The US market witnessed a 5.3% two-day drop after the UK referendum. Global markets lost $2T overall in just one day. Apparently, the market did not see the Brexit coming, at least not all of the investors. While some renowned investors such as Jim Rogers opine that a black-swan blowout is going to hit the market, investor resilience managed to pull the S&P 500 back by 4.9% in just three sessions, erasing over 90% of the Brexit loss. Given the quick short-term round trip after the Brexit outcome, did the market price Brexit wrong?

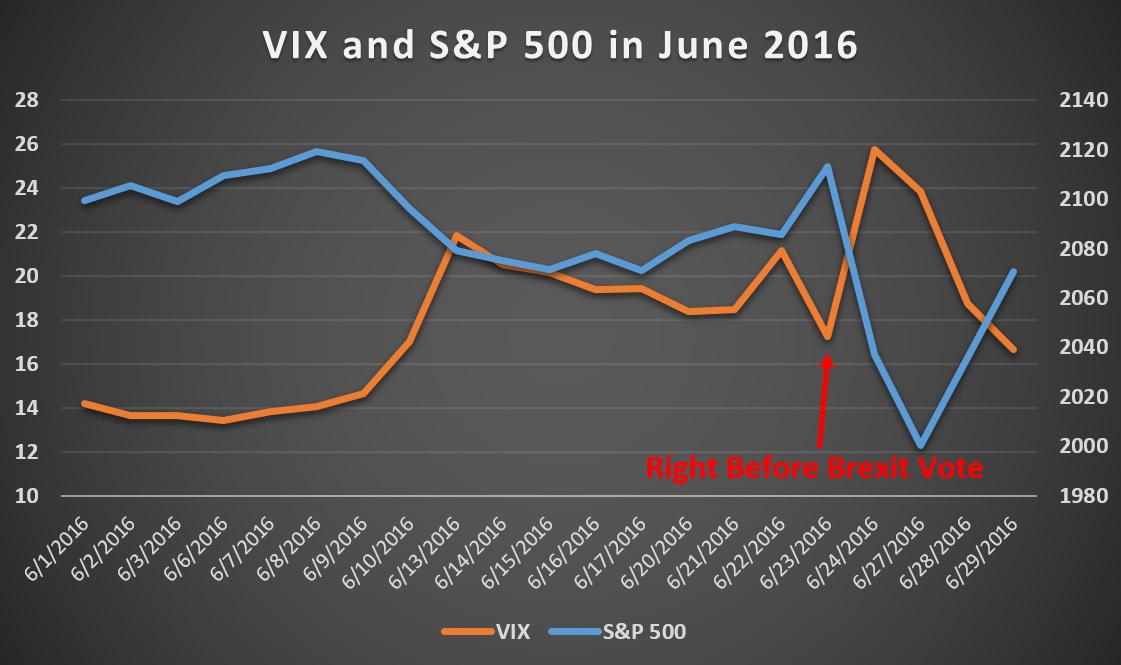

The VIX is one of the tools widely used to track market attitudes towards upcoming events. The VIX uses both call and put options on the S&P 500 companies over the next 30 days to calculate their index. The level of VIX directly indicates agent behavior and positively correlates with market concern over the upcoming period. Starting from two weeks prior to Brexit, the VIX did start moving upward; however, the volatility indicator gradually fell back to a moderate level till the night of the Brexit vote. Temporarily alleviated concerns were accompanied by the S&P 500’s approaching its former all-time high level above the 2100 line. Clearly, the market did not believe UK would leave EU.

In a prior research report, we discussed how VIX had become the victim of Goodhart’s Law and lost its forecasting power. The Brexit vote was no exception. VIX dropped to a mild level the day before the UK referendum, suggesting measured market optimism. If you relied on VIX for the Brexit trade, then you might have not slept very well in the past week. But it is still too soon to conclude that VIX has no value to investors. Goodhart’s Law works when too many investors exploit the same indicator at the same time.

Therefore, when there are not as many agents herding together, indicators can still maintain their investing power. To discern this requires shifting our investment timeline. If we jump back to two weeks prior to the Brexit vote, the VIX precipitously jumped over 60% in one week. Assuming that was the point at which the market captured the Brexit risk, the corresponding market level could imply how severe the impact of Brexit would be on the US stock market. As ex-post evidence demonstrates today, we are bounced back to the same level as before Brexit in the S&P 500 as well as VIX.

One last interesting observation is that the VIX has been nose-diving since the Brexit vote on June 23, regardless of the equity-market selloff. We can interpret the VIX as suggesting that the market expects Brexit to have a short-lived negative impact on the US market. But again, as our last lesson just told us, we cannot rely upon the VIX alone as our key investing tool. After all, volatility can vary dramatically within days.

Leo Chen

Portfolio Manager & Quantitative Analyst