VeriSign (NASDAQ:VRSN) recently announced that more than 1.3 million domain names were registered in first-quarter 2017.

According to the latest “The Domain Name Industry Brief”, domain name registrations increased 0.4% sequentially to approximately 330.6 million across all top-level domains (TLDs) at the end of the quarter. Domain name registrations increased 11.8 million, or 3.7%, year over year.

Country Code Top-Level Domains (“ccTLDs”) increased 1.7% year over year and 0.3% sequentially to 143.1 million in Mar 2017 quarter. The growth was across all Top-Level Domains (TLDs) as both .com and .net grew during the quarter. On a combined basis, .com and .net domain names improved 0.8% year over year to approximately 143.6 million in the first quarter.

Domain Registration Prospects

VeriSign is the exclusive registrar of the .com, .net and .name domains per its agreements with The Internet Corporation for Assigned Names and Numbers (ICANN).

The company is benefiting from strong gTLD prospects. New gTLDs (“ngTLD”) represent 7.7% of total domain name registrations.

Reportedly, new .com and .net registrations were 9.5 million compared with 10 million in the year-ago quarter. VeriSign reported that .com continued to maintain its #1 position as the largest TLD, followed by .cn (China) and .tk (Tokelau).

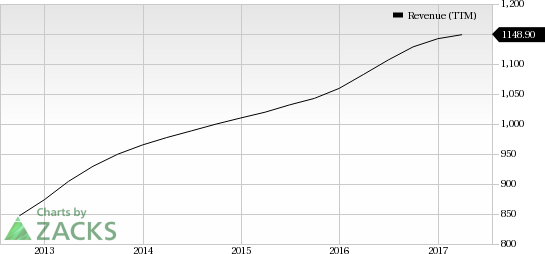

We believe that increasing domain name registration coupled with price hikes for the .com and .net domain names will drive top-line growth.

Moreover, in order to maintain its growth trajectory, VeriSign needs to keep expanding in the international market, particularly in emerging markets like India and China.

Per a recent study, India’s domain name industry has grown nearly 12% in the last three years compared to the global average of 8.7%. China has also been showing a consistent improvement in ranking, which indicates increased demand for domain name registration in the country.

Security Solutions a Key Catalyst

The company also enjoys strong growth opportunities in the Distributed Denial of Service (DDoS) security market and the network security products space. Increasing instances of cybercrime have expanded the scope for cybersecurity companies like VeriSign.

Notably, its shares have massively outperformed the S&P 500 on a year-to-date basis. While the index gained 10.7%, the stock returned 29.6%.

However, the negative impact of search engine adjustments on domain monetization remains a headwind.

Zacks Rank & Stocks to Consider

Currently, VeriSign has a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include XG Technology (NASDAQ:XGTI) , NetEase (NASDAQ:NTES) , and Sabre Corporation (NASDAQ:SABR) . While XG sports a Zacks Rank #1 (Strong Buy), NetEase and Sabre carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rates for XG, NetEase and Sabre are currently projected to be 20.00%, 17.45% and 9.27%, respectively.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

NetEase, Inc. (NTES): Free Stock Analysis Report

VeriSign, Inc. (VRSN): Free Stock Analysis Report

Sabre Corporation (SABR): Free Stock Analysis Report

XG Technology, Inc (XGTI): Free Stock Analysis Report

Original post

Zacks Investment Research