On Aug 28, we issued an updated research report on Pleasanton, CA-based Veeva Systems Inc. (NYSE:VEEV) , a global provider of cloud software and data solutions for life sciences industry. The company currently carries a Zacks Rank #3 (Hold).

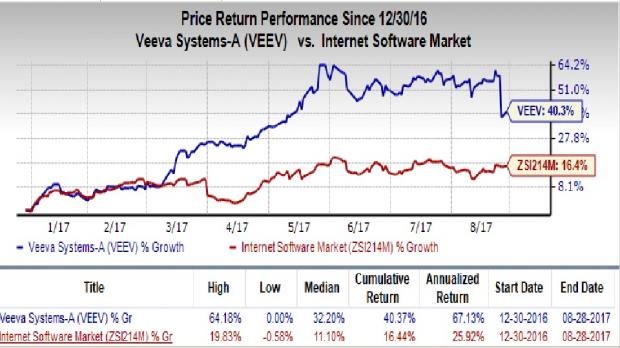

Veeva had an impressive run on the bourse year to date, trading above the industry in terms of price performance. A glimpse at the price movement reveals that Veeva’s shares have gained 40.4%, comparing favorably with the industry’s 16.4% decline. The company has a solid track characterized by consecutive earnings beat for the four trailing quarters.

The company has strengthened the recurring part of its revenue mix with significant growth in subscription revenues in recent times. Moreover, launches of the Veeva Vault and the Veeva Commercial Cloud platforms are encouraging. The company is also supported by considerable strength in its CRM platform.

Veeva’s industry-specific focus gives it a significant leverage, in our view. This is aptly demonstrated by its strong sales growth aided by new business gains, better pricing and product innovation. The company’s knowledge on different components of the life sciences industry is helping it to build targeted products. Notably, product like Veeva OpenData provides customer data to all healthcare professionals (HCP), healthcare organizations (HCO) and affiliations across life sciences’ major markets.

Looking ahead, Veeva is optimistic about its product pipeline that includes an exclusive range of products on its flagship Vault and Commercial cloud platforms. These products include Vault CTMS, Vault PromoMats Dam, CRM Engage Meeting and CRM Engage Webinar.

A glimpse at the last reported fiscal second-quarter results reveals strong revenues and adjusted earnings. The top and the bottom line beat the Zacks Consensus Estimate. Additionally, solid year-over-year subscription revenue growth has enhanced the recurring part of the company’s revenue mix.

However, on the flip side, unfavorable foreign currency is expected to hurt earnings in the near term. Also escalating costs and expenses are weighing on its margins. Last month, a comparative study of Veeva’s forward P/E (forward 12-month basis) multiple reflected that the stock has been quite overvalued.

Key Picks

A few better-ranked medical stocks are IDEXX Laboratories, Inc. (NASDAQ:IDXX) , Lantheus Holdings, Inc. (NASDAQ:LNTH) and Edwards Lifesciences Corporation (NYSE:EW) . Edwards Lifesciences sports a Zacks Rank #1 (Strong Buy), while Lantheus Holdings and IDEXX Laboratories carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

IDEXX Laboratories has a long-term expected earnings growth rate of 19.8%. The stock has gained around 6.2% over the last six months.

Lantheus Holdings has a long-term expected earnings growth rate of 12.5%. The stock has surged 34.9% over the last six months.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. The stock has rallied roughly 19.1% over the last six months.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Learn the secret >>

Veeva Systems Inc. (VEEV): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH): Free Stock Analysis Report

Original post

Zacks Investment Research