There are a ton of indicators that traders use to try to get an edge on the market. And that is the major problem with indicators. Indicators were designed to try to create a a warning signal that something was changing. They needed other indicators and price to confirm.

But somewhere along the way that changed. traders decided that it was easier to cheat the indicator set up. To jump ahead of confirmation. That seems like a recipe for failure. Death by a 1000 cuts as the rest of the story does not line up.

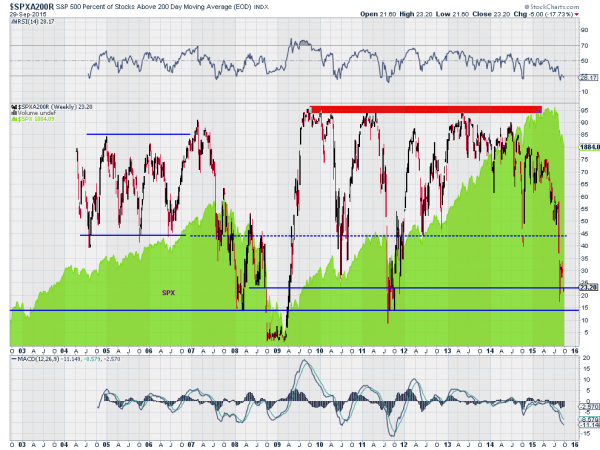

With that backdrop I have one indicator to look at that is back to extreme conditions. It is the Percent of Stocks in the S&P 500 Above their 200 Day Simple Moving Average. This indicator closed the day Tuesday at 23.20%. This is up from 20.4% Monday, but both are really low levels. From the chart below you can see it has only happened three other times in the last 12 years.

The three prior occurrences happened in 2008, 2009 and 2011. These dates will immediately trigger the fear sensor in your brain. But they should actually trigger the greed center. These extreme lows area buying opportunity. When? When the other indicators including price turn around and start back higher.

There are certainly some lessons to learn from this chart. In 2008 this bottomed as a precursor to a slight bounce in the market before the move to the ultimate bottom in 2009. Will that be the case again? That is why you wait for confirmation. In 2009 a new extreme low was made under 5%. A buying opportunity for sure. But at the right time. It persisted for six months. Finally in 2011 the low was a bit higher and bounced quickly, like now, but fell back again also like now, before reversing and the market rising.

So is this extreme low a buying opportunity in the S&P 500? Absolutely, it is just a matter of when.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.