Four weeks of corporate earnings are about to hit the market like an Arctic wind. As you brace yourself for the data, you will note that while stock prices have lifted into earnings season, expectations are still on ice. The strong U.S. dollar versus a year ago, combined with weak bank earnings and very weak energy earnings, have done their job to lift negative preannouncements to recent highs and keep optimism in check. With investors not overweight risk, and the pain trade looking higher, a few well-placed earnings beats or signs of optimism could cause a stampede into stocks. We are always a bit anxious going into earnings season, but it feels a bit more on edge this quarter with the Fed now looking determined to delay on interest rate increases. The other cross winds to keep an eye on right now are the weakening U.S. dollar (which will help future earnings comparisons) and the rising interest in Emerging Market currencies, debt and equities (after 6 years of underperformance). Good luck with your earnings season.

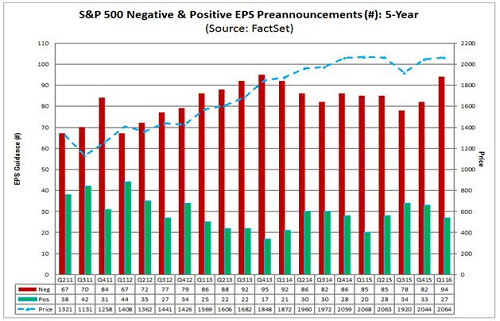

The spike in negative preannouncements keeping expectations in check…

@FactSet: 94 S&P 500 cos. have issued negative EPS guidance for Q1, second highest total in 10 yrs.

Looking at where the markets interest lies, Gold Mining stocks (NYSE:GDX) continue to be in demand with solid buying volumes…

International Treasury Bonds (NYSE:BWX) also remain a focused area due to the weak U.S. dollar and flight to a safety trade with overseas assets…

About that weakening U.S. dollar…2014 levels look to be in store which would be welcome to global commodity players, as well as U.S multinational earnings…

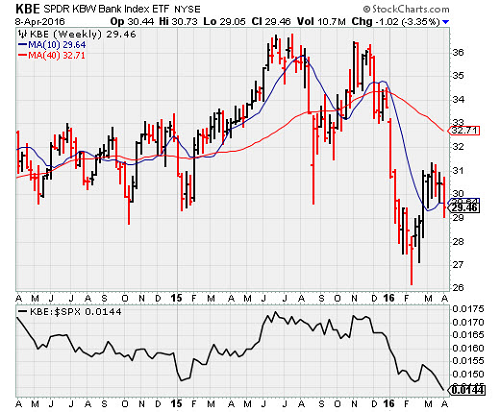

Besides U.S. dollars, the market also dislikes Bank Stocks (NYSE:KBE)…

Trading revenues stink, Net Interest Margins stink, Credit will only deteriorate, Regulation continues to get worse, the Government continues to block announced M&A and Factset is looking for Q1 EPS to fall 8.5%. Does anyone see light at the end of this tunnel?

Speaking of M&A, $350b+ in deals now canceled with the Pfizer (NYSE:PFE)/Allergan (NYSE:AGN) deal sent back…

Trends in the Asset Management industry continue to amaze…

A striking 18 Morningstar 500 funds suffered outflows of at least 40% of assets under management in the trailing 12 months ended February 2016, 61 shed 25% or more, and 168 had outflows of 10% or more.

If a Mutual Fund company wanted to get rid of all of its customers and financial advisors, I would recommend pay in kind for all redemptions…

When Tom Bentley tried to pull his money from a mutual fund troubled by its large stake in Valeant Pharmaceuticals International Inc (NYSE:VRX)., he instead received shares in a Springfield, Mo. auto-parts retailer.

Sequoia Fund Inc. sent the retired computer hardware engineer about 5% of his money in cash and the rest was stock in one company–O’Reilly Automotive Inc. Mr. Bentley said he sold the shares as soon as they appeared in his account on April 7, but they had already dropped in value.

“It has been pretty horrendous,” Mr. Bentley said.

Typically, mutual fund investors expect cash instead of stock when they ask for their money back. But investors seeking to pull large sums from Sequoia are getting a combination, according to people familiar with the matter.

If you have NFL clients, make certain that they are maxing out their 401(k) program. If you have other pro athlete clients, check to see if their league 401(k) is as lucrative…

The NFL has one of the best 401(k) programs in the country, according to Kerney. Players are automatically enrolled, and can put in up to $18,000 a year (unless they’re a rookie or on a practice squad). And the league will put in two dollars for every dollar a player puts in — up to $13,000. So a player can set aside $44,000 a year in the plan ($18,000 + $26,000).

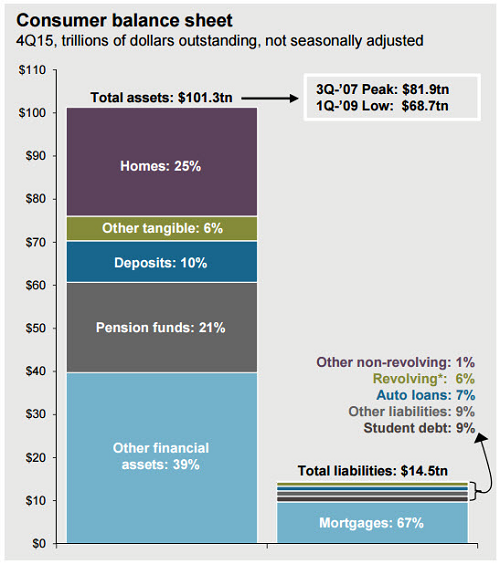

A great chart on U.S. assets and liabilities from JPMorgan…

I bet that your elementary schooler will not need a driver’s license. But don’t only listen to me, read what the former Corp VP of R&D and Planning at General Motors (NYSE:GM) thinks…

“Driverless vehicles are not a fairy tale,” Burns said at the AIC on Tuesday. “I absolutely believe driverless vehicles are real.”

Combined with the rise of electric engines and ride sharing services, driverless cars will eventually change the auto industry in profound ways. Imagine the end of driving, the internal combustion engine, car dealers, car ownership, and the car insurance industry as we know it.

Burns, who studied safety issues like distracted drivers while at GM, said autonomous cars have the potential to reduce accidents by as much as 94 percent, using integrated sensors, lasers, radars and cameras to make driving decisions and communicate with other vehicles.

“This is what we do with aircraft today,” Burns said.

Op-Ed of the Week…

“GE has been in business for 124 years, and we’ve never been a big hit with socialists. We create wealth and jobs, instead of just calling for them in speeches. We take risks, invest, innovate and produce in ways that today sustain 125,000 U.S. jobs.” Jeff Immelt, GE

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, 361 Capital is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of 361 Capital.