Today is mid-term election day in America, a nation that is suffering from a major infection of...fiat-currency germs.

“You’re going to get not only inflation, not only a recession but what I call the ‘Great Stagflationary Debt Crisis.’” – Nouriel Roubini, Nov 6, 22.

Before they decide whether a blue or red fiat-obsessed government will represent them best, savvy citizens like to cast their first vote for gold!

The short-term price action is stellar, and the long-term, even more so. There’s a bull flag on the short-term chart, and while it could fail and see gold trade at $1614 again, the large bull wedge on this weekly chart suggests a more positive scenario is increasingly likely.

A breakout to above $1700 would indicate gold is ready to stage a strong rally up to $1810 and then to the $1900-$2100 range in 2023.

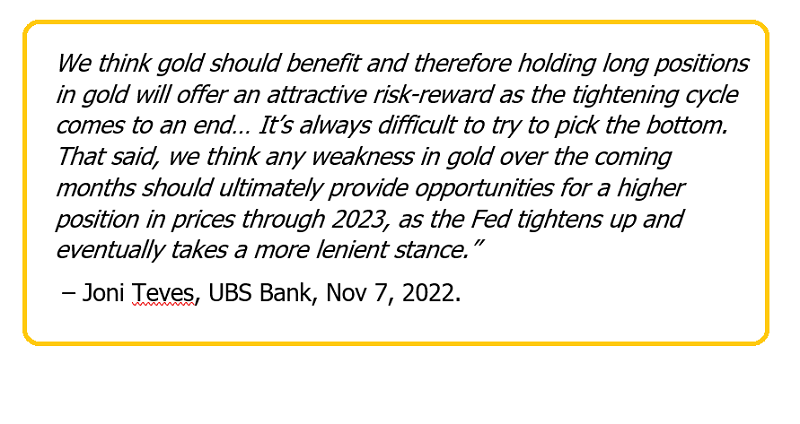

I’m not alone in suggesting that 2023 will be a golden year.

Heavyweight UBS analyst Joni Teves notes that gold has a history of rallying 19% for each 1% cut in rates.

Like most analysts, Joni sees the Fed cutting rates later in 2023. I don’t see that happening, but the good news is that in the 1970s, gold staged even more dramatic gains than Joni envisioned and did so as the Fed hiked rates. Citizens and money managers viewed the situation as out of control.

The Fed is unlikely to cut rates if inflation remains well above 2%, but it is likely to stop hiking and begin a narrative that the 2% threshold may be too low.

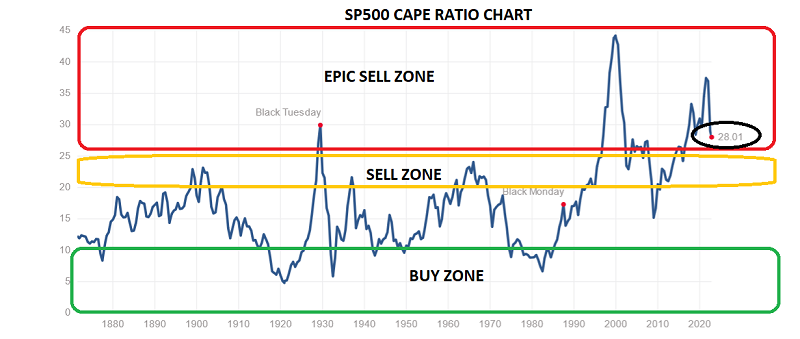

What about the stock market? The stock market has a history of rallying after the US mid-terms, regardless of who the winners are.

That said, the market is outrageously overvalued. The Dow is holding up well and could hit a new high, but most investors are not in that old economy market. They own some S&P 500 stocks and a lot of the tech companies that have essentially been obliterated.

I would not be averaging down or dollar cost averaging into the US stock market until the CAPE ratio falls toward much lower levels, and that’s unlikely to happen for many years.

A stagflationary gulag is set to become the main US stock market theme for the next 10 to 20 years.

Crypto investors dreamed of a world where bitcoin would become a hot Nasdaq stock, bought aggressively by money managers.

They got their wish, and as the saying goes, they wished for something too hard and got it; the money managers bought, but the price fell anyways. The bottom line for the stock market and crypto:

Crypto is a better performer than the US stock market on stock market rallies, but the days of “otherworldly” gains are in the past.

So, where should investors focus most of their attention?

The big play for the stagflation-oriented decades ahead is gold, silver, and commodities. In the short term, the stock, commodity, bond, and gold markets are gyrating wildly.

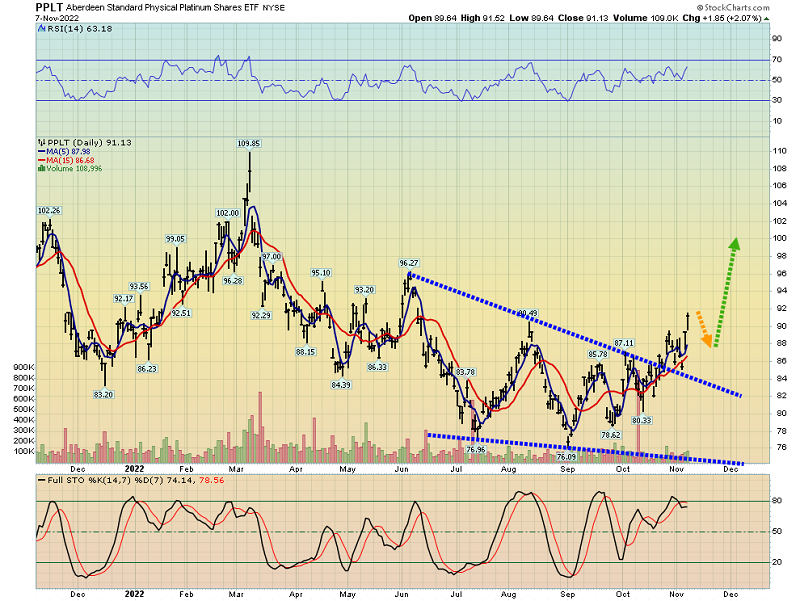

The interesting the Physical Platinum Shares ETF (NYSE:PPLT) chart. I own a decent amount of platinum, and a great way to accumulate it is to buy modestly on every $100/oz price sale.

Keep the tactics simple to relax and enjoy the next ten to twenty years of higher prices.

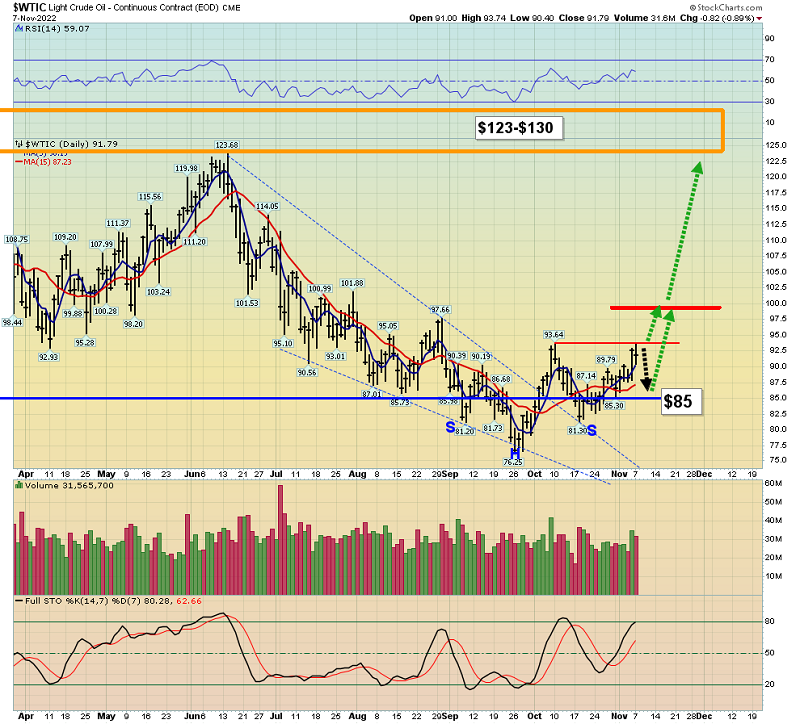

While the US mid-terms may have some effect on the gold price action, most of it is now related to oil.

There’s a big base pattern on the daily oil chart and for more good news. The Canadian Dollar Trust (NYSE:FXC) chart. Canada’s currency (called the Cbone by FOREX traders) is arguably the world’s oil currency; where goes oil, so goes the Cbone. Note the nice inverse H&S pattern in play.

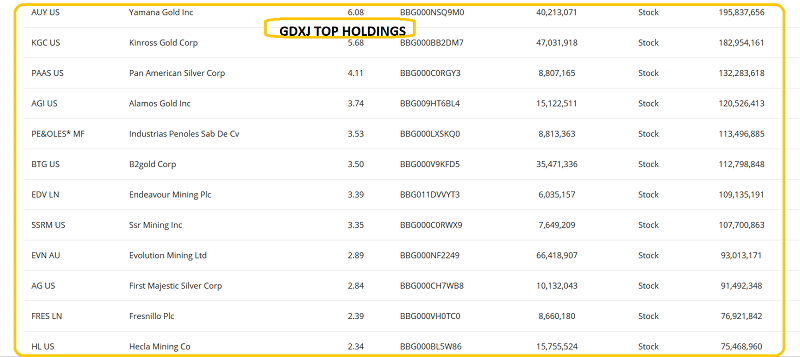

The miners are, of course, the favorite asset class of most gold bugs. VanEck Junior Gold Miners ETF (NYSE:GDXJ) is called a junior mining ETF, but it’s really an ideal mix of senior and intermediate producers, with a few juniors too. I consider it, and the holdings, a good fit for all gold bugs in the current environment.

The important GDXJ daily chart. I suggested the miners would struggle through the FOMC meet and then stage a big rally higher after Friday’s jobs report. That’s exactly what happened.

GDXJ has a huge rounding bottom in play, and a rally in 2023 Q1 to $50 is the most likely scenario as a minimum price target. Once it becomes clear that the Fed can’t get inflation to 2%, a tidal wave of institutional mining stock buying should begin marking the rounding bottom pattern for GDXJ as a gold bull-era launchpad.