As Warren Buffett continues adding to his stake in oil refiner Phillips 66 (NYSE:PSX), many investors are wondering if Valero Energy Corporation (NYSE:VLO), another refiner, is an equally attractive dividend stock.

Valero offers a high yield of 4.4%, trades at less than 10x trailing earnings, and has more than doubled the S&P 500’s return over the last five years.

Dividend growth has been outstanding as well. Valero’s quarterly dividend payment has increased from 5 cents per share in 2010 to 60 cents most recently.

Offering a strong combination of yield and income growth, many conservative dividend investorsare wondering if Valero is a good fit for their portfolios or if the company’s best days are behind it.

After all, Valero slashed its quarterly dividend by 67% in 2010. If business conditions are about to deteriorate in a meaningful way, some investors wonder if history will repeat itself.

Let’s start with a review of the company before digging deeper into the safety and growth prospects of Valero’s dividend.

Business Overview

Valero incorporated in 1981 and is the world’s largest stand-alone refiner with 15 petroleum refineries across the United States, Canada, and the United Kingdom.

The company’s refineries process crude oil into many different products. Valero buys crude oil from other companies and processes it into conventional and premium gasoline, diesel, jet fuel, asphalt, petrochemicals, lubricants, and other refined products (e.g. petroleum coke, propane, lubes).

Valero sells its branded and unbranded refined products on a wholesale basis through a bulk marketing network and roughly 7,500 outlets that carry its brand names.

In addition to its refineries, Valero owns 11 ethanol plants that sell ethanol on a wholesale basis. Valero’s ethanol is primarily used in renewable fuels.

Valero is also the majority owner of Valero Energy (NYSE:VLO), a fee-based master limited partnership that operates liquids-focused pipelines and logistics assets. Valero owns the entire 2% general partner interest, all incentive distribution rights, and 67% of outstanding LP interests.

Valero used to have a company-owned retail network of gas stations and convenience stores but spun off this business in 2013.

Segments

Refining (97% of 2015 operating income; 88% of 2014 operating income): Valero’s petroleum refineries have total throughput capacity of 3.0 million barrels per day. Over 70% of the company’s refining capacity is located in the U.S. Gulf Coast and Mid-Continent.

Ethanol (3% of 2015 operating income; 12% of 2014 operating income): Valero’s ethanol plants process corn to produce ethanol and distillers grains. Ethanol is sold primarily to refiners and gasoline blenders. The price of ethanol generally follows the crude oil and gasoline prices, which is why this segment’s contribution to total operating income collapsed in 2015.

Business Analysis: Valero

Refining is extremely capital intensive. Valero spends $1.5 billion annually just to maintain its existing facilities.

A single refinery can be the size of several football fields and cost several billion dollars.

Building new refineries is especially challenging due to permitting issues and stringent environmental regulations.

Refineries also require access to transportation systems, pipelines to move their products, and feedstock supply agreements.

For these reasons, there are few new entrants to the market. Until 2012, the U.S. hadn’t seen a new refinery built in 30 years.

Not surprisingly, a handful of large players control the majority of total refining capacity.

Despite the industry’s high barriers to entry, operating margins are volatile and typically sit in the low- to mid-single digit range.

Margins are slim because refiners sell commodities on a global basis, have little to no pricing power, and have capital-intensive operations.

The best companies in commodity markets are those with the lowest costs and strongest balance sheets, which makes Valero a potentially attractive investment candidate.

Valero is the largest independent refinery in the world and can process some of the most complex crudes compared to its competitors.

Many different types of crude oils can be processed – light sweet, heavy sour, etc. – and each type has its own benefits, disadvantages, and price points depending on market conditions.

Valero can process over 80 different types of crude oils, giving the company input flexibility to capitalize on a range of different market conditions to maximize profit.

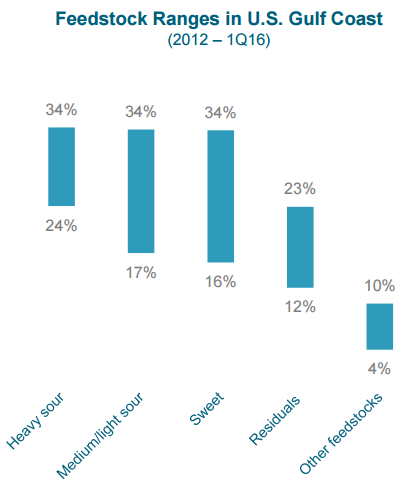

The chart below highlights the feedstock flexibility enjoyed by Valero:

Source: Valero Investor Presentation

While approximately 59% of Valero’s crude oil feedstock requirements are purchased under contracts (the rest are purchased on the spot market), its input flexibility prevents it from being overly dependent on any single supplier.

Beyond scale and flexibility, Valero’s operations also benefit from their geographical positioning. Over half of Valero’s refining capacity is positioned in the U.S. Gulf Coast.

These advantaged locations enjoy access to low-cost energy sources and provide Valero with easy access to export markets around the world.

Valero’s MLP subsidiary (Valero Energy Partners) also helps the company’s operational efficiency because its assets are integrated with Valero’s refineries.

The MLP provides access to low-cost logistics and transportation systems to source and move Valero’s oil feedstock and end products.

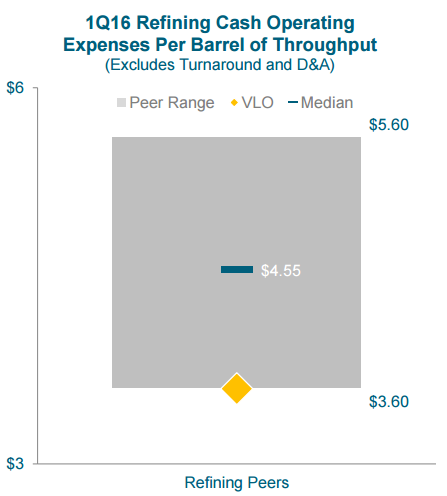

As seen below, Valero is the lowest cost operator in the industry on a per barrel basis:

Source: Valero Investor Presentation

While selling prices fluctuate heavily, petroleum refiners benefit from the predictable demand for refined products.

Downstream demand for Valero’s products essentially follows GDP growth, and investors do not need to worry about the company’s end products ever going obsolete (gasoline will remain an essential need despite increased energy efficiency over the coming years).

However, even when demand trends are steady, Valero’s quartery profits can swing wildly.

Key Risks: Refining Margins are Volatile!

Valero’s ethanol and refining segments have different risks. The ethanol business is sensitive to the price of oil, which drives the prices Valero can charge.

Additionally, renewable fuel standards impact demand for ethanol and are a controversial issue. With ethanol contributing less than 5% of Valero’s total operating income last year, I won’t dwell long on this topic.

Investors seeking more information about the risks of ethanol should review the risks I outlined in my thesis on Archer Daniels Midland (ADM), which has more meaningful exposure to ethanol.

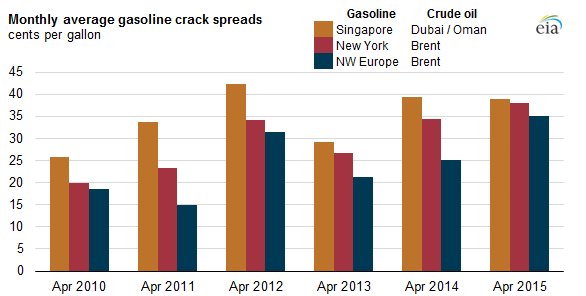

The refining business is what will really make or break Valero’s profits going forward. A common evaluation of refiners’ profitability is the crack spread, which measure the difference between the purchase price of crude oil and the selling price of finished products (e.g. gasoline).

U.S. refiners have enjoyed an unprecedented boom in profitability over the last five years thanks to the surge in domestic production of crude oil and natural gas. Daily oil production nearly doubledfrom 2010 through 2015.

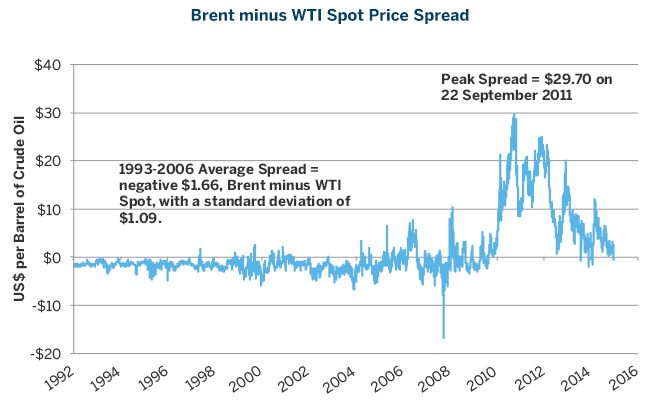

As a result, domestic oil prices (West Texas Intermediate – WTI) began to trade at a major discount to Brent crude oil prices, which serve as a benchmark for refined products sold internationally.

Since U.S. refiners source their crude oil needs domestically, they benefit from a wide Brent-WTI spread.

As seen below, the Brent-WTI spot price spread remained near zero from 1992 through 2009. Once U.S. oil production took off, a flood of domestic capacity kept WTI prices far below Brent prices. The spread hit nearly $30 per barrel in 2011.

Source: CME Group (NASDAQ:CME)

U.S. refiners enjoyed a boom in profits as input costs (i.e. crude oil) declined and gasoline consumption and exports increased.

Between 2010 and 2015, U.S. exports of gasoline and other fuels surged 38%, according to the Wall Street Journal (I highly recommend reading the article if you are considering investing in refiners).

While most of the energy sector was walloped by plunging oil prices, Valero’s profit grew significantly. As seen below, crack spreads significantly widened over the last few years.

Source: U.S. Energy Information Administration

Infrastructure (e.g. pipelines, marine transportation, and railcars) eventually began to catch up, narrowing the Brent-WTI spread significantly in recent years and smoothing out regional pricing differences that had helped some refiners gain access to cheaper landlocked oil.

With Congress overturning the ban on U.S. crude oil exports in late 2015 and domestic oil production beginning to decrease in response to lower prices, the Brent-WTI spread will likely remain near $0.

In commodity markets, high prices often cure high prices. In addition to the narrowing Brent-WTI spread, refiners have cranked up production levels to take advantage of the wide crack spreads, which has started to reduce the industry’s juicy margins.

Valero’s profit nearly halved during the first quarter of 2016 as weak gasoline and oil prices hurt refining margins.

Where crack spreads go from here is anyone’s guess. Valero will be hurt if the price of oil surges and gasoline prices remain steady.

Longer-term margins will depend on supply and demand for crude oil and refined products.

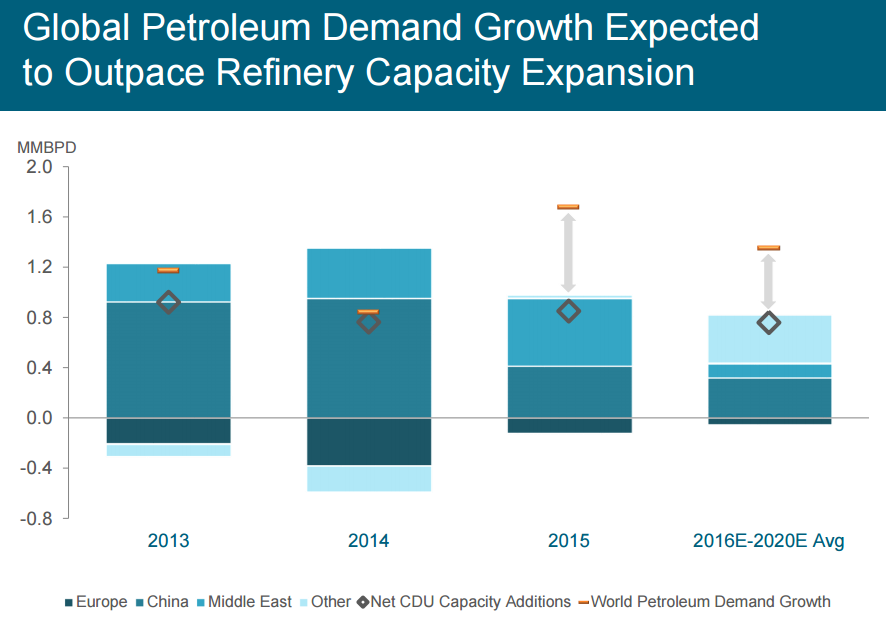

As seen below, Valero expects world petroleum demand growth to exceed net capacity additions. It remains very difficult to build new refineries and takes years of time.

Source: Valero Investor Presentation

At the end of the day, Valero’s business seems like it will always be needed in the global economy. However, its profitability will continue to swing wildly depending on a number of uncontrollable factors.

While a “normalized” margin in the mid-single digits seems fair for a commodity business, there are a lot of moving parts that can impact Valero’s profitability over any given quarter.

Investors need to approach Valero with some caution or might even decide to rule it out altogether given the company’s complexity.

Valero has benefited from very advantageous macro conditions over the last five years and could continue its reversion to the mean.

Let’s take a look at the dividend.

Dividend Analysis: Valero

We analyze 25+ years of dividend data and 10+ years of fundamental data to understand the safety and growth prospects of a dividend. Valero’s dividend and fundamental data charts can all be seen by clicking here.

Dividend Safety Score

Our Safety Score answers the question, “Is the current dividend payment safe?” We look at factors such as current and historical EPS and FCF payout ratios, debt levels, free cash flow generation, industry cyclicality, ROIC trends, and more. Scores of 50 are average, 75 or higher is very good, and 25 or lower is considered weak.

Valero’s Dividend Safety Score of 68 suggests that the company’s dividend is very safe for the time being.

Before diving in to the current dividend’s safety, some investors are likely wondering why Valero cut its dividend by 67% in 2010.

Essentially, Valero experienced a massive margin squeeze as crude oil prices rose much faster than gasoline prices.

The financial crisis dented economic growth, which caused demand to slump and left too much inventory and spare refining capacity in the industry.

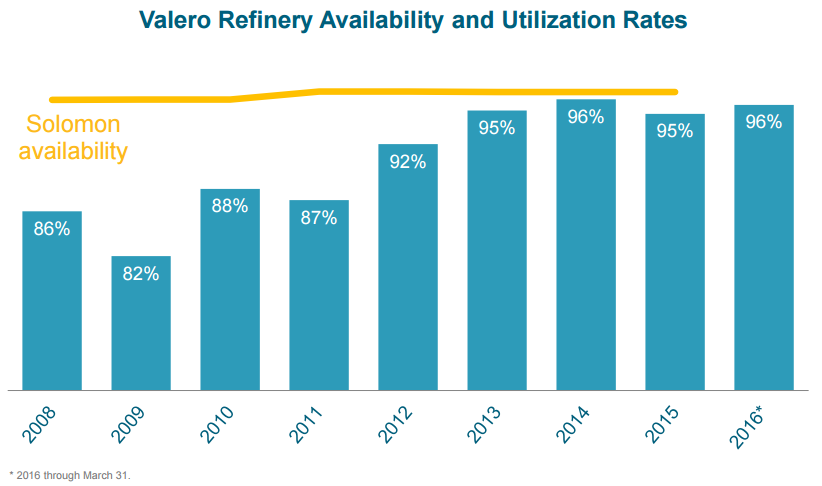

Source: Valero Investor Presentation

With lower utilization across its refineries, Valero’s high fixed costs (along with the collapse in crack spreads) destroyed its profitability.

Valero swung from high profits in 2007 to a loss in 2009. Unfortunately, the company’s balance sheet was also stretched.

Valero ended 2009 with $7.4 billion in total book debt compared with cash of $825 million. From 2010 through 2012, Valero’s debt coming due totaled $1.4 billion.

In other words, the company needed to retain as much cash as possible during the credit crisis. Cutting the dividend by 67% saved the company over $200 million per year.

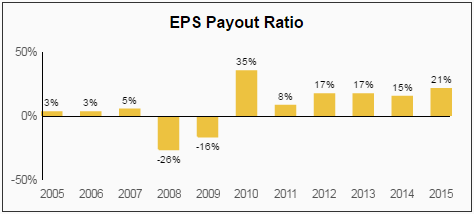

Interestingly enough, Valero’s payout ratio in 2007 was below 10%. Dividend investors who only focused on payout ratios as a measure of safety were burned badly.

Cyclical, commodity-sensitive companies with financial leverage must be scrutinized.

With Valero’s profits set to take steep dive this year, why does the company score above average for Dividend Safety?

While I don’t put too much weight on low payout ratios for cyclical companies, Valero has only paid out 42% of its cash flow as a dividend year-to-date. Despite macro headwinds, the company is still generating excellent income.

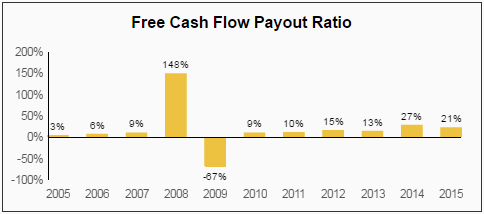

As seen below, Valero’s payout ratio has expanded over the last decade and can be very volatile depending on economic conditions.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

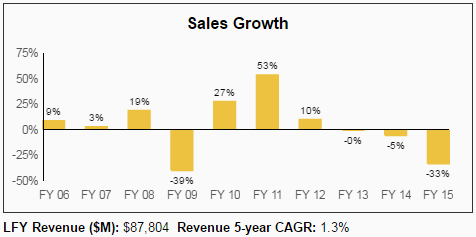

Not surprisingly, Valero has experienced major swings in revenue and earnings. Sales collapsed nearly 40% in 2009 and were down 33% in 2015.

Revenue is sensitive to the price of oil, which drives prices for many of Valero’s end products. However, falling revenue does not mean Valero’s net income is also dropping.

In fact, Valero’s diluted earnings per share grew by 16% in 2015. It all comes down to whether crack spreads are widening (good) or shrinking (bad).

Either way, the volatility of Valero’s business reduces its dividend safety. Conservative investors should also be aware that Valero’s stock returned -69% in 2008, trailing the S&P 500 by 32%.

Source: Simply Safe Dividends

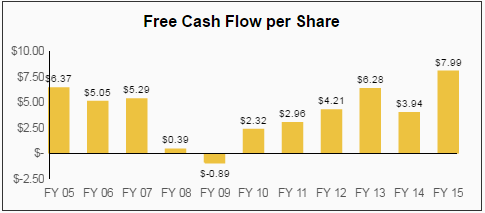

On a more positive note, Valero’s capital-intensive operations have down a surprisingly nice job of generating free cash flow, which is necessary for paying sustainable dividends.

As seen below, Valero has generated positive free cash flow in 10 of the last 11 years, and it lost less than $1 per share during 2009 despite harsh industry conditions.

The company’s economies of scale, flexible refineries, and low-cost production certainly help.

Source: Simply Safe Dividends

Perhaps most importantly, a cyclical company’s balance sheet significantly impacts dividend safety.

Companies will always make their debt and interest payments before issuing dividends. Cyclical businesses can find themselves in a cash crunch if they are overleveraged during a period of unexpected economic weakness.

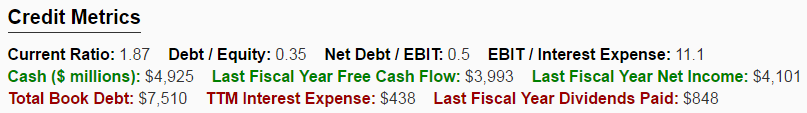

Valero is in much better financial health today compared to the last recession and maintains investment-grade credit ratings from S&P, Moody’s, and Fitch.

The company has nearly $5 billion in cash compared to total book debt of $7.5 billion and annual dividend commitments of about $1.1 billion.

Source: Simply Safe Dividends

In addition to its cash on hand, Valero has the option to borrow over $3 billion from its credit facilities, with the majority of the available funds not maturing until late 2020.

The company’s debt maturity schedule is also favorably staggered. Through 2020, only $2.55 billion of Valero’s debt load is coming due ($950 million in 2017, $750 million in 2019, and $850 million in 2020).

With annual maintenance capital expenditures of $1.5 billion and dividend payments of $1.1 billion, Valero needs at least $2.6 billion in free cash flow each year to break even before accounting for potential debt repayments.

With $5 billion in cash and several billion dollars available through its credit facilities, Valero could likely continue making dividend payments during the next cyclical downturn if free cash flow went to zero for a very short period of time.

However, it would be an uncomfortable holding. Management also has confidence in the current dividend and recently made the following statement:

“Our dividend is a commitment to our shareholders and we do consider it non-discretionary. With our cash position and nearly $5 billion of liquidity we have available to us, we’re quite comfortable with the sustainability of our current dividend and also the payout target of at least 75% of net income. And in addition, we’re not concerned with the funding of our capital program…

We did take a good hard look at this. And obviously margins can be volatile, right? That’s an understatement for the year. Last year they were strong, this year they’re weaker. And so, we ran cases before we presented to the board the dividend increase, which really looked at different margin scenarios. And that’s how we got our comfort level with it. I mean, we stressed it pretty hard. And, obviously, in this low-margin environment and with earnings where they are, we’re still in a good position on the dividend.”

Source: Seeking Alpha

Overall, Valero’s current dividend looks pretty safe in the current environment. It would take a major industry downturn similar to the one experienced in 2008-09 to create risk of a dividend cut, and the company appears to be better positioned today to get through tough times.

Dividend Growth Score

Our Growth Score answers the question, “How fast is the dividend likely to grow?” It considers many of the same fundamental factors as the Safety Score but places more weight on growth-centric metrics like sales and earnings growth and payout ratios. Scores of 50 are average, 75 or higher is very good, and 25 or lower is considered weak.

Valero’s Dividend Growth Score is 50, which indicates that the company’s dividend growth potential is about average.

Despite the company’s dividend cut in 2010, Valero’s annual dividend payments have grown by 24.5% per year over the last 10 years.

Source: Simply Safe Dividends

In fact, total dividends paid in 2015 ($1.70 per share) nearly tripled the company’s payout of 60 cents per share in 2009 prior to the dividend cut.

It only took two years for Valero’s dividend to eclipse prior highs after the reduction in 2010 (total dividends per share hit 65 cents in 2010, up from the previous high of 60 cents in 2009).

Valero last raised its dividend by 20% earlier this year. While macro headwinds are weighing on earnings growth, the company’s low payout ratios, continued free cash flow generation, and healthy balance sheet provide Valero with flexibility to keep increasing its payout.

Management targets a payout ratio of 75% of earnings in 2016, including share repurchases. I expect the company to continue rewarding shareholders with healthy dividend growth, albeit at a more moderate pace compared to recent years.

Valuation

As a cyclical company, Valero’s earnings will fluctuate greatly over the course of a cycle. One of the fastest ways to lose money is to purchase shares of cyclical companies at peak earnings and high multiples.

Valero’s shares have retreated approximately 25% since peaking at $73 in late 2015.

Analysts are baking in more than a 50% drop in Valero’s 2016 earnings per share, reflecting the compression in refining margins that has occurred this year.

Trading at $55 today, Valero’s shares trade at a forward-looking P/E ratio of 16.7 and offer a dividend yield of 4.4%, which is meaningfully higher than their five-year average dividend yield of 1.9%.

Looking further out, earnings are expected to rebound in 2017 and 2018, resulting in a 2017 P/E ratio below 10x.

From 2005 through 2015, Valero’s median annual free cash flow generation was $4.21 per share. If we assume this figure is Valero’s mid-cycle earnings power, the stock trades at a multiple of about 13x “normalized” cash flow.

While cyclical companies often trade at lower multiples than the market, it’s hard to argue that Valero’s multiple is expensive.

Barring an absolute shock in refining margins, Valero’s stock appears to be reasonably priced today.

While Valero is making a number of growth investments in logistics today, over the long run, Valero’s earnings per share growth will likely match growth in GDP.

If the company’s earnings sustainably grow by 3-5% per year, the stock appears to offer total annual return potential of 7-9% per year (4.4% dividend yield plus 3-5% annual earnings growth).

However, the path certainly won’t be linear given the cyclicality of refining margins! If the stock were to dip below $50, it could really begin to look like a bargain for long-term investors.

Conclusion

Valero is a highly volatile stock that should be approached with some caution because refining margins can unexpectedly swing and materially impact short-term earnings results.

Valero’s business has benefited significantly from lucky macro tailwinds over the last five years that helped lift free cash flow from $2.32 per share in 2010 to $7.99 per share in 2015.

Trees can’t grow to the sky, and neither can cyclical businesses. Refining margins have recently contracted, pushing Valero’s earnings down 60% in the latest quarter.

No one can forecast where the crack spread goes from here, but Valero’s valuation is certainly looking more attractive for long-term dividend investors that have the stomach for a volatile stock.

Valero’s dividend looks very safe for the time being, but an investment in the company does require some monitoring of the company’s overall financial health – especially if refiners ever face another environment like they did during the last recession.

Valero is in better health today than it was back in 2008-09, but you can never be fully sure with any cyclical company. Investors in search of less volatile investments might want to consider some other high quality dividend stocks.