This week’s news continued in a positive trend. All signs from the EU point to an uptick in overall activity. Canada continues to grow modestly but is still dealing with negative business investment. Japanese inflation was positive this month – a very welcome development for a country trying to undo decades of deflation. And finally, the UK continues to confound those (myself included) who predicted a post-Brexit recession.

EU news continued its positive trend. Most important were the Markit numbers: the composite reading was 56, a 70-month high. The service sector was also near a 5-year high with a 55.5 reading. New orders and business activity increased, as did employment. Rising prices were the only negative. The manufacturing number rose .2 to 55.4; both production and new orders were higher.

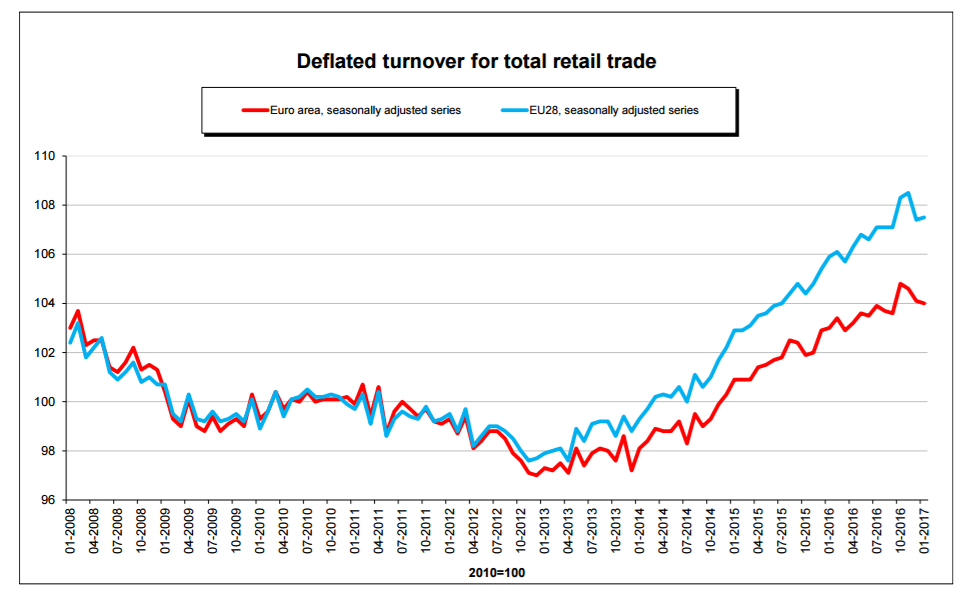

But like the service report, prices were a problem, with some commodities described as “sellers markets". Unemployment was steady at 9.6%; loan growth and money both increased. Thanks to a 9.2% increase in energy prices, CPI rose 2% Y/Y. And while retail sales declined .1% M/M, they increased 1.2% Y/Y, which continues this data series near 4-year continuous increase:

EU news turned the corner in 4Q16; nothing since has cast any aspersions on that change in direction and magnitude.

The Bank of Canada maintained rates at .5%. Their announcement offered this following brief summation of the Canadian economy:

In Canada, recent consumption and housing indicators suggest growth in the fourth quarter of 2016 may have been slightly stronger than expected. However, exports continue to face the ongoing competitiveness challenges described in the January MPR. The Canadian dollar and bond yields remain near levels observed at that time. While there have been recent gains in employment, subdued growth in wages and hours worked continue to reflect persistent economic slack in Canada, in contrast to the United States.

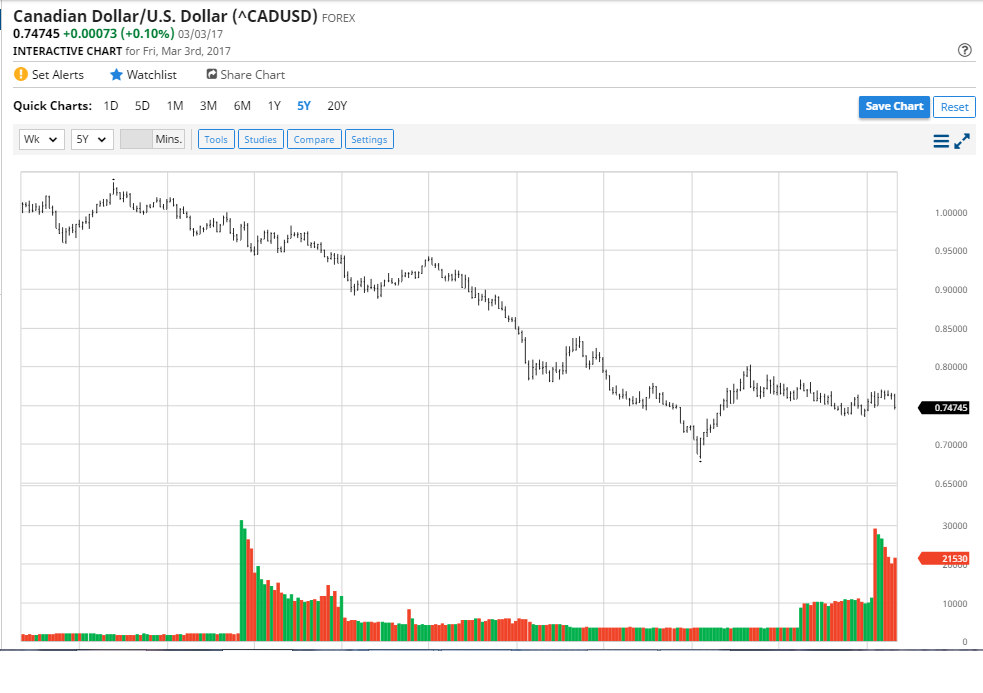

This week’s released of 4Q Canadian GDP supports this view. While household spending rose .6%, business investment contracted again, this time by 2.1%. Non-residential structure spending was off 5.9% while intellectual property investment declined 1.9%. The 9-quarter contraction in business investment indicates that business sentiment is still muted. On the plus, the Canadian dollars near five year low relative to the US dollar should help to spur exports in the coming quarters:

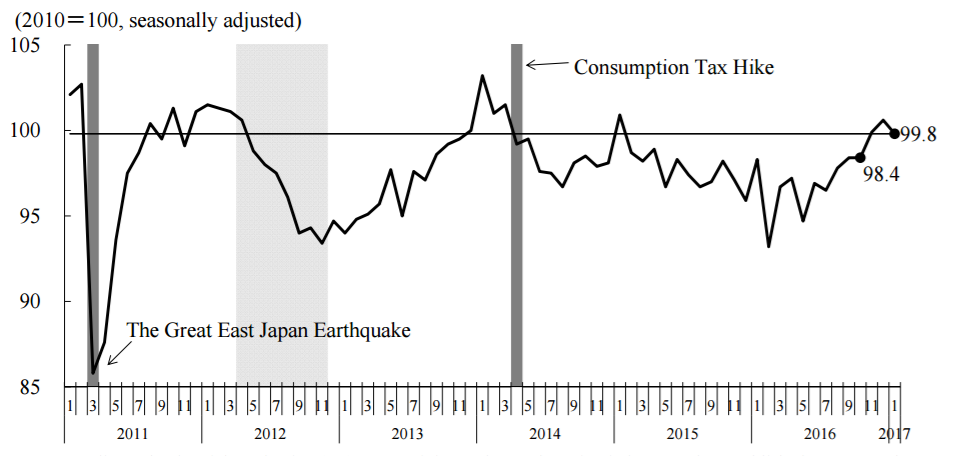

News from Japan was positive. Most important was the .4% Y/Y increase in CPI. For a country that has not only suffered from deflation for decades but is also throwing the kitchen sink at the economy to solve the problem, this was welcome news. While industrial production was off .8%, this was the first decrease in 6 months:

And the 35-month high in the Markit manufacturing number (it rose from 52.7-53.5), indicates industrial activity will increase in the coming months. Moreover, production rose 3.2% Y/Y. Unemployment was remarkably low, decreasing .1% to 3%. And the Japanese consumer continues to spend, helping to raise retail sales 1%. Finally, the yen’s low levels should help to spur exports over the first half of the year:

The monthly releases from Markit were the only economic numbers from the UK. Manufacturing was off slightly, but it still registered a positive 54.6 thanks to an increase in production and new export orders. The low level of the sterling relative to the dollar and euro is clearly helping. The UK service sector is still expanding: the headline number decreased from 54.5-53.3. Activity and new work are still positive, although rising cost pressures are starting to hit bottom lines.