(Tuesday Market Close) To borrow a phrase from Mark Twain, it looks as though reports of volatility’s death were “greatly exaggerated.”

The market’s most closely-followed “fear index,” the VIX, jumped more than 25% Tuesday after easing earlier in the week, with major stock indices going the opposite way and taking a big plunge. Financials— which are heavily weighted in the major indices—fell hard, exacerbating overall point losses.

Three Horsemen Ride Again

Three major themes as the sell-off gained steam and volatility mounted included worries about the China deal, concerns about an inversion in the short end of the yield curve, and growing fears of a possible slowdown in the U.S. economy.

Remember what you read here last week about possible euphoria after a deal announcement followed by disappointment as investors searched for more details? That seems to be exactly what’s happening, though it may have sped up a little due to U.S. financial markets being closed tomorrow in honor of the late President George H.W. Bush.

The initial impetus for Tuesday’s sharp losses appeared to be some second thoughts among investors about the trade deal, perhaps due to mixed signals from the administration. While some officials have stressed their optimism about coming talks with China, news that an administration member known as a hawk will participate might have hurt stocks after their big trade-related rally Friday and Monday.

President Trump also made some hawkish headlines Tuesday when he called himself a “tariff man.” That seemed to unnerve some investors, but it’s surprising how many people forget that the president often makes big statements and then sometimes backs off. This has arguably been a hallmark the last two years. The markets go crazy based on something he said, and then it’s often forgotten two weeks later. Also, Trump is still negotiating with China, so it’s possible that the rhetoric—both market-friendly and unfriendly—could continue.

If nothing else, the selling might serve as a reminder that tariffs remain arguably the number one focus of many investors and might continue to for a while. The agreement over the weekend was good to see, but it’s really just a start. There’s also some debate about the actual stipulations, including what type of tariff China might have on U.S. autos. Shares of General Motors (NYSE:GM) and Ford Motor Company (NYSE:F), both of which climbed Monday, downshifted Tuesday.

Other stocks getting sold, possibly on China jitters, included well-known “canaries in a coal mine” Caterpillar (NYSE:CAT) and Boeing (NYSE:BA). As we’ve noted, those two depend a lot on trade with China and often tend to go up and down in line with optimism or pessimism about the tariff situation. Apple (NASDAQ:AAPL) also got smacked around Tuesday, though that might have been partly due to an analyst downgrade.

Yield Inversion Points Up Economic Fears

The other big news today, which we mentioned this morning, is the inversion of three- and five-year Treasury note yields, which looked like it caught many by surprise. Sometimes inversions in the Treasury market have been associated with economic slowdowns, though it’s unclear if it’s cause or effect. Some analysts pointed out that three- and five-year yields inverted in 2005, years before the 2008-2009 recession. The takeaway might be that an inversion doesn’t necessarily mean a recession anytime soon.

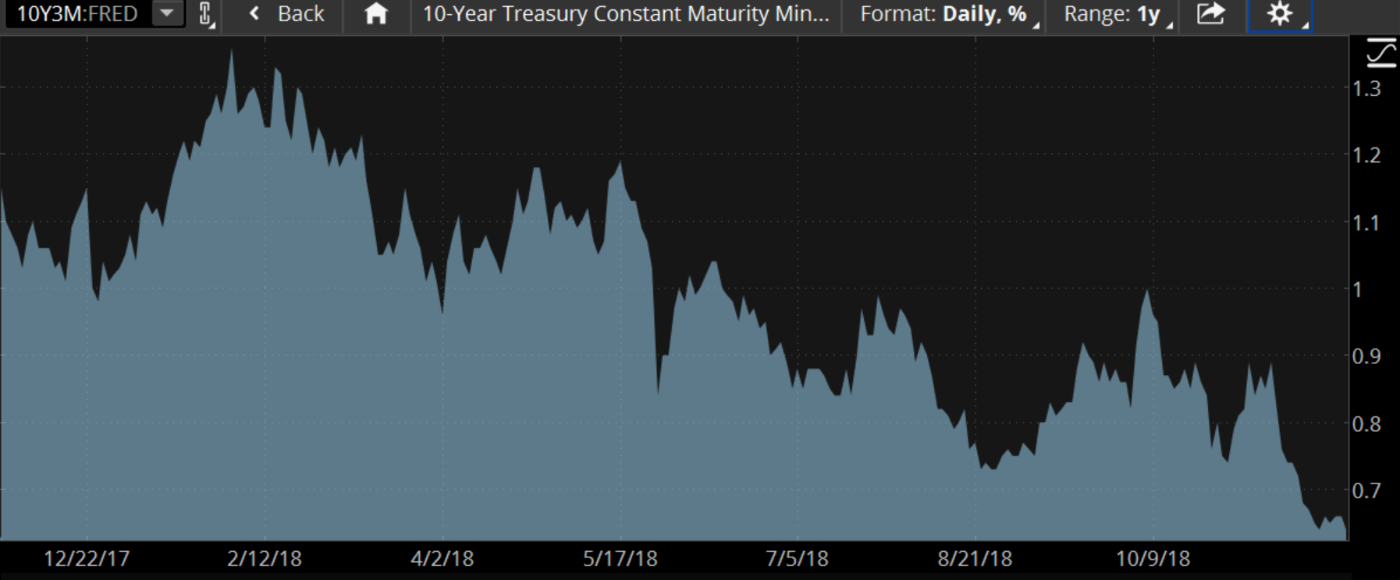

At the same time, the gap between 10-year and two-year yields fell to about 11 basis points by late Tuesday, the lowest in more than a decade. The shorter-dated yields have been rising more quickly than the long-end most of this year, partly in reaction to the Fed’s three interest rate hikes. Longer yields haven’t risen as much, in part because of what might be more investor demand for U.S. Treasuries due to low yields on foreign offerings, and because many investors don’t appear to see U.S. economic growth continuing so strongly over the long term.

Which leads us to the third horseman of Tuesday’s sell-off: Economic fears. The weakness in long-term yields, with the 10-year now down to around 2.91% from 3.25% just a couple of months ago, might signal investor concern about 2019 U.S. growth. Many analysts have started expressing doubt that U.S. gross domestic product (GDP) can continue as strong as it’s been without much help from overseas economies, and the tariff fears play into this as well. Most of the rest of the developed world has seen flat growth this year, in contrast with 3% to 4% growth in the U.S. the last two quarters.

Looking ahead, earnings are still expected to rise for U.S. companies next year, but at a much slower pace than in 2018. That’s partly because the tax cut effect will probably be fading, and also due to tariff concerns and tough comparisons.

With all this in mind, investors seem to have dialed back their predictions about what the Fed might do. The futures market now predicts that after a widely-expected rate hike later this month, the Fed might hike just once next year. Earlier in 2018, some analysts had predicted as many as three Fed rate hikes in 2019. We’ll likely have a better sense of the Fed’s thinking on this come Dec. 19, when the Federal Open Market Committee (FOMC) meeting wraps up and delivers investors an updated “dot plot” of where members see rates headed in years to come.

Financials Hit Hard as Bank Stocks Falter

From a sector standpoint, financials took a big blow Tuesday, in part due to falling yields. The financial sector was down more than 4% late in the session, with all the major banks off at least 4% and Morgan Stanley (NYSE:MS) and Bank of America (NYSE:BAC) down 5%. An inverted yield curve can make it hard for banks to do their business, which depends on borrowing on the short end and lending on the long. Also, banks might be getting hit by concerns that loan demand and perhaps trading volume could fall if the economy slows.

That said, two major bank CEOs interviewed Tuesday on CNBC expressed positive thoughts about the industry and said their customers haven’t sounded bearish on the economy. Whatever the case may be, Tuesday’s action in the financials came as another reminder of how frustrating it’s been for many investors to trade this sector all year.

Other sectors leading the down move Tuesday included industrials, consumer discretionary, and info tech. Only utilities gained ground on the day as a sector, but three of the major staples stocks that have been holding their own during many of the recent sell-offs once again managed to hold their heads up on a pretty ugly day. PepsiCo(NASDAQ:PEP), Coca-Cola Company (NYSE:KO) and Procter & Gamble Company (NYSE:PG) all finished flat to slightly lower, easily outpacing the major indices. It used to be that the FAANG stocks were viewed by some as a place to “hide out” on days like this, but that play is clearly over. The new hideout might be PEP, KO, and PG. Many investors seem to be looking for blue chip, dividend stocks if they don’t want to go to bonds.

From a technical standpoint, Tuesday’s losses sent the S&P 500 Index (SPX) back to well below what had looked like possible support at the 200-day moving average of 2762. For a while Tuesday, it looked like old psychological support at 2700 might be the next level to consider watching. By the end of the day, however, the SPX was exactly at that level. It’s been interesting to see how much trouble the SPX has had over the last two months staying above its 200-day moving average, and could speak to some possible underlying weakness.

While the VIX did rise 25% to above 20, investors might take solace in the fact that it stayed below 21, and remains well below October’s highs of above 25. Still, it could remain a factor to watch in coming days, especially ahead of the OPEC meeting starting Thursday and the payrolls report Friday.

Some of the late-day selling might have reflected the fact that markets are closed tomorrow for the mourning of President Bush. That might have caused some investors to unload more than they normally would, just because they can’t trade Wednesday. However, volume wasn’t too heavy most of the day, especially compared to the kind of volume we saw during sell-offs in October. This could be a positive signal, because typically you see higher volume on days like this.

In addition, active traders might want to take note: Check your positions for anything—including S&P 500and SPY (NYSE:SPY) options—that may have had its expiration or delivery date changed or affected by Wednesday’s market closure. If you have questions about anything expiring this Wednesday, consider calling the trade desk.

There won’t be a Market Update column tomorrow morning, as the markets are closed. We’ll be back Thursday morning.

Figure 1: Narrowing Yield Curve. Banks were among the weakest performers Tuesday, partially on concerns of flattening in the yield curve. The above chart plots the difference between the 10-year Treasury yield and the yield on 3-month Treasury bills. Note the sustained downtrend over the past year. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.