The Zacks Medical – Products industry comprises companies that provide medical products and top-notch technologies for diagnosis, observation, consultation, treatment and other healthcare services. Focus on research and development is the primary area of focus for companies in the space.

The industry caters to important therapeutic areas like cardiovascular devices, nephrology and urology devices, ophthalmic devices, neurological devices, dermatological devices, respiratory devices, skin care devices, dental devices, orthopedic devices and gastrointestinal devices.

Let us take a look at the three major themes in the industry:

- AI, Medical Mechatronics & Robotics: The growing prevalence of minimally-invasive robot-assisted surgeries, self-automated home-based care, use of IT for quick and improved patient care, and shift of the payment system to a value-based model indicate the growing significance of AI in the Medical Products space. Mechatronics — a high-end technology incorporating electronics, machine learning and mechanical engineering — also characterizes the industry now. Intuitive Surgical (NASDAQ:ISRG) (ISRG) deserves a mention with respect to AI, robotics and medical mechatronics. The company designs, manufactures and markets the da Vinci surgical system — an advanced robot-assisted surgical platform. This Mechatronic-based platform enables minimally-invasive surgery that helps reduce trauma associated with open surgery.

- Rampant M&As: In recent times, there has been a pickup in M&A activities in this space. This strategy has been aiding dominant Medical Products players to expand customer bases and gain leverage apart from lessening pricing pressure and competition. Of the recent ones, Aurora Cannabis Inc.’s (ACB) acquisition of Whistler Medical Marijuana Corporation deserves a mention. The buyout is expected to provide Aurora with an exceptional and differentiated organic certified product portfolio. This in turn will expand both its medical and consumer offerings, and fortify Aurora's presence in the already strong West Coast cannabis market.

- Emerging Markets Hold Promise: Given the rising medical awareness and economic prosperity, emerging economies have been witnessing solid demand for medical products. An aging population, relaxed regulations, cheap skilled labor, increasing wealth and government focus on healthcare infrastructure make these markets a happy hunting ground for global medical device players.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Medical Products industry falls within the broader Zacks Medical sector. It carries a Zacks Industry Rank #97, which places it in the top 38% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few insurance broker stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry’s Stock Market Performance

The industry has outperformed both its sector and the Zacks S&P 500 composite in the past year.

The industry has increased 4.1% over this period compared with the S&P 500’s growth of 2.4%. However, the broader sector has declined 4.9%.

One Year Price Performance

Industry’s Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E) ratio, which is commonly used for valuing medical stocks, the industry is currently trading at 24.38X compared with the sector’s 20.14X and the S&P 500’s 16.70X.

Over the past five years, the industry has traded as high as 25.04X and as low as 16.77X, with the median being at 19.44X as the charts show below.

Price-to-Earnings Forward Twelve Months (F12M)

Price-to-Earnings Forward Twelve Months (F12M)

Bottom Line

Given the bipartisan two-year suspension of a 2.3% excise tax on Medical Products and Medical Device manufacturers at the beginning of 2018, the industry witnessed massive investments. The reintroduction of the controversial 2.3% medical device tax’ repeal by the Senate in April 2019 has bolstered optimism.

Meanwhile, per a CISION report, the United States remains the largest Medical Products market in the world with a market size of approximately $156 billion. The industry has been raking in more than $180 billion a year due to rising research and development activities and growing exposure to AI.

Here, we present three stocks that sport a Zacks Rank #1 (Strong Buy). These stocks are well positioned to grow in the near term. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cardiovascular Systems, Inc. (CSII)

Cardiovascular Systems, Inc. is a medical device manufacturer that develops and commercializes innovative solutions to treat patients suffering from peripheral and coronary arterial diseases, including those with arterial calcium.

The company delivers a unique, patented Orbital Atherectomy System (OAS) of products that remove calcified and fibrotic plaque in arterial vessels throughout the leg and heart in very short treatment time.

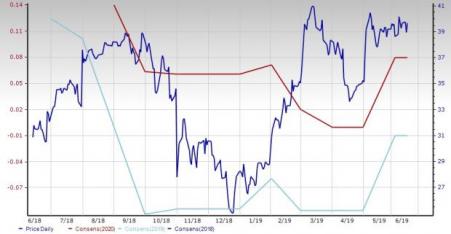

For this St. Paul, MN-based company, the Zacks Consensus Estimate for 2019 revenues indicates year-over-year improvement of 13.3%. It has an average positive earnings surprise of 77.08% in the trailing four quarters.

Price and Consensus: CSII

Haemonetics Corporation (HAE)

Haemonetics Corporation (HAE) provides blood management solutions to customers including blood and plasma collectors, hospitals and health care providers globally. The company’s portfolio of integrated devices, information management, and consulting services offers blood management solutions for each facet of the blood supply chain, resulting in better clinical outcomes.

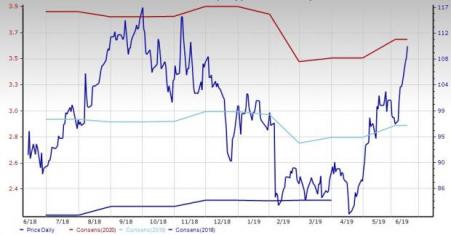

For this Braintree, MA-based company, the Zacks Consensus Estimate for 2019 revenues indicates year-over-year improvement of 4.2%. It has an average positive earnings surprise of 15.47% in the trailing four quarters.

Price and Consensus: HAE

Quidel Corporation (QDEL)

Quidel Corporation discovers, develops, manufactures and markets point-of-care, rapid diagnostic tests for detection of medical conditions and illnesses. These products provide accurate, rapid and cost-effective diagnostic information for acute and chronic conditions that affect women's health throughout the phases of their lives including reproductive status, pregnancy management and osteoporosis.

For this San Diego, CA-based company, the Zacks Consensus Estimate for 2019 revenues indicates year-over-year improvement of 1.6%. It has an average positive earnings surprise of 24.76% in the trailing four quarters.

Price and Consensus: QDEL

Quidel Corporation (QDEL): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Haemonetics Corporation (HAE): Free Stock Analysis Report

Cardiovascular Systems, Inc. (CSII): Free Stock Analysis Report

Aurora Cannabis Inc. (ACB): Free Stock Analysis Report

Original post

Zacks Investment Research