We are going bananas not because Trump is/was just another politician when it comes to the modern American tradition of debt-leveraged inflation to disenfranchise the middle and poor and enrich the already spectacularly wealthy. We are going bananas because that’s the only path out of this mess that people in power who want to stay in power will choose. Always.

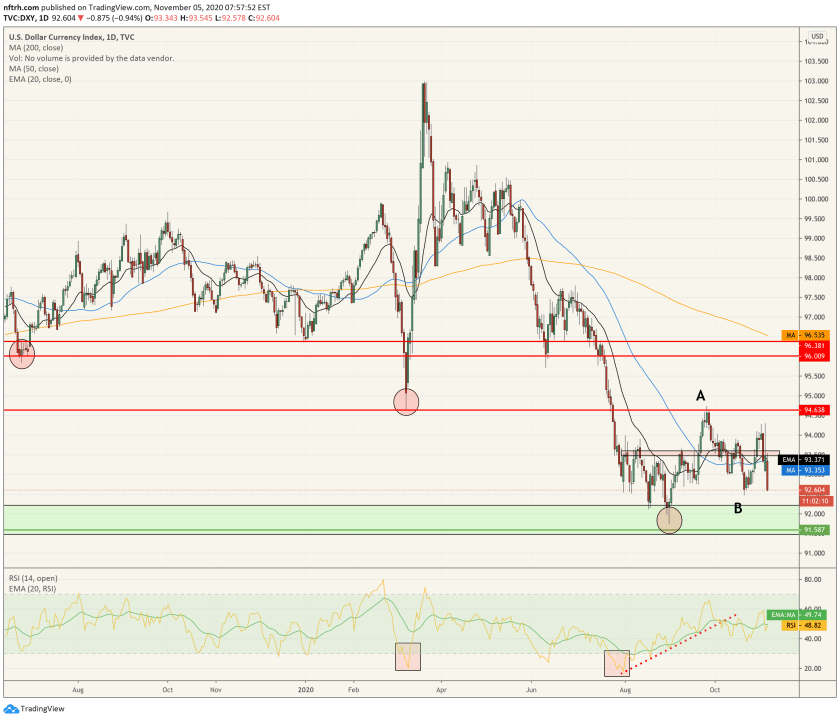

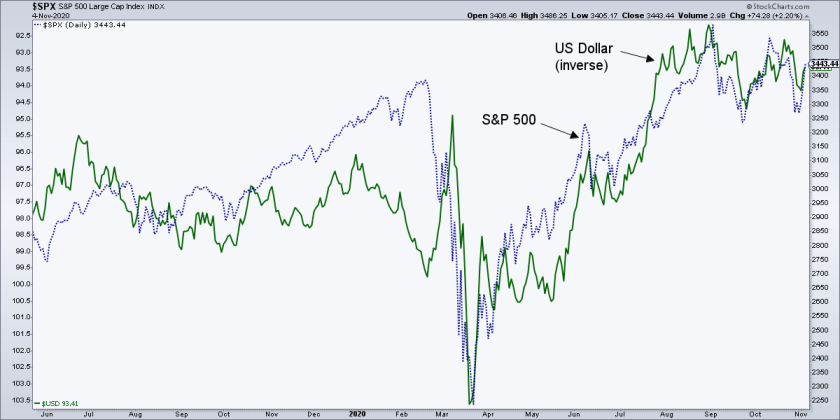

They will choose inflation by currency devaluation because it is a neat macro parlor trick that will boost certain desirable asset prices to the degree that the average person will think they are doing the right thing. After all, running a true savings/investment-based economy featuring Larry Kudlow’s mythical “King Dollar” would crash the S&P 500, for one.

Now, the Republican senate will probably stand in the way of some of the Democrats’ plans, like the Green New Deal when that pork wagon tries to roll into town. But they will not stand in the way of the ongoing and massive bailout stimulus aimed straight at the US dollar going one way and enriched asset owners going the other.

There may be some volatility here in the next few weeks and a market correction could still come about (unfortunately, the unpredictability of Trump’s tantrums will probably drive that, not some guy’s charts) but when it all shakes out and if it shakes out as currently indicated politically, America will still be going bananas because it’s the same tired old game plan Trump was using (even before the Pandemic, as the economy was slowly decelerating and the yield curve steepening in mid-late 2019).

Sit back, relax, have a banana (smoothy, daiquiri, with your corn flakes or straight up). There are only two ways this story can ultimately end. Either a deflationary whirlpool or ole’ von Mises’ Crack-up-Boom.