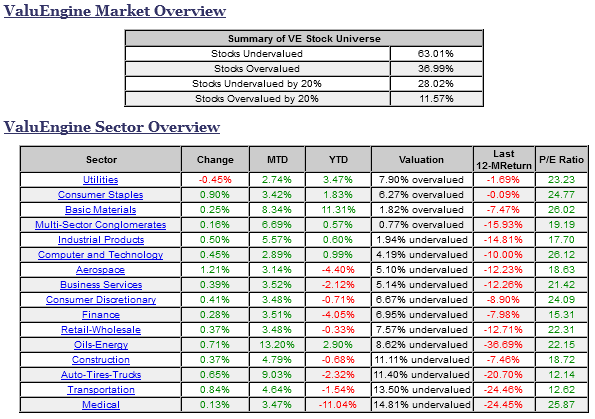

ValuEngine tracks more than 7000 US equities, ADRs, and foreign stock which trade on US exchanges as well as 1000 Canadian equities. When EPS estimates are available for a given equity, our model calculates a level of mispricing or valuation percentage for that equity based on earnings estimates and what the stock should be worth if the market were totally rational and efficient--an academic exercise to be sure, but one which allows for useful comparisons between equities, sectors, and industries. Using our Valuation Model, we can currently assign a VE valuation calculation to more than 2800 stocks in our US Universe.

We combine all of the equities with a valuation calculation to track market valuation figures and use them as a metric for making calls about the overall state of the market. Two factors can lower these figures-- a market pullback, or a significant rise in EPS estimates. Vice-versa, a significant rally or reduction in EPS can raise the figure. Whenever we see overvaluation levels in excess of at 65% for the overall universe and/or 27% for the overvalued by 20% or more categories, we issue a valuation warning.

We now calculate that 36.99% of the stocks we can assign a valuation are overvalued and 11.57% of those stocks are overvalued by 20% or more. These numbers are pretty much identical to what we saw the last time we published our valuation study at the beginning of March. We saw values climbing well into "normal" range--between 40-60%--during the market rally since then, but they have declined a bit with the latest pull back..

In case you hadn't noticed, the US is in a presidential election cycle, which has often correlated to a good year for stocks in the past. However, this year we see a variety of challenges. Every bit of good news about the US economy gets negated by something in China, or on the world-wide commodities markets, or in the energy sector, etc.

We need to wait and see what happens this cycle. We remain confident that if the Fed manages to curb its appetite for rate increases in order to allow US workers to benefit from the recovery--finally--we will see decent growth here. Of course, this pre-supposes election results which do not end up in new austerity measures, government shut downs, etc.

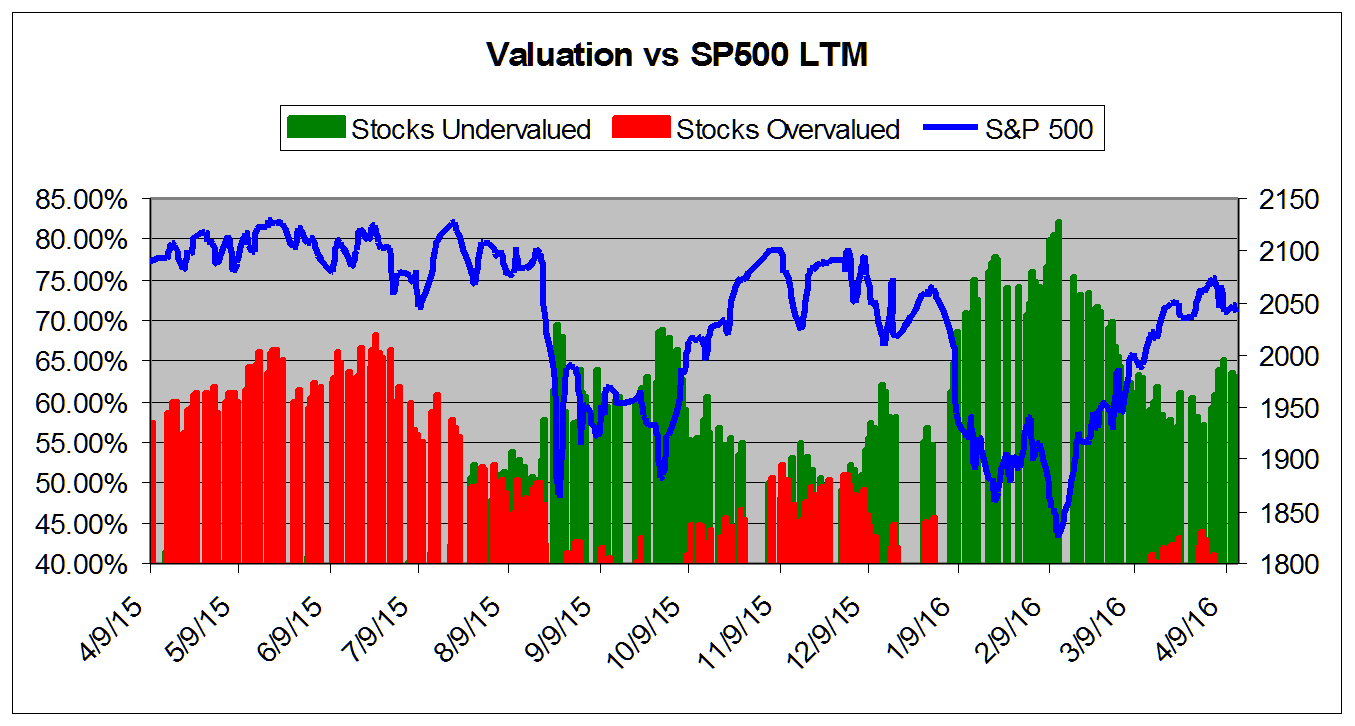

The chart below tracks the valuation metrics from April 2015. It shows levels in excess of 40%.

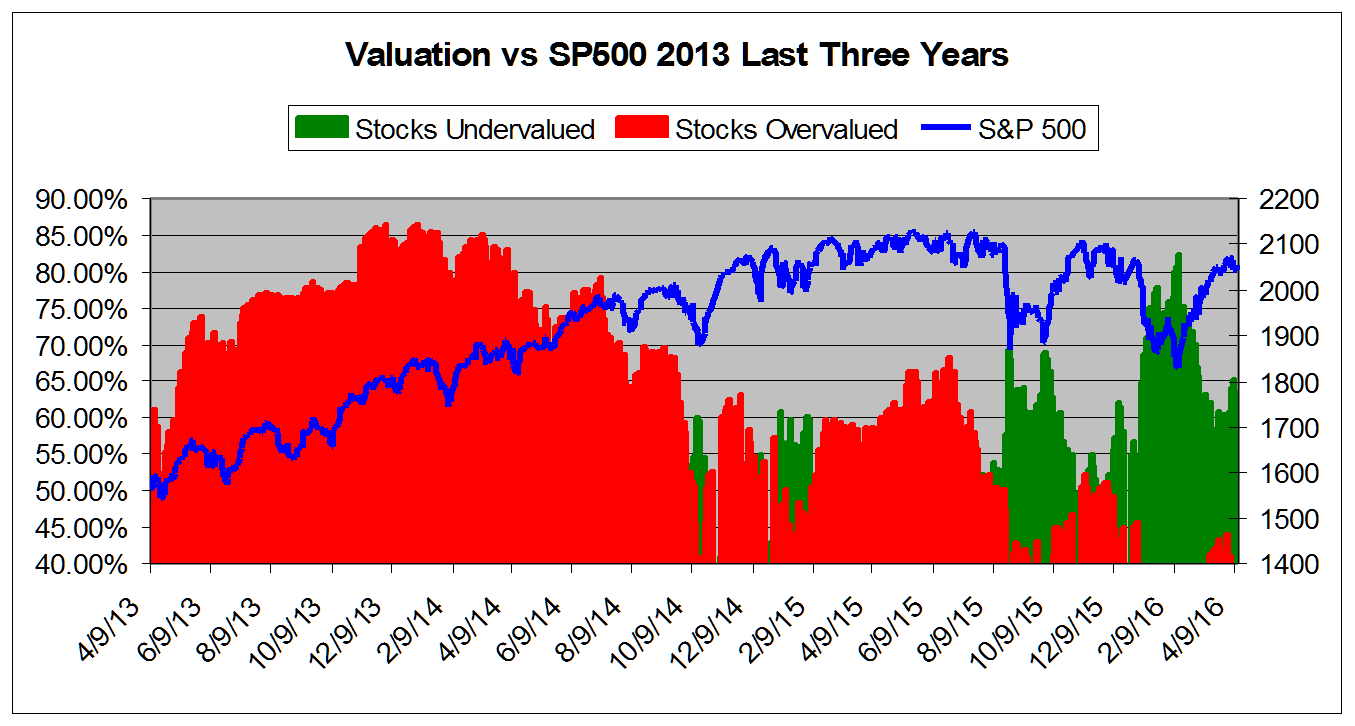

This chart shows overall universe over valuation in excess of 40% vs the S&P 500 from April 2013.

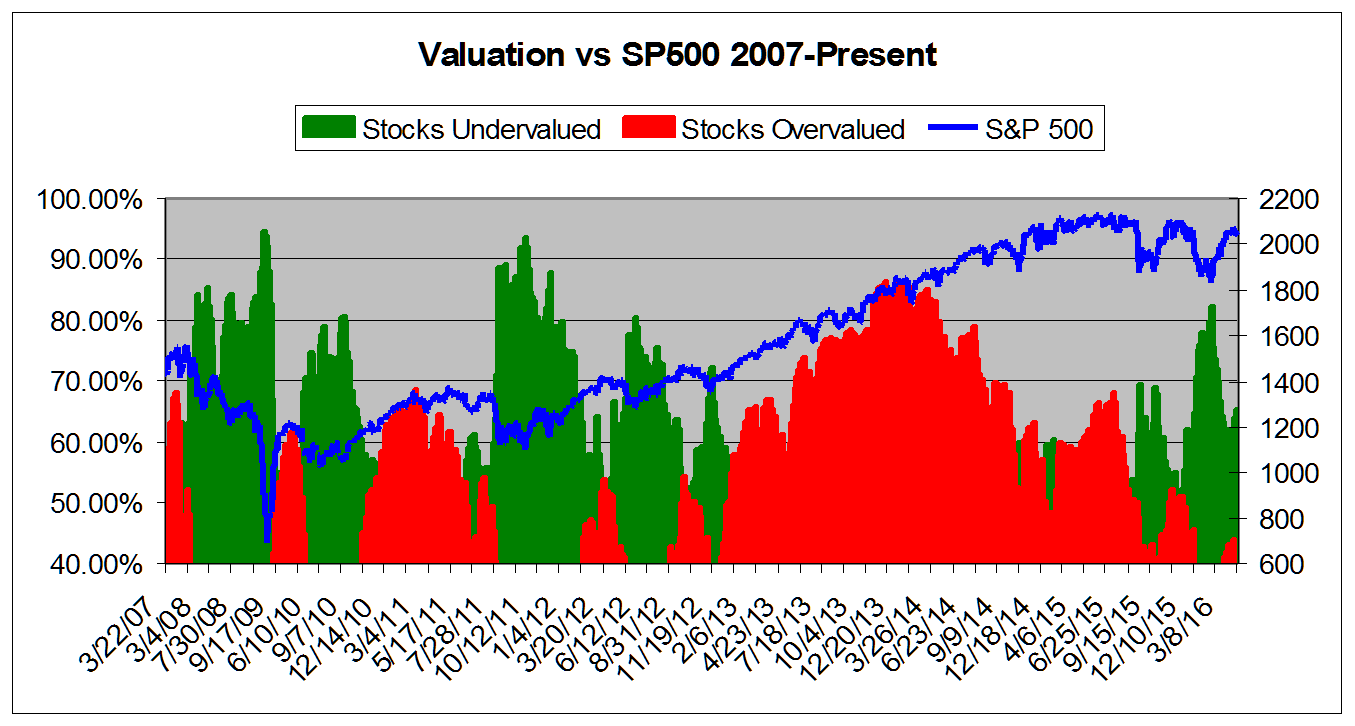

This chart shows overall universe under and over valuation in excess of 40% vs the S&P 500 from March 2007.