We share the Weekly Gamma Bands Update by Viking Analytics. The report uses options gamma to help you better manage risk and your equity allocations.

The S&P 500 (SPX) sold off on Monday and consolidated near the 4,200 level most of last week. The market remains in an amplified volatility regime below the gamma flip level near 4,480. We are entering this week with a 0% allocation to the SPX.

War and related headlines will likely continue to whipsaw the market. If value remains below the lower gamma level (currently near 4,250), our model will continue in a flat position.

Last Friday was an important quarterly option expiration ("quad witching") day, and we have seen volatility into and in the days following these quarterly expirations. The last two major sell-offs (in March 2020 and December 2018) climaxed in the days following this quarterly expiration.

There are order flow dynamics that can help to explain these patterns. As such, we are generally comfortable with a flat or minimal allocation to stocks unless the current downtrend somehow reverses itself this week. The dashed lines below show the dates of the recent monthly expirations.

The Gamma Band model[1] can be viewed as a trend following model that shows the effectiveness of tracking various "gamma" levels. When the daily price closes below Gamma Flip level, the model will reduce exposure to avoid price volatility and sell-off risk. If the market closes below what we call the "lower gamma level," the model will reduce the SPX allocation to zero.

The main premise of this model is to maintain high allocations to stocks when risk and corresponding volatility are expected to be low. For investors who have been conditioned to "buy low and sell high," it is counter-intuitive to increase allocations when the market rises, but this approach has shown to increase risk-adjusted returns in the back-test.

Risk management tools like this have become more important than ever to manage the next big drawdown. We incorporate many options-based signals into our daily stock market algorithms. Please visit our website to learn more about our trading and investing tools.

The Gamma Band model is one of several indicators that we publish daily in our SPX Report (click here for a sample report).

The Gamma Flip – Background

Many market analysts have noted that daily volatility in the S&P 500 will change when the value of the SPX moves from one gamma regime to another. Some analysts call this level the "gamma flip."

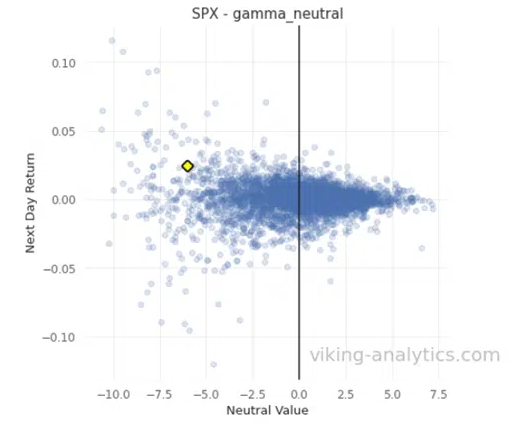

The scatterplot below shows how price volatility (on the y-axis) is increasingly lower as the value of SPX rises higher above the Gamma Neutral level (on the right side of the chart). When the value of the S&P closes lower than Gamma Neutral (to the left of the chart), volatility increases.

Gamma Band Model – Background

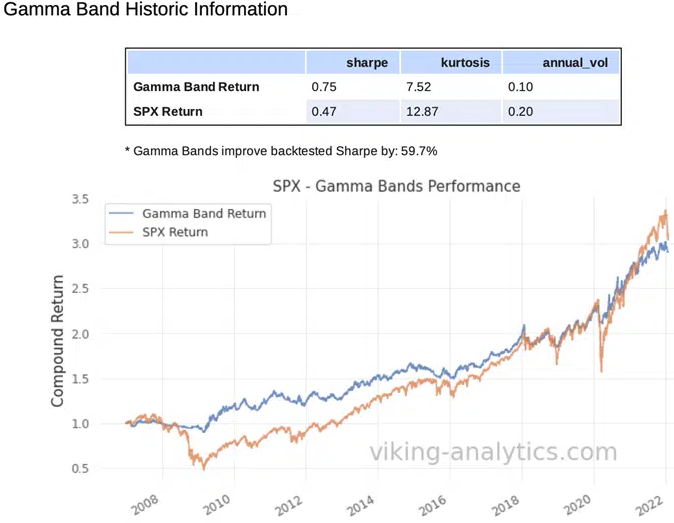

The purpose of the Gamma Band model is to show how tail risk can be reduced by following a few simple rules. The daily Gamma Band model has improved risk-adjusted returns by over 60% since 2007. The graph below demonstrates how this approach can limit drawdowns while maintaining good returns. A quick video introduction of the Gamma Band model can be seen by following this link.

Disclaimer: This is for informational purposes only and is not trading advice. The information contained in this article is subject to our full disclaimer on our website. [1] The Gamma Band model in our SPX Market Report adjusts position size DAILY based upon the daily closing levels of SPX value and calculated Gamma Neutral. The Weekly Gamma Band model is shown for illustrative purposes only.