.S. for 12 successive quarters. Comps increased on the back of increased traffic and rising consumer spending. In fact, the company continues to expect positive comps growth year over year at Walmart U.S. in fiscal 2018.

Expanding into e-Commerce Business

Apart from boosting store traffic, Walmart has also been pushing itself constantly to match the e-commerce biggie Amazon. Walmart has aggressively adopted a number of initiatives in this regard. Recently, it has teamed up with Alphabet Inc.'s (NASDAQ:GOOGL) Google to enter the budding voice-shopping market and opened 1,000th Online Grocery Pickup location, which enables customers to order groceries online and pick them up at their local Walmart store.

Also, with Easy Reorder on walmart.com, customers can repurchase items by looking into their previous in-store and online purchases records. The company also has a dedicated back-to-school destination on walmart.com which enables customers to shop school supply lists for more than 1 million classrooms across the country.

The company also offers free two-day shipping service to U.S. shoppers on a minimum order of $35. In April, Walmart introduced a program wherein it offered discounts on online items, only if shoppers picked their orders from a nearby store. This acted as an added feature to Walmart’s Walmart Pickup delivery service, which enables customers to place orders online and then pick them up from a store for free.

Walmart has also undertaken many small acquisitions to grow its e-commerce business. Since Jet.com acquisition in September 2016, the company has acquired four e-commerce businesses — Bonobos, ShoeBuy, Moosejaw, ModCloth. Recently, the company plans to invest in online cosmetics startup Birchbox.

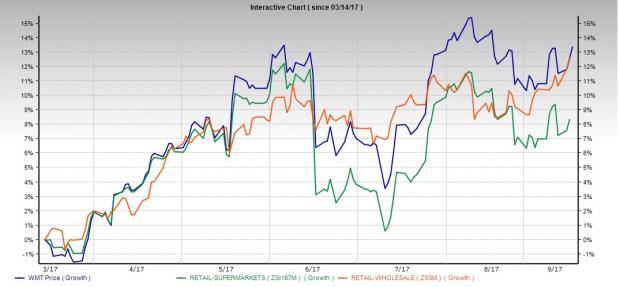

If we look into the last six months’ performance, we note that Wal-Mart’s shares have rallied 13.4%, higher than the industry, which grew 8.3%. The broader Retail-Wholesale sector has increased 12.7% in the said time frame.

Stock with Favorable Combination

A better-ranked stock in the retail space includes Canada Goose Holdings Inc. (NYSE:GOOS) , carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Canada Goose has an expected earnings growth of 34.1%, for the next three to five years.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Original post

Zacks Investment Research