VIX Non-Commercial Speculator Positions:

Large volatility speculators sharply turned around in their net positioning in the VIX futures markets this week as the markets underwent a sharp selloff, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

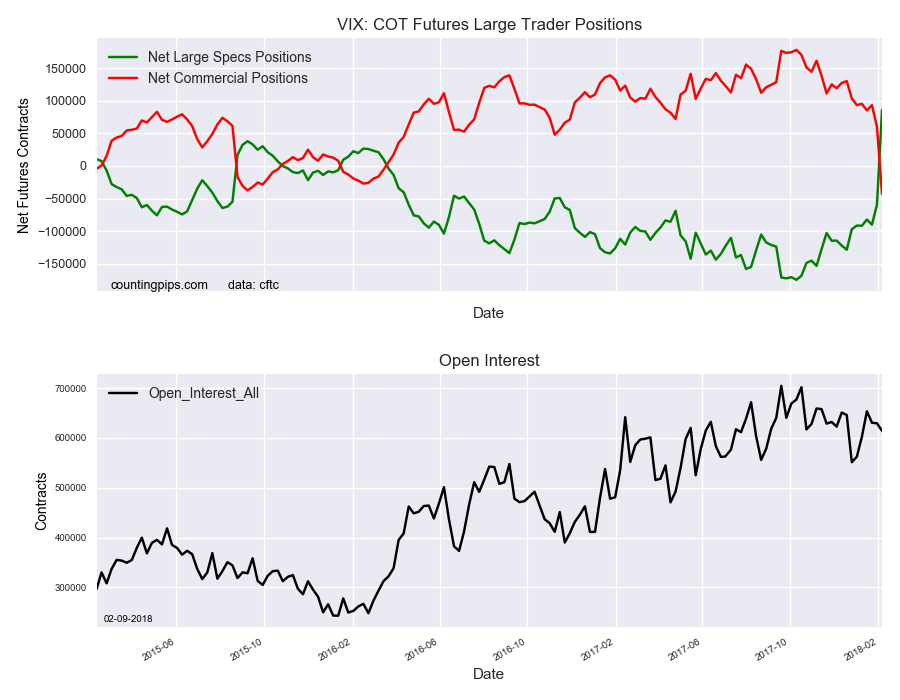

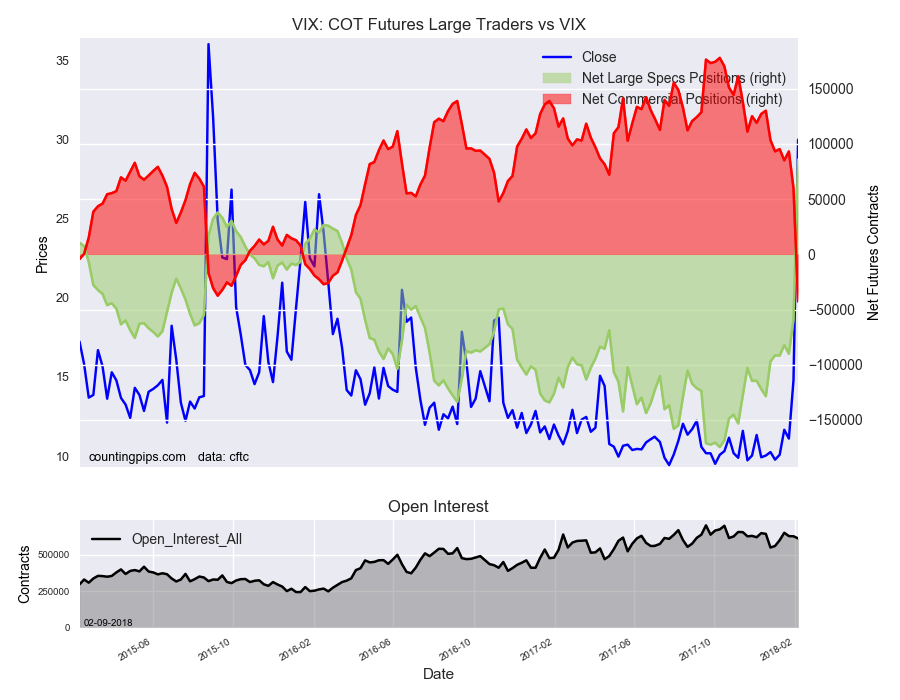

The non-commercial futures contracts of VIX futures, traded by large speculators and hedge funds, totaled a net position of 85,818 contracts in the data reported through Tuesday February 6th. This was a weekly lift of 145,175 contracts from the previous week which had a total of -59,357 net contracts.

The VIX, which measures the volatility of the SP500, experienced a large upward spike with the stock markets roiling this week and saw speculator positions flip over to positive for the first time since March 15th of 2016 when the net positions totaled +10,326 contracts.

VIX Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -42,820 contracts on the week. This was a weekly loss of -102,919 contracts from the total net of 60,099 contracts reported the previous week.

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the VIX, which tracks the volatility of the S&P 500, closed at approximately 29.98 which was an advance of 15.19 from the previous close of 14.79, according to unofficial market data.