The CBOE's short term volatility index VXST futures have been trading for over six months now—enough time get a feel for how they behave. The CBOE provides historical data —on a per future basis (VSW), which requires some work to get it into a consolidated format.

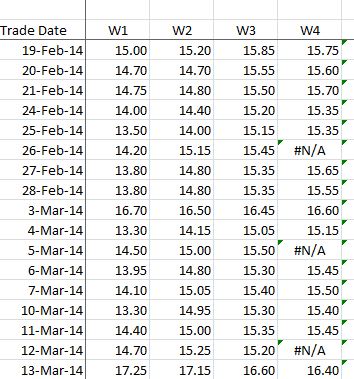

I organized the data by weeks, with the next to expire future prices labeled week 1, the next to expire week 2, and so on. Typically there are four sets of VXST futures active at any point in time, with a set expiring every week on Wednesday morning.

The “#NA”s occur on week 4 futures because the CBOE currently waits a day after expiration day before initiating trading on futures that are 4 weeks out.

The expiration value of a VXST future is tied to a special quote of the VXSTsm index (SVRO), which is linked to actual bid/ask values of S&P 500 options near the market opening on Wednesday mornings. This process is important because among other things it enables VXST futures market makers to hedge their positions with SPX options

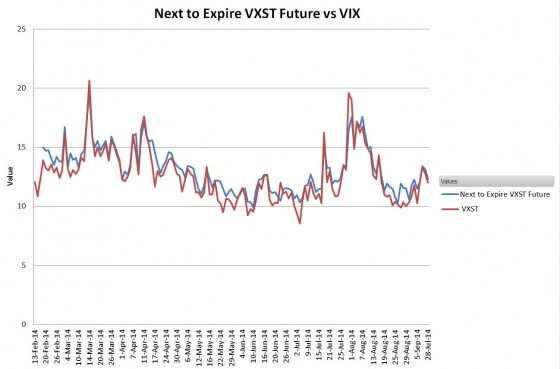

I charted how the futures were tracking the underlying VXST index:

|

Visually the two look like they’re tracking reasonably well, but from a percentage basis it’s not all that great.

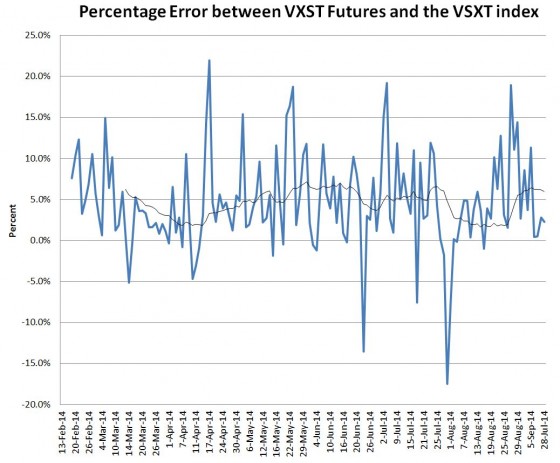

|

There are frequent differences greater than +-10%, and the 20 day moving average error is around 5%.

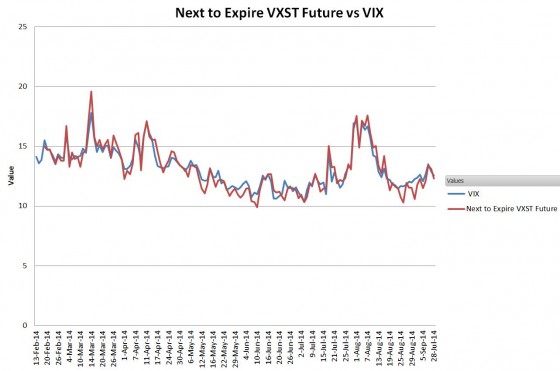

I also looked at the VXST futures values compared to the VIX® index.

|

These traces are considerably closer to each other, with only 3 occasions having greater than +-10% error and a 20 day average error of around -1%. This relationship isn’t too surprising because volatility futures tend to trade at a premium to their indexes, and the longer the time horizon (e.g., 9 days vs 30 days) the higher the futures tend to be priced.

Bottom line, the next to expire VXST futures look like a decent proxy to the non-tradable VIX index. Unfortunately this is only useful if your time frame is pretty short (e.g., a week) — otherwise the carry costs of the futures are probably prohibitive.

VXST Exchange Traded Products

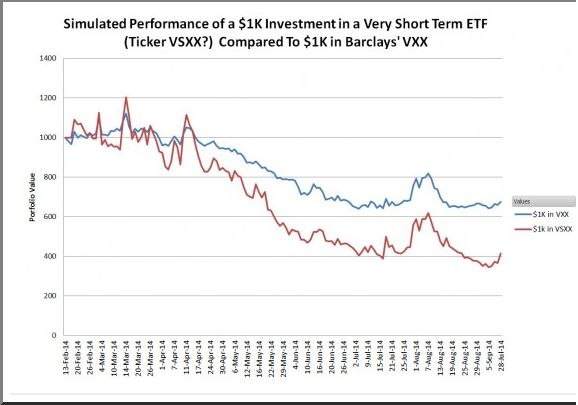

Currently there are no Exchange Traded Funds (ETF) or Exchanged Traded Notes (ETN) using VXST futures, but that situation could change quickly. The chart below shows the simulated performance of a very short term volatility fund that uses the same rolling futures strategy that iPath S&P 500 VIX Short Term Futures (ARCA:VXX) uses—except it uses VXST futures instead of VIX futures.

The simulated very short term fund behaves as you would expect—more volatile than VXX and larger contango losses during the quiet periods.

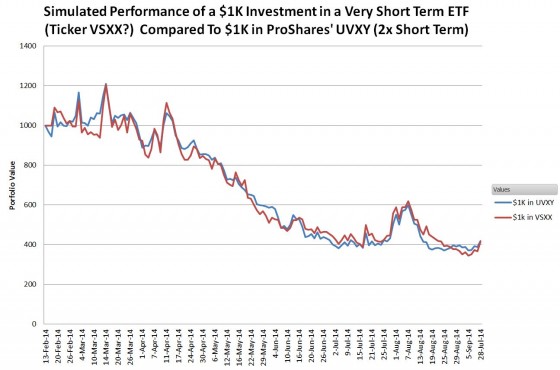

I then compared the very short term fund to ProShares Ultra VIX Short-Term Futures (ARCA:UVXY), a 2X leveraged short term volatility fund.

|

Surprisingly similar. If this behavior continues (likely) there won’t be an advantage for an Exchange Traded Product based on VXST futures versus the existing 2X leveraged UVXY and VelocityShares Daily 2x VIX Short Term (NASDAQ:TVIX) funds. Bummer.

Of course, there is nothing set in concrete that the exact same futures rolling strategy that the existing short term funds use must be used in a very short term fund. For example, mixes of the first four weeks’ futures could be used, but I suspect that would just end up with performance in-between VXX and UVXY—not something particularly useful.

VXST futures have not been a great success so far, with volumes for the nearest two week contracts combined averaging around 50 contracts per day, and open interest of twice that, but if they continue to show a good short term correspondence to the VIX then I can imagine their popularity will grow.