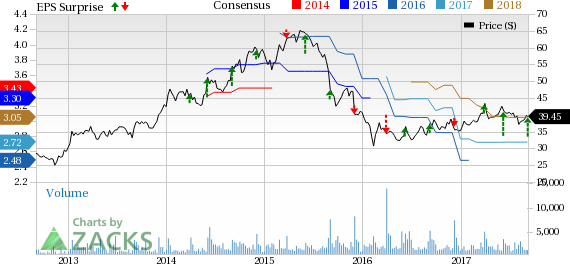

Verint Systems Inc. (NASDAQ:VRNT) reported fiscal second-quarter 2018 non-GAAP earnings of 61 cents per share, which beat the Zacks Consensus Estimate of 47 cents and increased 7% year over year.

The company reported non-GAAP revenues of $278.2 million, which increased 5.3% from the year-ago quarter. The figure also surpassed the Zacks Consensus Estimate of $270 million.

Management noted that first half fiscal 2018 revenues represented 48% of the full year outlook. This indicates that the company’s operations and strategic initiatives are on the right track.

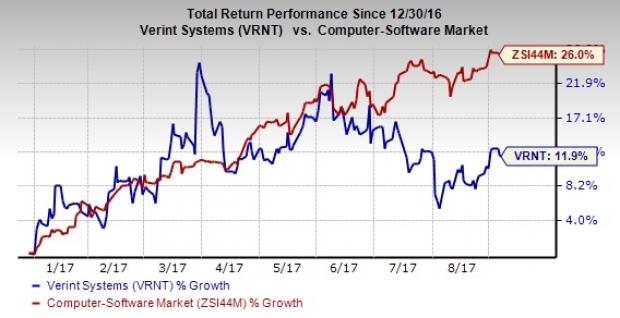

Verint Systems’ stock has gained 26% year to date, substantially outperforming the 11.9% rally of the industry it belongs to.

Revenue Details

Verint’s operations are divided into two segments, namely Customer Engagement and Cyber Intelligence.

Geographically, in the Americas, the company generated non-GAAP revenues of $144 million. Revenues from the EMEA were $85 million and that from APAC were $49 million. In the year-ago quarter, the company had generated $139 million in Americas, $82 million in EMEA and $43 million in APAC.

In the reported quarter, Customer Engagement non-GAAP revenues were $184 million, which increased 5% sequentially and 3% from the year-ago quarter on a constant currency basis.

The company is expanding its presence among existing customers as well as adding new ones on the back of a strong product suite. Verint is also investing to create an effective partner network for better integration of its offerings.

The company added organizations from the fields of telecommunications, insurance and automation to its customer base in the second quarter. Verint is also enriching its product portfolio inorganically by acquiring related companies.

Recently, the company’s UK subsidiary announced the acquisition of workforce management software provider EG Solutions. Verint believes that this acquisition will be beneficial for its upcoming venture of providing solutions for back office customer engagement, which it plans to launch in the second half of the year.

The Cyber Intelligence segment generated non-GAAP revenues of $95 million in the quarter that grew 4% from the previous quarter and 12% year over year.

Management stated that continuous deal wins have aided segment revenues. Verint plans to launch web and social intelligence products that will involve real-time data collection and analysis. These will help to identify abnormal behavior of the system and generate predictive solutions.

The company is working on a new range of products based on customer feedback and management believes this range will be beneficial for the company’s top line going forward.

Margin Details

Non-GAAP gross margin decreased 110 basis points (bps) year on year to 64.5%. The decline in the figure can be attributed to the company’s product, services and revenue mix within its cross segments, per management. Unfavorable mix of hardware, software and services from third party vendors included in the cyber intelligence segment was cited as another reason for fluctuating margins.

Non-GAAP operating margin declined 190 bps from the year-ago quarter to 16.4%. Increased spending in research and development pertaining to a surge in demand from the security market primarily resulted in the decline in operating margin.

Balance Sheet and Cash Flow

Cash and cash equivalents for the six months ending Jul 31, 2017 was $365.14 million compared with $340.12 million for the six months ending Jul 31, 2016.

Net cash from operations was $98.51 million for six months ending Jul 31, 2017 and that for the six months ending Jul 31, 2016 was $69.3 million.

Guidance

For fiscal third quarter 2018, management expects revenues to be in the range of $280 to $285 million. Expenses are anticipated to be more or less the same as in the second quarter.

For fiscal 2018, revenues are expected to be $1.14 billion (+/-2%). Non-GAAP earnings per share are projected to be around $2.75, up by 5 cents from the previous guidance.

Zacks Rank and Stocks to Consider

Verint has a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include Applied Materials (NASDAQ:AMAT) , Activision Blizzard (NASDAQ:ATVI) and Applied Optoelectronics (NASDAQ:AAOI) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Applied Materials, Activision and Applied Optoelectronics is currently projected to be 17.1%, 13.6% and 17.5%, respectively.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars. This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Verint Systems Inc. (VRNT): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research