Investing.com’s stocks of the week

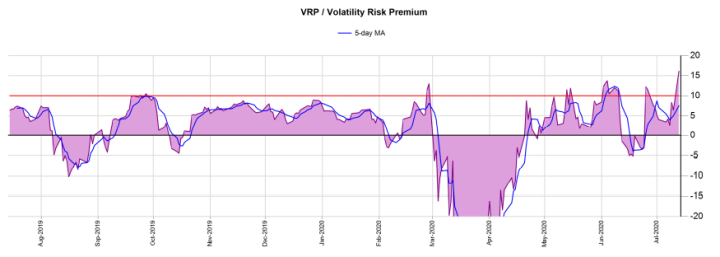

An interesting divergence has developed over the past week. As the VIX raced higher, S&P 500 realized volatility has collapsed. Traditionally, the VIX is supposed to lead and predict levels of SPX realized volatility. On Monday, we had a big intraday reversal in SPX and a big decline into the close. The VIX spiked to 32. But all the selling simply got stock prices back to their Friday levels.

On a close-to-close basis, hardly anything happened, as SPX didn’t even lose a full percentage point. That has been the story for a week now. SPX has been grinding in place by moving up and down about 1% per day. Most of measures of near term realized volatility like HV5 (5-day realized volatility), or HV10 have been declining and are now clocking in around 16 to match these 1% daily oscillations.

At the same time, it appears professional investors have been paying attention to the rising COVID cases in the United States and have been paying up for hedges in anticipation of economic slowdown and a matching market collapse. The Volatility Risk Premium (VRP), which is the difference between implied and realized volatility, is currently clocking in at some of its highest levels ever.

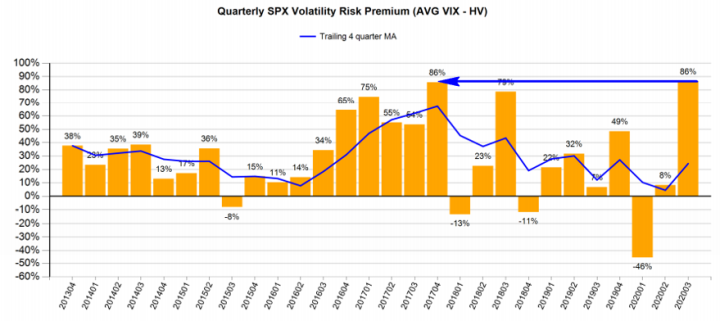

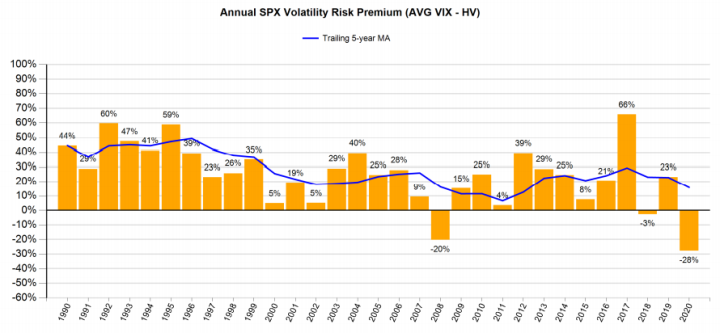

The VIX is about 30 right now while HV10 is 16. This is a VRP of about 14. In percentage terms, this is around 86%. This is a very wide volatility risk premium, the likes of which we haven’t seen since 2017. What is even more curious is that in 2020, VRP has been largely negative. Implied volatility has trailed well below realized volatility with VRP at -28% for the full year. In other words, we are observing something very odd happening. While the SPX hasn’t really shown much weakness recently, option markets have grown extremely edgy over the past 2 weeks.

Secular And Cyclical Stocks Diverge

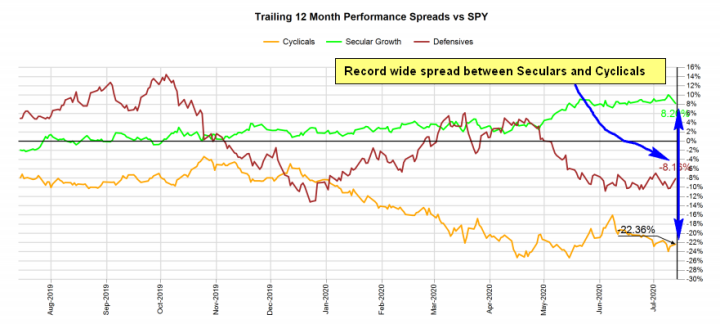

Market internals tell a similar story. Investors have recently been selling economically sensitive cyclical sectors such as XLE (energy), XLI (industrials) and XLF (financials), which would get hurt if new COVID lockdowns are imposed and buying up secular sectors like XLK (tech) and XLV (health care), which would benefit from the new Work-From-Home trends or from the development of COVID vaccines and treatments.

The relative spread between seculars and cyclicals is at the widest levels ever seen. Secular sectors have outperformed cyclical sectors by more than 30% over the past year. While valuations are stretched for seculars, it can be argued that they are cheap for cyclicals. This very large divergence sets up a potential Benign Rotation from expensive secular sectors to cheaper cyclical sectors.

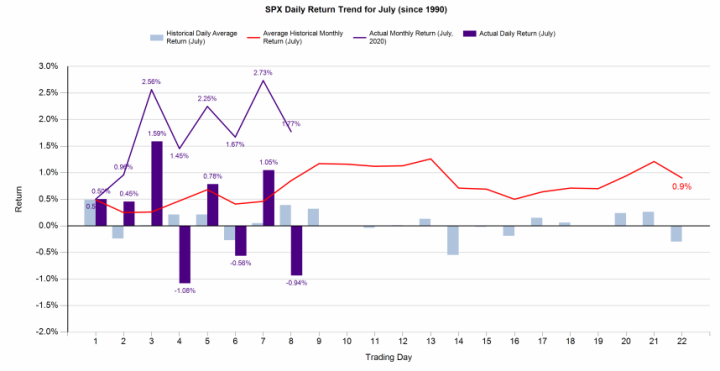

The question for investors is whether this elevated level of fear in the hedging markets is justified? Implied volatility haves nothing more in the world than rotations -- when money can find a home without the need for a hedge. Despite SPX surging back to almost flat on the year, amidst historic economic declines, it appears that investors have positioned themselves extremely well for a bad market selloff this summer. If the anticipated Armageddon doesn't transpire, there is record amounts of volatility risk-premium to compress, as the Benign Rotation takes place.