Valero Energy Corporation (NYSE:VLO) is set to report fourth-quarter 2019 results on Jan 30, before the market opens.

In the last reported quarter, the company came up with earnings of $1.48 per share that surpassed the Zacks Consensus Estimate of $1.35 on the back of lower total cost of sales and the Diamond Green Diesel plant expansion.

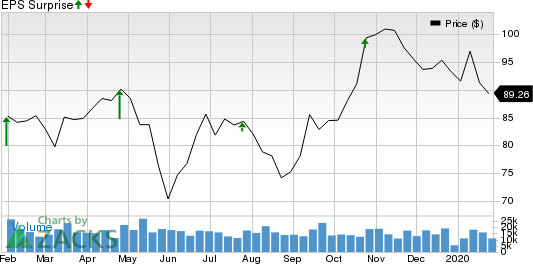

Notably, the leading independent refining player surpassed the Zacks Consensus Estimate in each of the last four quarters, with the average being 48.9%, as shown in the chart below.

Let’s see how things have shaped up prior to the announcement.

Trend in Estimate Revision

The Zacks Consensus Estimate for fourth-quarter earnings of $1.60 has seen four upward and downward revisions each in the past 30 days. The figure suggests a year-over-year decline of 24.5%.

Further, the Zacks Consensus Estimate for revenues is pegged at $27.6 billion for the quarter, indicating a decline of 4% from the year-ago reported figure.

Factors to Consider

With refining contributing the most among all operating segments of Valero, which is one of the largest refiners in North America, weak refined petroleum products demand is likely to have hurt the company’s fourth-quarter profit and lowered total throughput volumes.

The Zacks Consensus Estimate for the total refining throughput volumes is pegged at 2,929 thousand barrels per day (Bbls/d), indicating a decline from the year-ago quarter’s 3,013 Bbls/d. As such, the Zacks Consensus Estimate for operating income from the Refining segment is pegged at $1,263 million, suggesting a decrease from $1,481 million in the year-ago quarter. This might have affected the company’s fourth-quarter bottom line.

However, the Zacks Consensus Estimate for fourth-quarter operating income from the Ethanol segment is pegged at $14.9 million, implying a turnaround from $27 million operating loss recorded in the year-ago period. This is likely to have partially offset the negatives.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Valero this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases chances of an earnings beat. That is not the case here as you will see below.

Earnings ESP: The company’s Earnings ESP is 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate stand at $1.60 per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Valero Energy currently carries a Zacks Rank #3.

Stocks That Warrant a Look

Though an earnings beat looks uncertain for Valero, here are some firms that you may want to consider on the basis of our model. These have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

Enbridge Inc. (NYSE:ENB) has an Earnings ESP of +3.66% and carries a Zacks Rank #2. The company is scheduled to release quarterly earnings on Feb 14. You can see the complete list of today’s Zacks #1 Rank stocks here.

Continental Resources, Inc. (NYSE:CLR) has an Earnings ESP of +7.69% and a Zacks Rank #2. The company is set to release quarterly earnings on Feb 26.

Antero Resources Corporation (NYSE:AR) has an Earnings ESP of +6.02% and a Zacks Rank #3. The company is set to release quarterly earnings on Feb 12.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained an impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Valero Energy Corporation (VLO): Free Stock Analysis Report

Enbridge Inc (ENB): Free Stock Analysis Report

Continental Resources, Inc. (CLR): Free Stock Analysis Report

Antero Resources Corporation (AR): Free Stock Analysis Report

Original post

Zacks Investment Research