U.S. stocks in the last trading session took a serious beating amid a price war over oil and growing coronavirus concerns. Monday saw heavy selling, with all major benchmarks suffering a staggering loss of more than 7%, marking their worst one-day percentage decline since 2008.

Crude prices slipped after negotiations between the Organization of the Petroleum Exporting Countries (OPEC) and their allies weren’t fruitful. In fact, Russia refused to agree to Saudis’ plan of further crude production cuts. In response, Saudi Arabia prepares to increase crude output and has over the weekend trimmed crude prices. In the last trading session, the West Texas Intermediate crude for April delivery tanked 25% to $31.13 a barrel, while the global benchmark May Brent crude tumbled 24% to $34.36 a barrel. Thus, both of them saw their steepest one-day decline since the Gulf War in 1991.

Goldman Sachs (NYSE:GS) analysts additionally confirmed that this all-out dominance between OPEC and its allies could push oil prices toward $20 a barrel, as the recent coronavirus scare can easily slow down global demand for oil.

Talking about the virus, it has now infected 113,000 people globally and claimed almost 4,000 lives, per data from Johns Hopkins University. In fact, policymakers are now struggling to contain the spread of the deadly virus and eventually its impact on the economy.

Needless to say, the coronavirus outbreak may hamper consumer spending activities and supply chains. This compelled investors to take money out of riskier assets, including equities, and take shelter in the most safe-haven assets in the world.

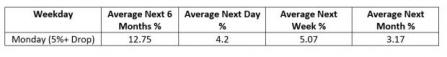

However, investors shouldn’t shun equities all-together at this point of time. The good news is that collectively, stocks have always rebounded from a so-called Black Monday. For instance, the broader S&P 500, on average, has always gained 12.75% in the following six months after a day’s drop of more than 5%. What’s more, the index has jumped, on average, 4.2% in the following day, while it has climbed 5.1% and 3.2% in the following week and month, according to data compiled by Bespoke Investment Group strategists.

Moreover, the recent losses are expected to ease and stocks are anticipated to climb after President Trump floated the idea of “a payroll tax cut or relief” to overshadow the negative impact of the coronavirus on businesses and individuals. Trump did say that “we are to be meeting with House Republicans, Mitch McConnell, and discussing a possible payroll tax cut or relief, substantial relief, very substantial relief.”

Such tax cuts by the way will certainly put more money into consumers’ wallets, which will lead to more consumption and in turn boost the economy. To top it, such tax cut reliefs come after Trump signed an $8.3-billion spending package last month to stimulate the economy.

5 Best Stocks to Buy After Black Monday

With things looking up for the stock market after Black Friday, investing in fundamentally-sound stocks that are poised to gain in the near term seems judicious. We have selected five such stocks that flaunt a Growth Score of A along with a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Publicly-owned asset management holding company, Cohen & Steers, Inc. (NYSE:CNS) has seen the Zacks Consensus Estimate for its current-year earnings move 7.6% north over the past 60 days. The company’s expected earnings growth rate for the current quarter and year is 20.7% and 16%, respectively.

Cirrus Logic, Inc. (NASDAQ:CRUS) is a fabless semiconductor company. The Zacks Consensus Estimate for its current-year earnings has risen 14.8% over the past 60 days. The company’s expected earnings growth rate for the current quarter and year is 56.8% and 47.4%, respectively.

Gibraltar Industries, Inc. (NASDAQ:ROCK) manufactures and distributes building products. The Zacks Consensus Estimate for its current-year earnings has moved 6.4% up over the past 60 days. The company’s expected earnings growth rate for the current quarter and year is 32.1% and 16.7%, respectively.

Tennant Company (NYSE:TNC) designs, manufactures, and markets floor cleaning equipment. The Zacks Consensus Estimate for its current-year earnings has moved up 43.2% over the past 60 days. The company’s expected earnings growth rate for the current quarter and year is 46.9% and 40.7%, respectively.

Provider of wealth management services, Focus Financial Partners Inc. (NASDAQ:FOCS) has seen the Zacks Consensus Estimate for its current-year earnings advance 8% over the past 60 days. The company’s expected earnings growth rate for the current quarter and year is 42.6% and 25.2%, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Cohen & Steers Inc (CNS): Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS): Free Stock Analysis Report

Gibraltar Industries, Inc. (ROCK): Free Stock Analysis Report

Tennant Company (TNC): Free Stock Analysis Report

Focus Financial Partners Inc. (FOCS): Free Stock Analysis Report

Original post

Zacks Investment Research