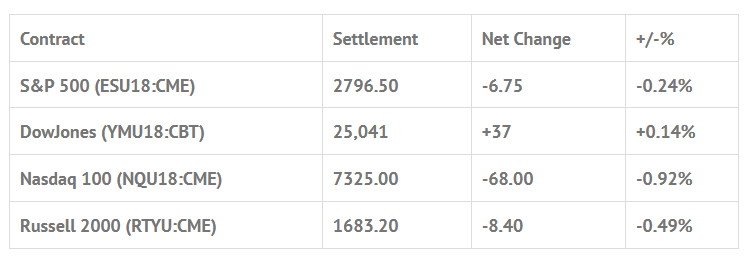

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed lower: Shanghai Comp -0.55%, Hang Seng -1.25%, Nikkei +0.44%

- In Europe 11 out of 13 markets are trading lower: CAC -0.44%, DAX -0.21%, FTSE -0.19%

- Fair Value: S&P +1.53, NASDAQ +14.70, Dow -20.26

- Total Volume: 797k ESU & 177 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Redbook 8:55 AM ET, Industrial Production 9:15 AM ET, Housing Market Index 10:00 AM ET, Jerome Powell Speaks 10:00 AM ET, and Treasury International Capital 4:00 PM ET.

S&P 500 Futures: Volume Drops As Peak Summer Vacation Week Rolls In

The global markets took a breather yesterday, with the Asian markets mostly closing lower and Europe following with the Stoxx 600 down 0.65% at midday. In the US, the S&P 500 futures traded up to a new high at 2809.00 and opened Monday’s session at 2802.50.

In the first few minutes the ES traded up to 2804.75. After the push up the futures made six separate lower highs and lower lows, making its early low at 2695.00 at 10:01. After the low, the ES traded back up to the big figure at 2800.00, sold back off down to 2796.75, and then traded up to 2803.25 before petering out down to 2795.25 as the Nasdaq weakened.

As the MiM went from sell $600 million, to sell $900 million, to over $1 billion for sale, the ES bounced back up to 2800.75 at 2:41 CT. On the 2:45 cash imbalance reveal the ES traded 2799.00 as the MiM fell to $1.7 billion for sale. On the 3:00 cash close the ES traded 2800.50, and then went on to settle at 2797.00, down -7.25 handles, or -0.26% on the day.

In the end, a total of 769,000 ES traded all day. When you take out the 110,000 from Globex, the total ES traded on the day session was only 669,000. Clearly people are going on vacation / taking time off from trading. In terms of the ES’s overall tone, I said sell the open or the early rally, and that ended up the best trade of the day. I don’t think anyone should be suprised by the semi-weak price action based on how much the ES has rallied over the last few weeks.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.