Verifone Systems, Inc. (NYSE:PAY) was a big mover last session, as the company saw its shares rise nearly 6% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This continues the recent uptrend for the company for the company—as the stock is now up 11.1% in the past one-month time frame.

The company has seen a mixed track record when it comes to estimate revision of no increase and decrease over the past few weeks, while the Zacks Consensus Estimate for the current quarter has remained unchanged. The recent price action is encouraging though, so make sure to keep a close watch on this firm in the near future.

Verifone Systems currently has a Zacks Rank #4 (Sell) while its Earnings ESP is negative.

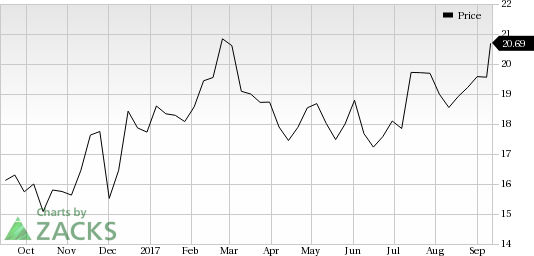

Verifone Systems, Inc. Price

A better-ranked stock in the Business Services sector is Green Dot Corporation (GDOT), which currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Is PAY going up? Or down? Predict to see what others think: Up or Down

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Verifone Systems, Inc. (PAY): Free Stock Analysis Report

Original post