As the U.S. stock market began its recent reversal, Wall Street bulls hit the exits at a rapid-fire rate. In fact, the National Association of Active Investment Managers (NAAIM) exposure index dropped by nearly 32 points, or 37%, last week -- the biggest point drop since August 2013, and the biggest percentage drop since February 2016. Meanwhile, the American Association of Individual Investors (AAII) poll showed the largest reduction in self-proclaimed bulls so far in 2018. Here's what that could mean for the stock market.

Specifically, AAII bulls -- or those who feel the direction of the market will rise over the next six months -- plummeted by 15.1 percentage points in the week ended Wednesday, Oct. 10, marking the largest one-week drop since November 2017, according to Schaeffer's Quantitative Analyst Chris Prybal. Most of those investors migrated to the bearish camp, with self-identified bears rocketing higher by 10.3 percentage points.

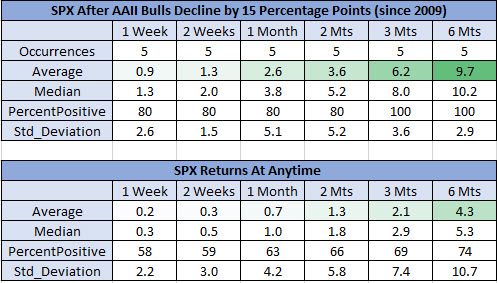

Since 2009, there have been just five other drops of this kind. Prior to November's sentiment signal, you'd have to go back to April 2013 for the last time AAII bulls dropped 15 percentage points or more in one week. However, S&P 500 Index (SPX) returns after these signals have been grand.

One week after a signal, the SPX was up 0.9%, on average, and higher 80% of the time. That's compared to the index's average anytime one-week return of 0.2%, with a win rate of just 58%. A month after signals, the S&P was up 2.6%, on average -- more than triple its average anytime return of 0.7% -- and once again higher 80% of the time. Three and six months after signals since 2009, the broad-market barometer was higher 100% of the time, averaging gains of more than twice the norm, at 6.2% and 9.7%, respectively.

In conclusion, it's widely known that stocks climb a "wall of worry," so a lack of bulls amid a longer-term uptrend could be seen as a contrarian buy signal. Further, until we hit the "euphoria" phase of the sentiment cycle, it's unlikely that a market top is imminent. Those searching for bullish trading opportunities after the recent sell-off should consider these 25 stocks that tend to rally after big market pullbacks.