Investors remained concerned by the world-wide growth picture even as the US continues to post decent economic data. As we noted when the Fed announced their rate hike, we feel this move was a bit premature and should have been postponed in the midst of falling and/or volatile oil prices, Middle East unrest, the Chinese stock slide and economic downturn, etc.

Those factors may have a contagion effect for the US markets, even as the US remains the economy of last resort and the US dollar remains a safe haven. You can see their effects on the market so far this year, as 2016 is proving to be a bit of a downer so far with investors selling off positions due to short-term fears over China and share-price declines in their markets.

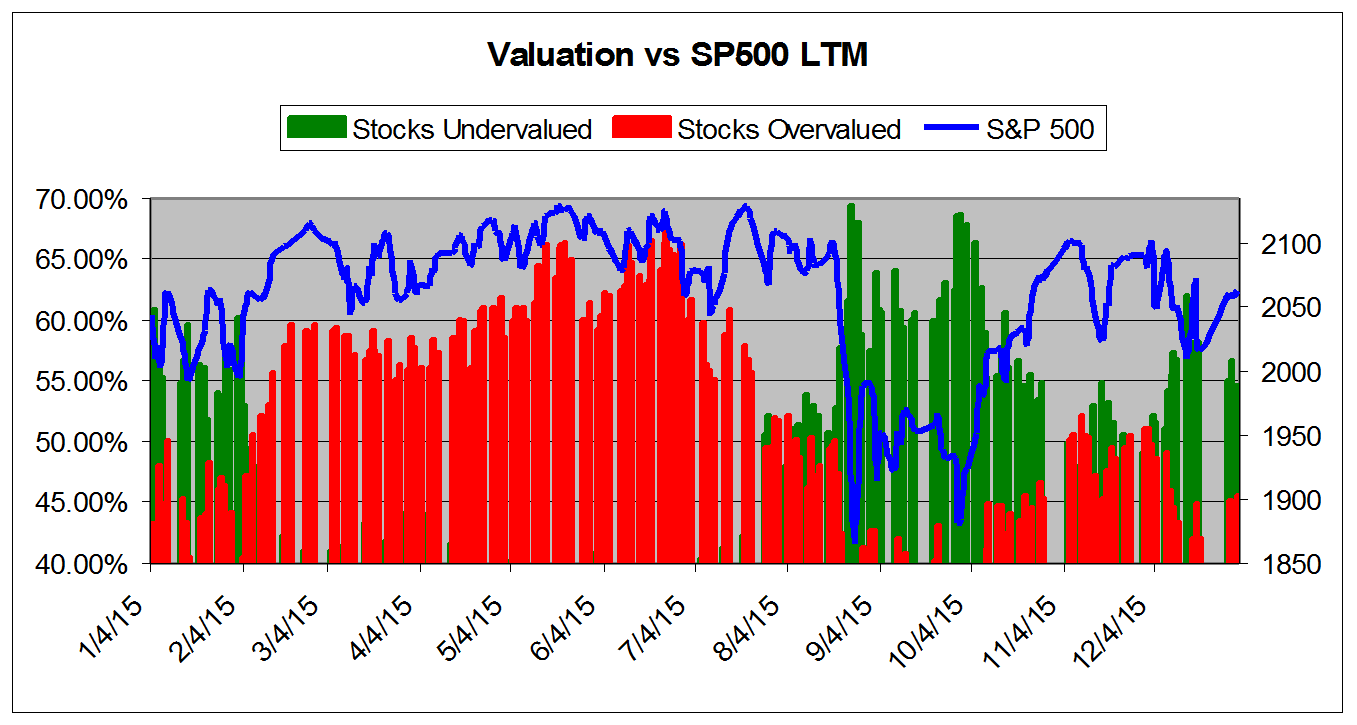

The chart below tracks the valuation metrics from January 2015. It shows levels in excess of 40%.

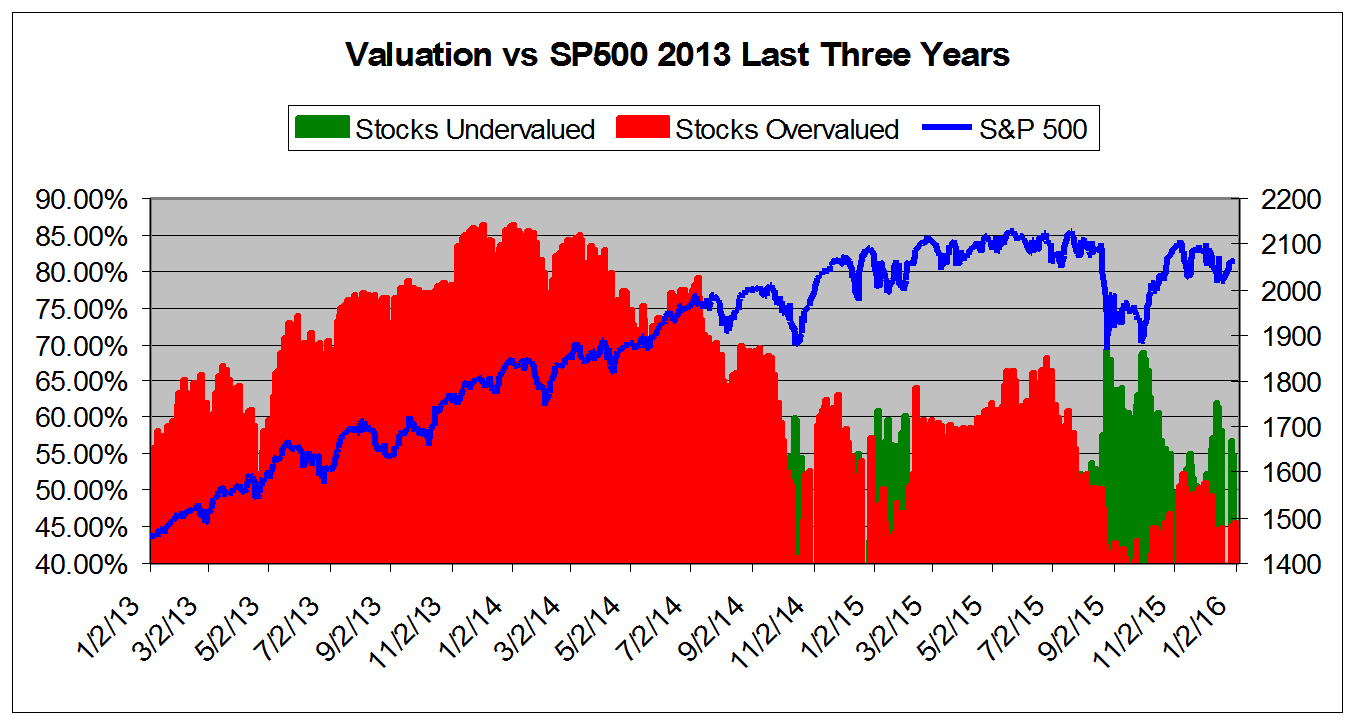

This chart shows overall universe over valuation in excess of 40% vs. the S&P 500 from January 2013

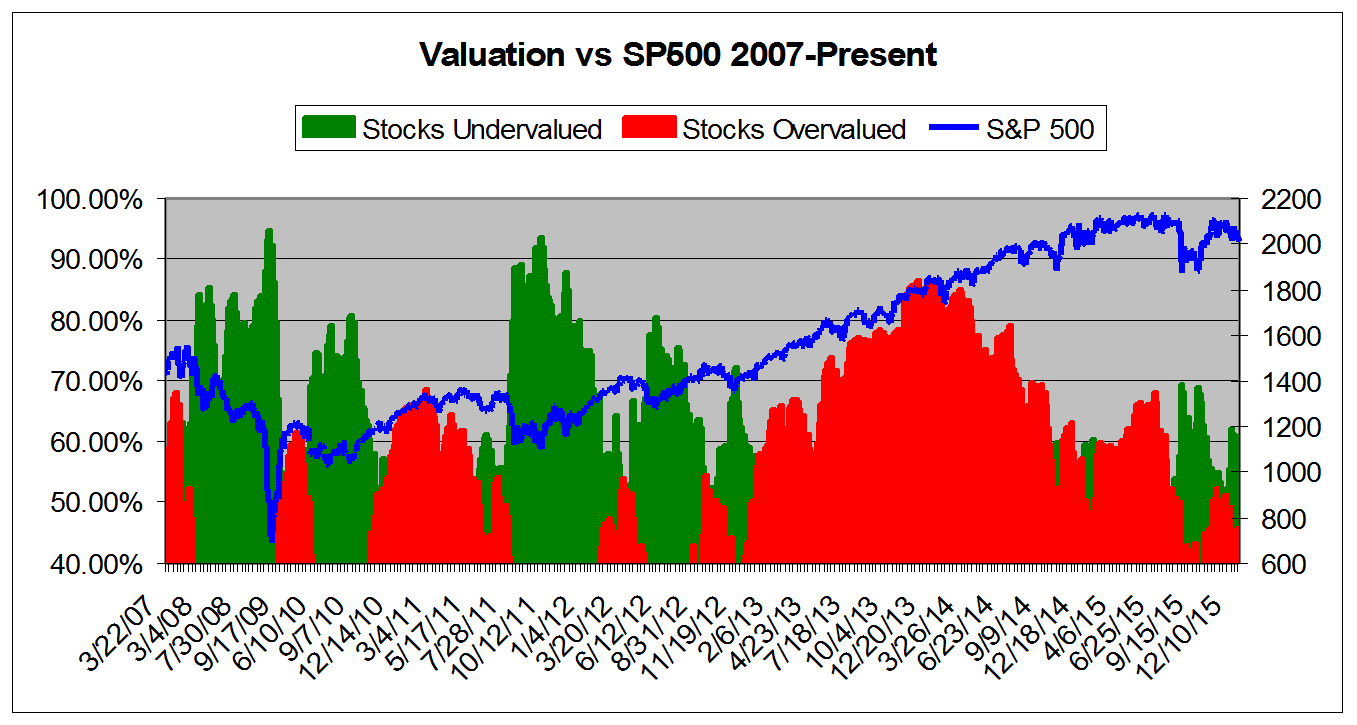

This chart shows overall universe under and over valuation in excess of 40% vs. the S&P 500 from March 2007*

*NOTE: Time Scale Compressed Prior to 2011.