Vietnam Enterprise Investments Ltd (LON:VEILV) is a specialist actively-managed, closed-ended investment company that is the largest and longest established fund focused on Vietnam-listed equities. Launched in 1995, it moved its listing to the LSE in July 2016 and has been included in the FTSE 250 Index since 18 July 2017. VEIL’s well-resourced investment team adopts a rigorous, bottom-up approach, aiming to achieve capital growth from a portfolio that typically comprises 35 to 40 holdings.

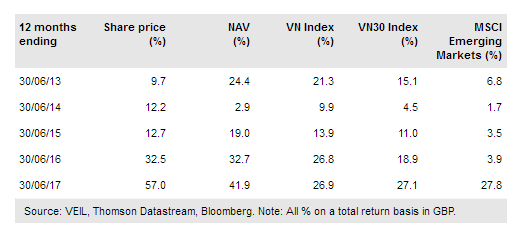

Absolute performance has been notably strong over one year and VEIL’s NAV total return has outperformed its VN Index benchmark over one, three, five and 10 years. The manager believes Vietnam’s stock market valuation is compelling and expects a number of attractive near-term opportunities to arise from the strong pipeline of prospective new listings and placings.

Investment strategy: Rigorous bottom-up approach

VEIL seeks medium- to long-term capital growth from a relatively concentrated portfolio, drawn mainly from Vietnam’s top 70 listed ‘blue chip’ companies. The investment team selects stocks using a detailed, bottom-up process, drawing on a team of 11 research analysts dedicated to Vietnamese equities. Although aiming to outperform the VN Index, allocations are unconstrained by index weightings.

Environmental, social and governance (ESG) considerations are a key focus, with stocks deemed non-compliant excluded from the investment universe. VEIL is not activist, but seeks to collaborate with the management of investee companies.

To read the entire report Please click on the pdf File Below: