V.F. Corporation (N:VFC) has been in business for more than 115 years and owns some of the most famous consumer apparel brands in the world (e.g. The North Face, Vans, Wrangler, Lee, etc.).

Unseasonably warm winter weather, sluggish retail spending, unfavorable currency fluctuations, and several other transient factors have caused this dividend aristocrat to tumble nearly 30% since the end of July 2015. None of these factors seem to impact the company’s long-term earnings power, potentially setting up an attractive investment opportunity.

VFC has increased its dividend for 43 consecutive years (2.6% yield) and appears to be trading at a very reasonable price (forward P/E multiple of 16) considering the quality of the business. These are the opportunities we look for when we buy dividend growth stocks in our Top 20 Dividend Stocks portfolio.

Business Overview

VFC was founded in 1899 and is one of the largest apparel companies in the world with a strong portfolio of brands in the outerwear, footwear, denim, backpack, luggage, accessory, sportswear, occupational, and performance apparel categories. VFC annually produces over 500 million units spread across more than 30 brands including The North Face, Vans, Timberland, Wrangler, Lee, and Nautica.

Approximately 75% of the business is sold on a wholesale basis to retailers, and the remainder of the business is sold direct-to-consumer (VFC owns over 1,400 retail stores under its different brand names and maintains a significant e-commerce presence).

By geography, VFC derived 70% of its 2014 revenues from the Americas, 20% from Europe, and 10% from Asia Pacific.

Business Analysis

In business for more than 115 years, VFC clearly has some competitive advantages. Many of the company’s largest brands have carved out leading mindshare with consumers in their respective product categories because they have delivered quality for so many years – The North Face (1966), Vans (1966), Timberland (1973), Lee (1889), Wrangler (1947), Eastpak (1952), Red Kap (1923), Nautica (1983), Jansport (1967).

Strong brands help VFC charge more for its products and maintain prime shelf space with retailers (i.e. retailers need VFC’s products to draw in traffic – consumers expect them to have North Face, etc., and might shop elsewhere if they don’t carry it).

While VFC has had to evolve its products’ designs and marketing strategies over the years, its long-standing brand recognition and successful relationships with retailers (there is only so much shelf space for each product category) serve as major competitive advantages.

To stay relevant, VFC invests significantly in advertising (over $700 million in 2014, representing over 5% of sales) and consumer research. VFC realizes that developing a deep understanding of consumers’ needs must be at the core of how it designs and markets products to win customers’ loyalty. Over the past four years, VFC has conducted thousands of in-person interviews and surveyed more than 125,000 people in 15 countries to gain better consumer insights.

The best brands create strong, emotional connections with consumers, and VFC has proven time and again to excel at this objective. The company’s relationships with consumers should further strengthen as it expands its higher-margin direct-to-consumer business, which consists of more than 1,400 company-owned stores and a significant e-commerce operation.

VFC’s extensive distribution network and presence in numerous product categories have also helped the company thrive. Whenever VFC develops a new product or acquires a new brand, it can sell these products all over the world and expand them into adjacent product categories to grow sales faster. VFC’s markets are highly fragmented and extremely large in size (over $100 billion), providing no shortage of growth opportunities.

Finally, VFC’s supply chain is another advantage. The company produces more than 500 million units of apparel, footwear, and accessories every year, representing hundreds of thousands of combinations of style and color. Over 30,000 of VFC’s employees support supply chain activities, and retailers require timely fulfillment of quality products that will sell.

Unlike some of its competitors, VFC also manufactures about 25% of its own products (the other 75% are outsourced to third parties). Products manufactured in VFC’s own facilities have lower costs and shorter lead times. The company’s scale and in-house work helps it maintain very competitive production costs and supply chain reliability that smaller players would struggle to match.

Overall, VFC’s reputation for quality, strong portfolio of brands, long-standing relationships with retailers, and skill in navigating a competitive landscape marked by constantly evolving consumer preferences form the foundation of its successful business.

Key Risks

Just like many other consumer-focused companies, VFC’s business can unpredictably move around any given quarter depending on consumer spending trends, weather (e.g. many of VFC’s outdoor products don’t sell as well during unseasonably warm winters), raw material costs (e.g. denim), and inventory management issues.

While any of these factors could persist for several months of even a few quarters, we don’t believe they have any bearing on VFC’s long-term outlook. If anything, they are buying opportunities.

What would concern us? As consumers, we know that our tastes and preferences are constantly evolving – especially when it comes to fashion.

VFC’s business is heavily dependent on a small handful of brands. In fact, its top five brands account for over two-thirds of its sales. Each of these brands has thousands of different product designs and colors, but there is some risk that VFC’s most profitable brands become less relevant with consumers over the coming years and struggle to grow off of such a large revenue base.

For now, there is no evidence that this is happening. VFC’s North Face and Vans brands (its #1 and #2 largest brands) grew by 11% and 10%, respectively, during the third quarter of 2015. Timberland was also up 21%. For the full fiscal year, management expects the company’s top five brands to have a 10% increase in sales.

The company is also concentrated in the outdoor, action sports, and jeanswear apparel categories (80% of total revenue). While these are certainly clothing mainstays, consumer preferences could still evolve within these categories and favor new brands or styles that emerge. Once again, we don’t see any cracks in VFC’s armor today – these segments are on pace to grow about 10% in 2015.

If VFC’s brands did start to lose their luster with customers, it’s possible that some of the company’s retail customers could allocate VFC’s shelf space to a competitor. VFC’s largest customer was 8% of its sales last year, and its 10 largest customers generated about 20% of VFC’s sales. Obviously, losing a retailer would hurt results.

Some retailers are pursuing vertical integration business strategies (i.e. they make their own apparel or buy direct) in an effort to save costs and improve profitability by consolidating their supply chains. Wholesale suppliers with weaker differentiation will likely face more price pressure, but we don’t expect this potential trend to have much of an impact on VFC because of its strong brands. Still, it’s something to be aware of and is a reminder of the industry’s competitiveness.

Overall, VFC’s future competitiveness seems like it will depend on the company’s ability to stay in front of changing consumer tastes, which influence product design, marketing, and so much more. We would feel a little more comfortable if VFC had greater brand and product category diversification, but VFC’s existing brands have shown remarkable durability over many decades of time. Risk is also mitigated somewhat by management’s ability to grow or acquire new brands and plug them into the company’s existing distribution network.

Dividend Analysis

We analyze 25+ years of dividend data and 10+ years of fundamental data to understand the safety and growth prospects of a dividend.

Dividend Safety Score

Our Safety Score answers the question, “Is the current dividend payment safe?” We look at factors such as current and historical EPS and FCF payout ratios, debt levels, free cash flow generation, industry cyclicality, ROIC trends, and more. Scores of 50 are average, 75 or higher is very good, and 25 or lower is considered weak.

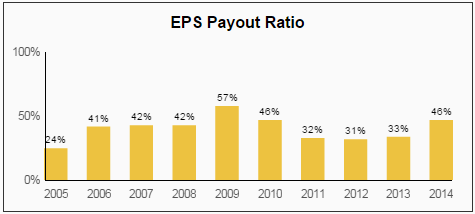

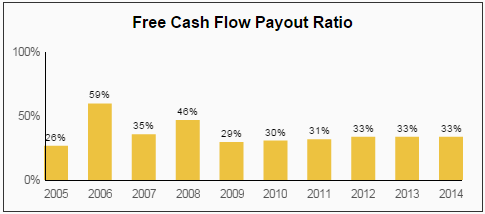

VFC’s dividend is extremely safe with an excellent Safety Score of 75. Over the last four quarters, VFC’s dividend has consumed 55% of its earnings and 79% of its free cash flow. As seen below, the company’s payout ratio has historically stayed in the 30-40% range most of the last decade. Management targets a 40% payout ratio, so this comes as no surprise. The company’s payout ratio is very healthy, providing plenty of cushion and room for dividend growth.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

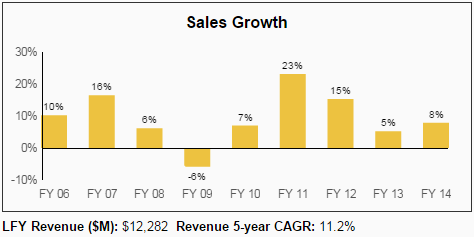

We can also look at how VFC performed during the last recession to better understand the safety of its dividend. The company’s sales fell by 6% in fiscal year 2009, and its earnings declined by 24%. VFC’s stock returned -18% in 2008 and outperformed the S&P 500 by 19%. Demand for VFC’s products is impacted by the health of the economy, which drives consumer spending, but its business model is still quite resilient.

Source: Simply Safe Dividends

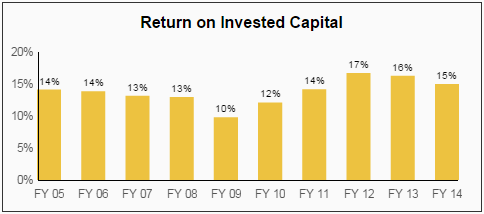

The company has also generated double-digit returns on invested capital in each of its last 10 fiscal years. Strong profitability is the sign of an excellent business, and VFC’s well-known brands have helped it maintain great returns over time.

Source: Simply Safe Dividends

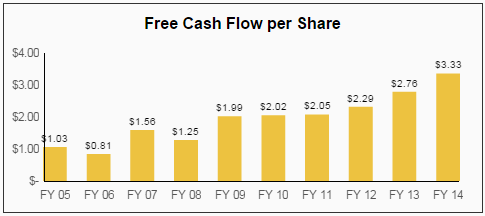

VFC has been nothing short of an excellent free cash flow generator and has seen free cash flow per share triple over the last decade. Free cash flow provides VFC with the flexibility to acquire other brands, repurchase its shares, and reward shareholders with higher dividend payments.

Source: Simply Safe Dividends

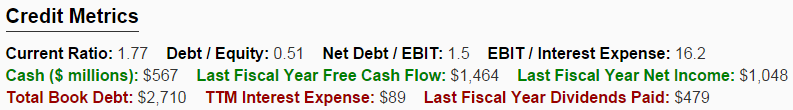

As seen below, VFC’s balance sheet also looks strong. The company could cover its entire debt with cash on hand and 1.5 years of earnings before interest and taxes (EBIT). Morningstar recently issued the company an “A” credit rating as well. Strong credit allows VFC to opportunistically pursue acquisitions to further enhance its long-term growth profile.

Source: Simply Safe Dividends

Overall, VFC’s dividend payment is about as reliable as they come. The company consistently generates free cash flow, maintains a conservative balance sheet, and has very healthy payout ratios.

Dividend Growth Score

Our Growth Score answers the question, “How fast is the dividend likely to grow?” It considers many of the same fundamental factors as the Safety Score but places more weight on growth-centric metrics like sales and earnings growth and payout ratios. Scores of 50 are average, 75 or higher is very good, and 25 or lower is considered weak.

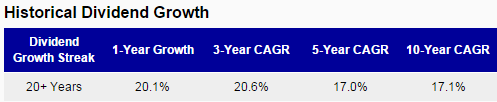

VFC’s dividend Growth Score of 77 suggests that the company’s dividend growth potential is significantly higher than most dividend-paying stocks. VFC most recently hiked its dividend by 16% in October 2015, representing its 43rd consecutive dividend increase. VFC is a member of the S&P Dividend Aristocrats Index and seems likely to join the Dividend Kings list (companies that have increased their dividends for at least 50 consecutive years) in seven years.

As seen below, VFC’s dividend has compounded at a 17% annual rate over the company’s last 10 fiscal years. VFC targets a 40% payout ratio, which the company is slightly above today. In other words, dividend growth over the next few years will likely track earnings growth. Management expects VFC’s earnings to grow 10-15% per year, and dividend growth will likely be in a similar range.

Source: Simply Safe Dividends

While VFC’s current 2.6% dividend yield isn’t great for investors living off dividends in retirement, the company’s strong dividend growth is something to keep in mind.

Valuation

VFC trades at about 16x forward earnings and offers a dividend yield of 2.6%, which is meaningfully higher than its five year average dividend yield of 1.8%.

While the faster pace of change in consumer apparel markets shouldn’t be understated, companies with excellent brand portfolios and long-standing distribution relationships typically do not come cheap.

Even if VFC doesn’t quite live up to management’s expectations of 10-15% annual earnings growth, the stock still appears to be trading at a very reasonable multiple. We believe VFC will continue compounding earnings at a growth rate between 7% and 11% per year over the next five years, resulting in total return potential of 11% to 14% per year.

Growth is supported by VFC’s extremely large and fragmented markets, track record of growing smaller brands into category leaders, geographic expansion opportunities, and continued mix shift into higher-margin areas (e.g. direct-to-consumer).

Conclusion

VFC’s stock seems somewhat unfairly beaten down today. While current macro trends are far from ideal, the company is still generating excellent growth from its core brands and has demonstrated skill in understanding and evolving with consumer preferences. We don’t see anything that suggests VFC’s long-term earnings power is impaired, but its stock has certainly become much cheaper over the last six months.

With over 40 years of dividend increases, a portfolio of well-known consumer brands, a conservative balance sheet, strong free cash flow generation, and numerous opportunities for continued growth, VFC is certainly a blue chip dividend stock that dividend growth investors should pay attention to.