It seems Wal-Mart Stores Inc. (NYSE:WMT) is leaving no stone unturned ina bid to gain traction in the e-Commerce market and to catch up with online giant Amazon.com Inc. (NASDAQ:AMZN) . In a recent move, the giant retailer is teaming up with Alphabet Inc's (NASDAQ:GOOGL) Google to enter the budding voice-shopping market, following the footsteps of Amazon.

Per media sources, Google will offer numerous Walmart items on the Google Express, Google’s online marketplace and through the voice-controlled Google Assistant starting from September end. Google Express already offers products from a variety of stores, such as Target Corporation (NYSE:TGT) . Customers will now be able to order items online through Google Home using their voice by linking their Walmart accounts to Google Marketplace. In fact, the company expects to start voice shopping experience in its 4,700 U.S. stores and its fulfilment network by next year.

Is Walmart Poised to Gain From the Latest Move?

The latest move is expected to pose tough competition to Amazon’s voice-controlled aide Alexa. While Google will is likely to offer free delivery on Google Express orders on a minimum order of $35, Amazon will offer free delivery to Prime members or on orders of $25 or more that include only eligible items.

Google also plans to use consumers’ past history to understand their evolving shopping needs and improve its services and shopping experience accordingly. However, we note that Google introduced its Express platform to Google Home in February, but Amazon already has an edge over it as it has been offering voice-activated shopping on Echo devices since 2014.

Walmart’s Other Services to Take on Amazon

Walmart is trying every means to develop an impressive digital brand portfolio and has been aggressively adopting a number of initiatives in this regard of late. In order to expand in the online grocery and delivery market, the retailer has partnered with the ride hailing service provider Uber and Lyft for speedy online grocery deliveries. Walmart now operates online grocery delivery service in six markets. The giant retailer also enables customers to order groceries online and collect them from 900 locations. Also, with Easy Reorder on walmart.com, customers can repurchase items by looking into their previous in-store and online purchases records. The company also has a dedicated back-to-school destination on walmart.com which enables customers to shop school supply lists for more than 1 million classrooms across the country.

Walmart’s own mobile payment system called Walmart Pay has also enabled shoppers to pay through its existing smartphone app in all of its 4,500-plus U.S. stores. This system, launched in July 2016, marked another step toward accelerating the company’s online business and making shopping easier and faster.

The company’s free two-day shipping service to U.S. shoppers on a minimum order of $35 and that too without a membership fee has also proved to be a success. This service replaced Walmart's existing two-day shipping program named 'Shipping Pass' that charged shoppers an annual membership fee of $49 and competed strongly with Amazon’s Prime shipping program, which charges customers $99 a year for two-day shipping with additional features like a streaming video service. In April, Walmart introduced a program wherein it offered discounts on online items, only if shoppers picked their orders from a nearby store. The discount given had an added feature to Walmart’s already existing delivery service called Walmart Pickup, which enables customers to place orders online and then pick them up from a store for free.

Not only this, Walmart is trying every means to compete with brick-and-mortar rivals and e-Commerce king Amazon. In this regard, the company continues to make huge investments in e-Commerce initiatives, including acquisitions. The company has acquired four e-Commerce businesses (Bonobos, ShoeBuy, Moosejaw, ModCloth) since the Jet.com acquisition (in September 2016) is in line with the Walmart’s expansion efforts. Recently, the company plans to invest in online cosmetics startup Birchbox. If the deal materializes, it will become the fifth e-Commerce acquisition, since the buyout of Jet.com. The company is also expanding in Mexico and China to gain substantial market share in those regions.

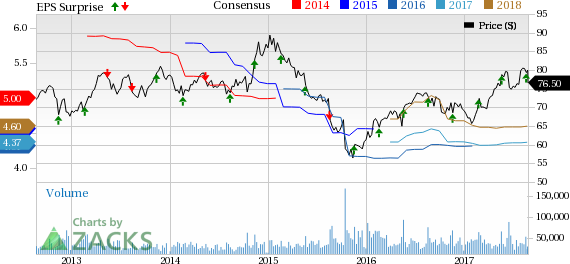

If we look into the last six months’ performance, we note that Wal-Mart’s shares have rallied 11.5%, higher than the industry, which grew 7.2%. The broader Retail-Wholesale sector has increased 9.3% in the last six months.

Our Take

As we can see, this Zacks Rank #3 (Hold) company is making huge investments in e-Commerce activities. While growing e-Commerce business is boosting the company’s sales, higher costs involved in it is pressuring margins. We remain encouraged by the company’s efforts to boost sales and regain investors’ confidence. However, it still faces many deterrents, which are likely to impact earnings in the near term. Declining international sales and currency headwinds are also expected to impact the results negatively.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Original post

Zacks Investment Research