We started the week off with stocks acting poorly and the poor action morphed into some solid weakness as the S&P 500 nears its major support level at the 200 day moving average.

We are into very oversold territory and a bounce is coming very soon, but I’d like to see a little more selling to the 200 day average before that bounce begins.

That would time perfectly with the election Tuesday of one Donald Trump or Hillary Clinton, or the Clumps as many now refer to them as.

I have no clue if the election results will stoke or stumble the markets and I am happy to be in an all cash position for now.

As for the metals, they perked up very nicely early in the week and mining stocks were the only sector showing strength so I bought a few nice positions who worked really well up until Wednesday when I had to lock in some gains, and one small loss.

Easy come, easy go, but the miners were acting so great it’s a shame to see weakness set in.

It happens.

In a choppy market like we have you just never know and often sectors of strength don’t last.

I’ll try solid looking trades in choppy markets sometimes but always using tight stops to keep me from getting chopped up.

Gold gained 2.17% and does look pretty solid here still.

Gold is setting up for higher with $1,310 the current buy level.

That said, miners are acting poorly and they usually lead and with the election sure to wreak havoc one way or another I just don’t know if we can rely on chart until the outcome is digested.

I sure would love to see a Brexit type of crash where we can pile in near the lows again but only time will tell.

Caution is warranted all around and I do not think I will do anything until mid-week, at the earliest.

Capital preservation is the only way to survive in the trading game and this week is about as unclear as we ever get, in terms of potential for a move either way.

I’ll react, not predict, as always.

Cash is a position.

Silver gained 3.23% and has a nice little bull flag pattern here.

As I stated above, it’s really hard to commit to a trade until after the election.

Chances of a gap much higher, or lower, come Wednesday, are nearly 100% and to try to guess which way that gap will come is not my jam.

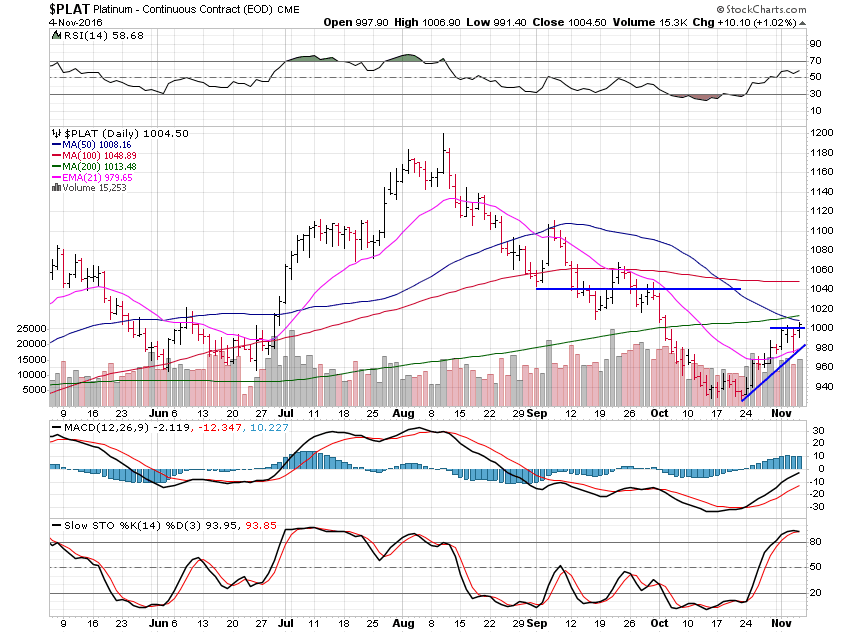

Platinum rose 2.35% and is trying to lead us higher once again.

Platinum is breaking above this little triangle and above the $1,000 buy level.

Let’s just see what plays out but platinum is telling me metals will continue to move higher.

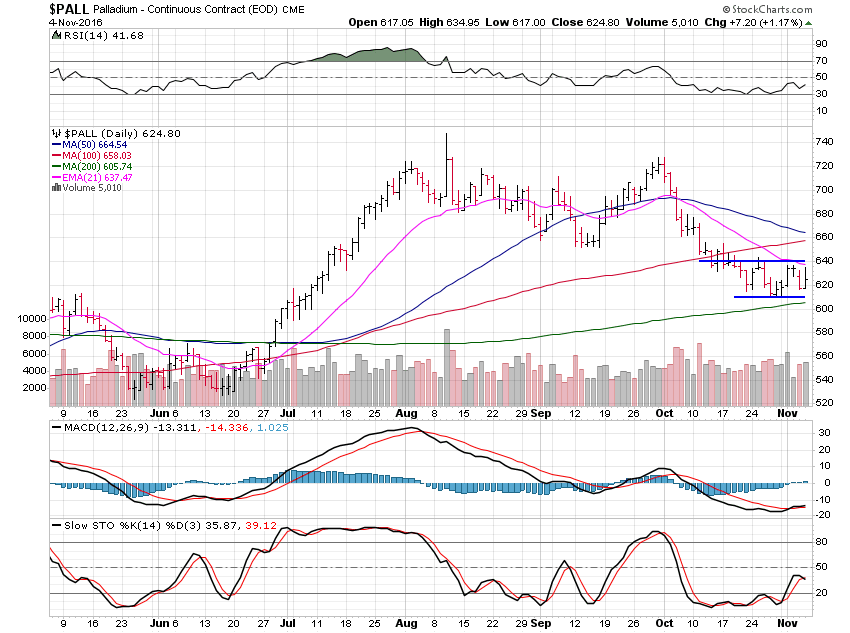

Palladium moved up my 1.37% this past week and has based well at the 200 day moving average area.

I’d look at $640 as the buy level now, but again, I have no clue what will occur after the election so I’m taking a wait and see approach unless something really stands out to me and right now nothing stands out at all.