Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) announced data from three studies wherein three different triple combination regimens were evaluated for the treatment of cystic fibrosis (CF). These led to pronounced improvements in lung function. Shares of the company surged more than 25% in after-hours trading following the announcement of the positive data.

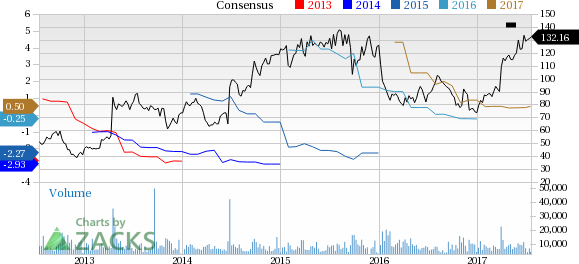

So far this year, Vertex’s shares have significantly outperformed the Zacks classified Medical-Biomed/Genetics industry. The stock has gained 79.4% compared with an increase of 8.8% registered by the industry.

Two phase II studies evaluated VX-152 (200mg q12h) or VX-440 (600mg q12h) and a phase I study evaluated VX-659, all three in combination with Kalydeco and tezacaftor for the treatment of CF patients with one F508del mutation and one minimal function mutation (F508del/Min). The primary endpoint of these studies was improvement in lung function measured by percent predicted forced expiratory volume in one second (ppFEV1). It measures the volume of air one can exhale in one second.

All the studies met their primary endpoints. The study evaluating VX-152 showed a mean absolute improvement of 9.7% points in ppFEV1 from baseline through two weeks versus placebo. The study on VX-440 showed an absolute change of 12% points in ppFEV1 from baseline to the average of the week 4 measurements versus placebo. The VX-659 regimen achieved a mean improvement of 9.6% points from baseline compared to placebo.

The data demonstrated the potential of the regimens to treat the underlying cause of CF in patients with severe and difficult-to-treat type of the disease rather than treating the symptoms. Also, the three different regimens were well tolerated in patients and most of the adverse events were mild to moderate in severity.

The company is also evaluating VX-152 or VX-440 in patients with two copies of the F508del mutation who are already receiving tezacaftor and Kalydeco combination. The initial data showed improvements in mean absolute ppFEV1 of 7.3% and 9.5% points.

Vertex fourth next-generation corrector under development is VX-445. A phase II triple combination (in combination with Kalydeco and tezacaftor) study on VX-445 is ongoing whereas the company expects to initiate phase II study on VX-659 early next month. Data from these studies are expected in early 2018. Thereafter, upon discussion with regulatory agencies, Vertex will initiate pivotal studies on one or more of these triple combination regimens in the first half of 2018.

We remind investors that Vertex remains focused on CF treatments. The company has two CF drugs – Kalydeco & Orkambi – in the market. Orkambi and Kalydeco together are approved to treat approximately 40% of the 75,000 CF patients in North America, Europe and Australia. They generated revenues of $481 million in the first quarter of 2017 together, which was 22% higher than the year-ago period.

On successful completion of these triple combination studies and subsequent approval, CF patients with minimal function mutations will also be eligible for treatment by Vertex’s portfolio of CF drugs. This should significantly boost Vertex’s sales.

Zacks Rank and Key Picks

Vertex currently carries a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the health care sector are Enzo Biochem, Inc. (NYSE:ENZ) , Exelixis, Inc. (NASDAQ:EXEL) and Corcept Therapeutics Incorporated (NASDAQ:CORT) . All the three stocks sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Enzo Biochem’s loss estimates have narrowed from 12 cents to 7 cents for 2017 and from 11 cents to 3 cents for 2018 over the last 60 days. The company came up with positive earnings surprise in the last four quarters, with an average beat of 55.83%. Its share price is up 64.8% so far this year.

Exelixis’ earnings estimates remained stable at 17 cents for 2017 and moved up from 53 cents to 55 cents for 2018, over the last 30 days. The company delivered positive earnings surprises in the last four quarters, with an average beat of 512.11%. The stock is up 75.4% so far this year.

Corcept’s earnings remained stable at 26 cents for 2017 and moved up from 51 cents to 52 cents for 2018, over the last 60 days. The company delivered positive earnings surprises in three of the last four quarters, with an average beat of 53.33%. The stock is up 70.9% so far this year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Vertex Pharmaceuticals Incorporated (VRTX): Free Stock Analysis Report

Enzo Biochem, Inc. (ENZ): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Original post

Zacks Investment Research