At the beginning of October – I wrote the piece “I Now See an 85% Chance of a Global Earnings Recession by Late 2019”.

In it – I described using a Bayesian formula to hypothesize that there’s a very high ‘chance-value’ for a worldwide earnings recession by late Summer next year.

I’ve been adding information to my formula ever since May 2018. And the last time I checked – there’s an 85% chance of an earnings recession happening.

Please read the linked article above to get caught up. It’s brief and extremely worthwhile – giving significant pretext for what I’m about to write. . .

Yesterday, a Yahoo Finance headline article read the following. . .

Wall Street Pros Warn We May Be Experiencing ‘Peak Earnings’ – you can read it here.

The article argues that the recent global stock market bloodbath is happening because corporations hit ‘peak earnings’ growth. It goes on listing big Wall Street bankers and strategists expecting corporate earnings to further weaken.

And soon, equity prices down with it. . .

“The market is pricing in the [earnings growth] slowdown now.” Blackstone (NYSE:BX) vice chairman Byron Wien tells Yahoo (NASDAQ:AABA) Finance.”

So – it looks like the mainstream’s finally catching on to the idea of an upcoming global earnings recession.

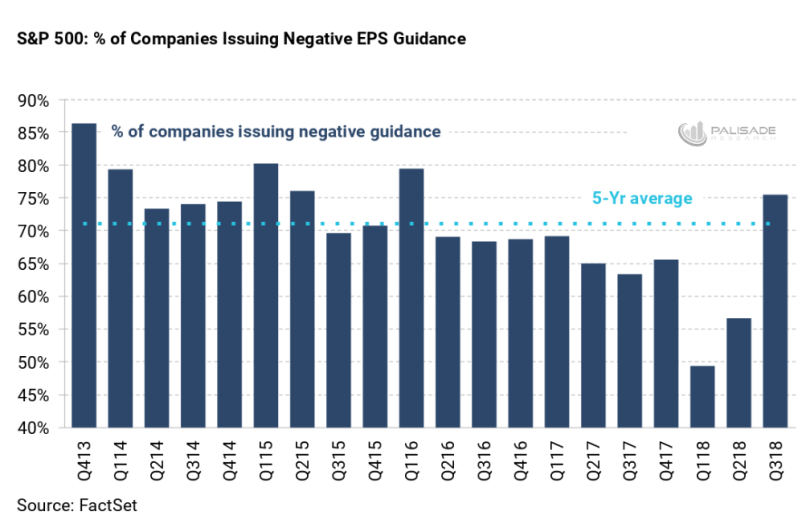

We’ve already seen how over 75% (or three-fourths) of S&P 500 companies have projected negative earnings going forward. . .

And even before corporations issued these estimates – there were other troubling signals.

Such as. . .

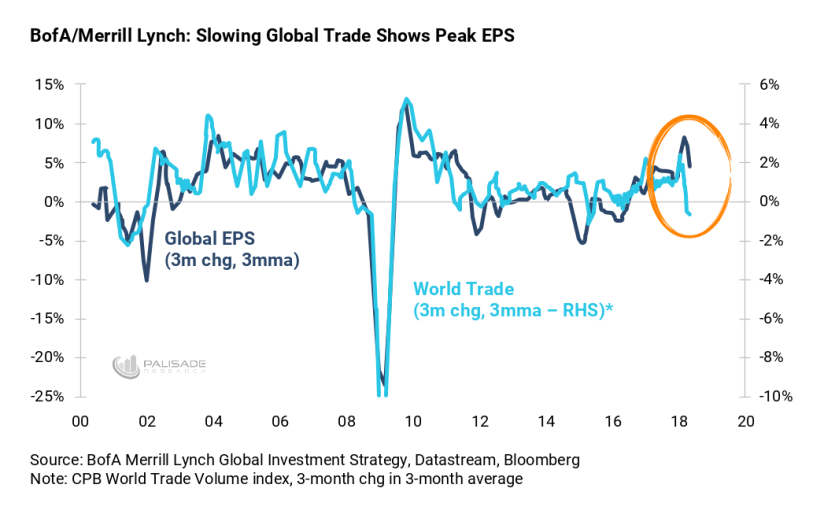

Bank of America/Merrill Lynch highlighted the correlation between world trade and corporate earnings.

Since the year 2000, they’ve closely mirrored each other. And as world trade sharply dropped – earnings will follow.

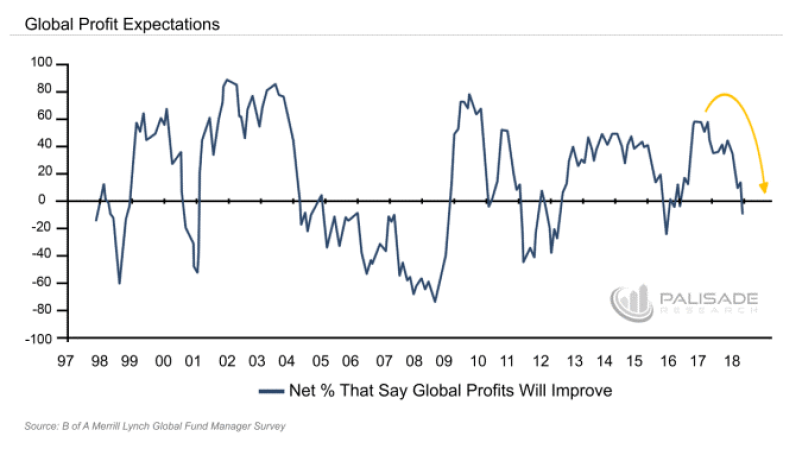

I also wrote back in July that according to Bank of America/Merrill Lynch – much of the ‘smart’ institutional money saw global profits dropping.

Because of all this (plus other indicators I’ve highlighted), we saw a very high ‘chance-value’ that a global earnings recession was only a year away.

But none of this should come as a surprise. . .

After 2008 – the Federal Reserve’s ZIRP (zero interest rate policy) made corporate earnings look better than they really were.

How? Well there’s a few reasons. . .

First – by lowering the cost of interest, companies could keep more of their earnings (since they pay less towards interest).

Second – we’ve also seen on the valuation side how lower rates affect Wall Street’s favorite tool – the Discounted Cash Flow (DCF) model. Lower interest rates make the ‘discount rate’ smaller – which artificially inflate future cash flow estimates.

Third – and most importantly – corporations have gorged on cheap debt to buy their own shares back. Making earnings per share look higher.

But now that rates are rising – it will negatively affect corporate earnings.

Not to mention there are some serious issues facing corporations in 2019. . .

‘Real’ interest rates are rising. Trade tariffs (especially between the U.S. and China) continue taking effect. And Trump’s Tax Cuts are wearing-off.

There’s also a host of other serious problems going on in the global economy – such as declining world trade volumes. . .

Because of these reasons – the market’s now starting to doubt the growth in global earnings.

As many readers know – I’ve been bearish on the global earnings outlook for many months now. Starting in early May.

And I expect the mainstream to continue catching on about declining corporate profits.

As for my current hypothesis? I still see an 85% chance of a global earnings recession by late Summer 2019.

Even if you don’t agree with my chance-value – you have to admit – things aren’t looking good.