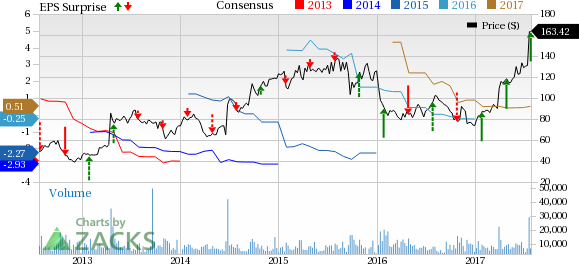

Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) reported second-quarter 2017 earnings per share of 10 cents (including the impact of stock-based compensation expense), which beat the Zacks Consensus Estimate of 6 cents. Notably, the company had posted a loss of 1 cent in the year-ago quarter. Strong product revenues led to higher profits in the quarter.

Excluding stock-based compensation expense, second-quarter adjusted earnings were 39 cents per share compared with the year-ago figure of 24 cents.

Vertex reported revenues of $544.1 million in the second quarter, up 26.1% year over year driven by strong product revenues. Revenues also beat the Zacks Consensus Estimate of $487.9 million by 11.5%.

CF Franchise Sales Strong

Vertex’s second-quarter revenues consisted of sales from cystic fibrosis (CF) products — Kalydeco and Orkambi, collaborative ($27.3 million) and royalty revenues ($2.9 million). CF product revenues were $514 million in the second quarter, up 21% year over year.

Kalydeco sales rose 5% to $190 million gaining from inventory stocking of $5 million ahead of the Jul 4 holiday.

In May this year, Kalydeco was approved for use in CF patients 2 years and older who have one of 23 residual function mutations in the CFTR gene. More than 900 people in the U.S. have one of these mutations. The expanded indication should boost sales of the drug in future quarters.

Orkambi (lumacaftor/ivacaftor) delivered sales of $324.0 million, up 32% year over year. On a sequential basis, Orkambi sales rose almost 10% in the second quarter, supported by continued uptake globally and further uptake in the pediatric indication for which approval was received in Sep 2016. Meanwhile, an inventory stocking of $10 million ahead of the Jul4 holiday also benefited sales in the second quarter.

Costs Rise

Adjusted (including stock-based compensation expenses) research and development expenses increased 10% to $284.3 million in the second quarter due to higher costs related to development of triple combination CF regimens. Adjusted (including stock-based compensation expenses) selling, general and administrative (SG&A) expenses increased 10.7% to $121.7 million due to increased investment to support the global launch of Orkambi.

Maintains 2017 Guidance

Vertex maintained its 2017 guidance for Orkambi and Kalydeco sales but raised its guidance for combined operating costs.

Orkambi revenues are expected in the range of $1.1–$1.3 billion while Kalydeco revenues are estimated in the range of $740 million - $770 million. We remind investors that following the approval for the additional indication in May, Kalydeco 2017 revenue guidance was upped to $740 million - $770 million from $710 to $730 million. Total CF product revenues are expected in the range of $1.84 billion to $2.07 billion in 2017.

Combined adjusted research and development (R&D) and selling, general and administrative (SG&A) expenses in 2017 are anticipated in the range of $1.33 to $1.36 billion, higher than $1.25–$1.30 billion expected previously.

Costs are expected to be higher due to accelerated development of the triple combination CF pipeline and investment to develop CTP-656.

Focus on Triple Combination CF Regimens

Vertex is evaluating some next-generation CFTR correctors (VX-152, VX-440, VX-659 and VX-445) as part of a triple combination withVX-661 (tezacaftor) and ivacaftor.

Data from VX-152 and VX-440 phase II and VX-659 phase I triple combination studies, conducted on CF patients who have one F508del mutation and one minimal function mutation (F508del/Min), were presented last week. The data demonstrated that all three combinations led to pronounced improvement in lung function. In fact, these are the first data to show the potential to treat the underlying cause of CF in patients who have a severe and difficult-to-treat type of the disease.

Following discussions with regulatory agencies, Vertex will initiate pivotal phase III studies on one or two of the four triple combination regimens in the first half of 2018.

Other CF Pipeline Update

In March, positive data from two phase III studies – EVOLVE and EXPAND – evaluating Kalydeco in combination with VX-661 (tezacaftor) in CF patients with two copies of the F508del mutation were also announced. Both studies met their primary endpoints and demonstrated statistically significant improvements in lung function. Based on positive outcome from the studies, the company recently submitted regulatory applications in both the U.S. and EU. Encouragingly, the combination was also granted Orphan Drug designation by the FDA in June.

Earlier this week, Vertex announced that it has closed the previously announced agreement to buy Concert Pharmaceuticals, Inc.’s (NASDAQ:CNCE) CF pipeline candidate, CTP-656. Vertex plans to develop CTP-656 for potential use in future once-daily regimens in combination with its other pipeline drugs to treat the underlying cause of CF.

Our Take

Vertex’s second-quarter results were encouraging, topping estimates on both counts as sales of both its CF drugs rose.

Shares declined slightly in after-hours trading probably in response to the hike in operating costs expectations for the year. However, so far this year, Vertex’s share priceis up a massive 121.8%, comparing favorably with an increase of 12% for the industry.

Meanwhile, Vertex’s CF pipeline is quite strong with a broad portfolio of next-generation CF correctors. Its triple combination CF regimens are considered crucial for long-term growth. If the triple-combo regimes are successful, Vertex can address a significantly larger CF patient population– almost 90% of patients with CF - in the future.

However, one cannot forget potential competition for Vertex’s triple combos. Belgian company, Galapagos NV (NASDAQ:GLPG) and AbbVie, Inc. (NYSE:ABBV) are also developing triple CFTR combination therapy for CF.

Vertex sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

AbbVie Inc. (ABBV): Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX): Free Stock Analysis Report

Galapagos NV (GLPG): Free Stock Analysis Report

Concert Pharmaceuticals, Inc. (CNCE): Free Stock Analysis Report

Original post