Investing.com’s stocks of the week

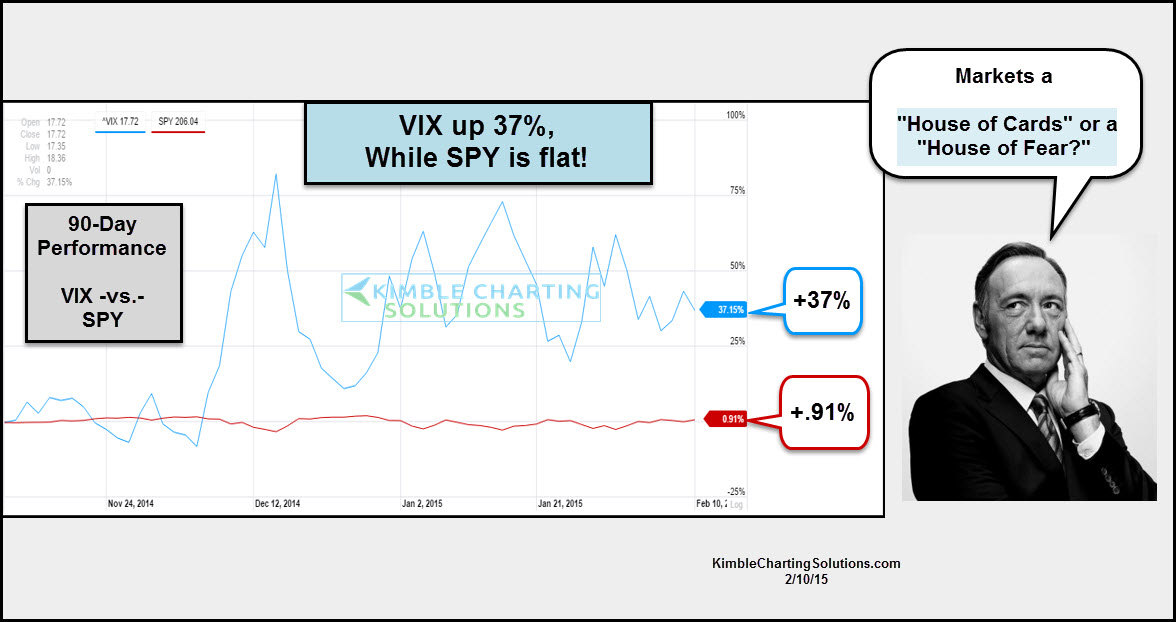

Do some investors think the market is a "House of Cards?" I say humbly that I don't know. It sure seems like something has them concerned, as fear levels remain lofty with the market making little progress up or down.

Over the past 90-days the S&P 500 is pretty much flat (up less than 1%). During that time the VIX (Fear Index) remains elevated, as it's been up the majority of the time the market has been going sideways.

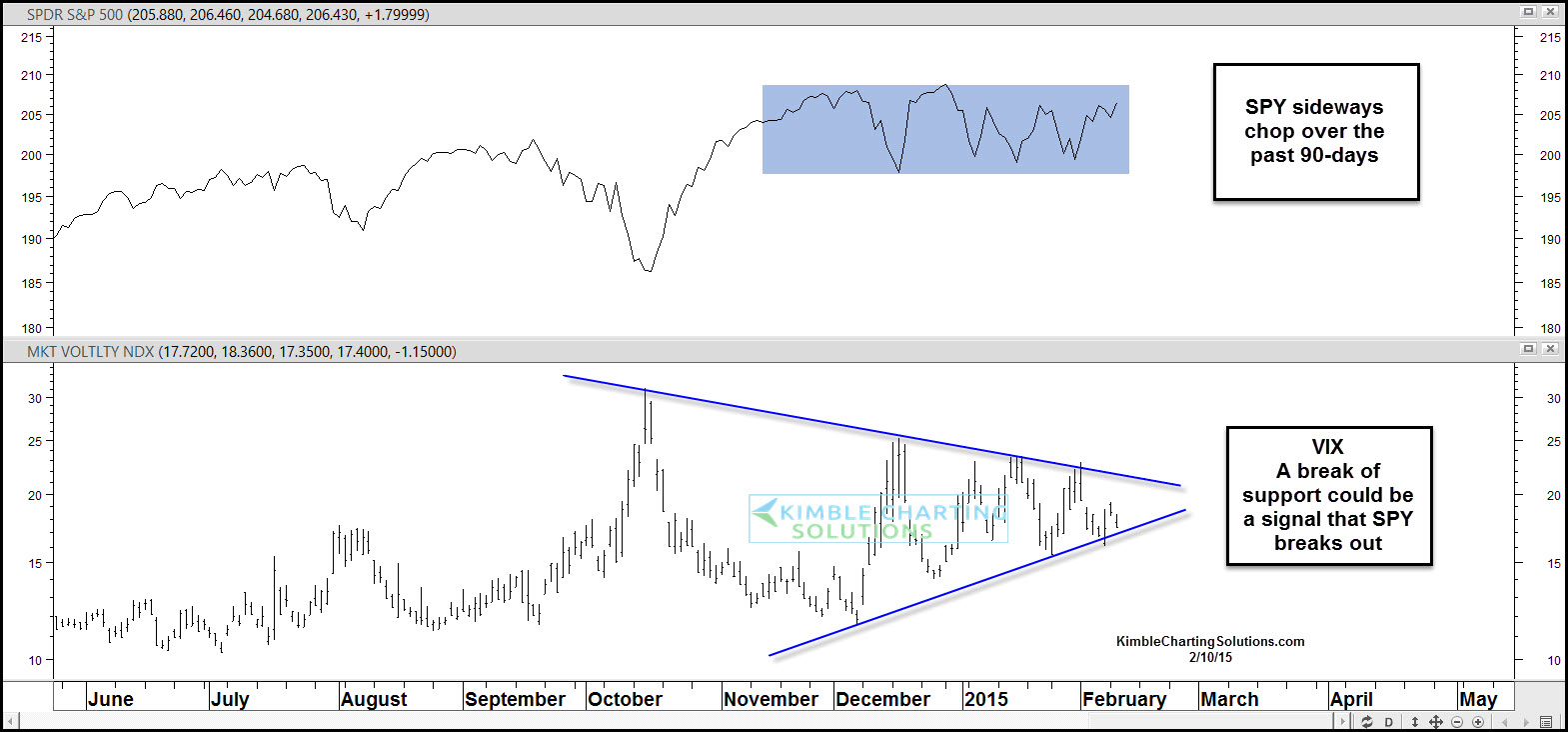

The VIX looks to be creating a pennant pattern over the past few months. How this pattern resolves itself could point to which direction the SPDR S&P 500 (ARCA:SPY) heads out of this sideways chop.

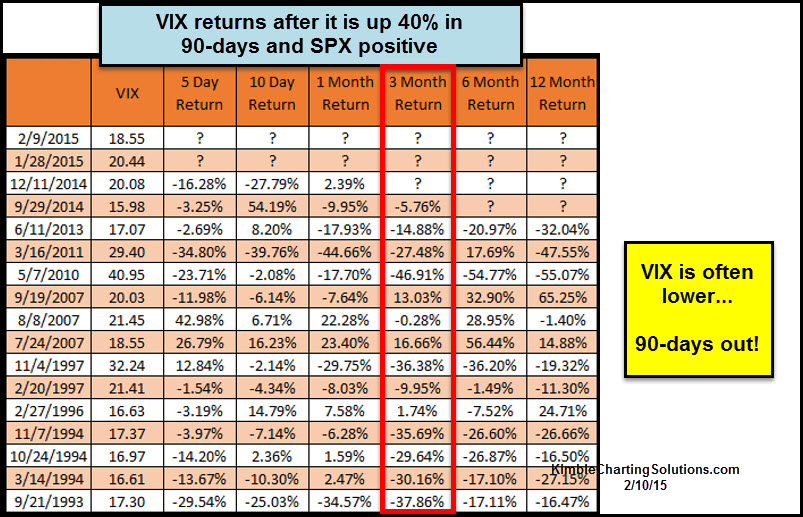

This table above highlights what happens to the VIX after it's up 40% in 90-days when SPY is positive. Majority of the time 90-days out the VIX is lower.

Falling fear can be positive for stocks and for VelocityShares Daily Inverse VIX (NASDAQ:XIV). If the VIX falls during the next 90-days, XIV could do fairly well. Let's see what happens from here.