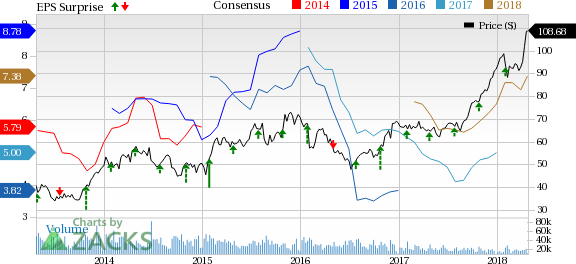

Valero Energy Corp (NYSE:VLO) posted first-quarter 2018 income of $1.00 per share, beating the Zacks Consensus Estimate of 92 cents. Quarterly earnings improved from the year-ago quarter’s figure of 68 cents.

Total revenues grew 21.4% to $26,439.0 million, from $21,772.0 million in the prior-year quarter. The figure surpassed the Zacks Consensus Estimate of $23,530.0 million.

Valero Energy’s results gained from higher throughput margin owing to 94% throughput capacity utilization.

Q1 Segmental Performance

Gross operating income in the Refining segment increased to $922 million from $640 million in the year-ago quarter, beating the Zacks Consensus Estimate of $783 million. The upside can be attributed to higher throughput margin owing to 94% throughput capacity utilization. Moreover, wider spreads between domestic sweet crude oil and Brent contributed to growth.

Ethanol gross operating income increased to $45 million from $22 million in the year-ago quarter and beat the Zacks Consensus Estimate of $34.86 million. The upside was led by higher distillate margins in most regions.

Gross operating income from the VLP segment was $84 million compared with $70 million in the prior-year quarter and surpassed the Zacks Consensus Estimate of $80 million. The increase was primarily due to new acquisitions made in the end of 2017. The acquired assets, which boosted growth, were the Port Arthur terminal assets and Parkway Pipeline.

Corporate and other segment reported gross expenses of $250 million, up from the year-ago quarter’s level of $192 million. The figure was wider than the Zacks Consensus Estimate of $212 million.

Throughput Volumes

In the quarter under review, refining throughput volumes were approximately 2.9 million barrels per day, up from 2.8 million barrels per day in the year-ago quarter. The figure surpassed the Zacks Consensus Estimate of 2.8 million barrels per day.

By feedstock composition, sweet crude, medium/light sour crude and heavy sour crude accounted for 45.9%, 13.9% and 16.4%, respectively. The remaining volumes came from residuals, other feedstock as well as blendstocks and others.

The Gulf Coast accounted for approximately 59% of the total throughput volume. The Mid-Continent, North Atlantic and West Coast regions accounted for 16%, 16% and 9%, respectively.

Throughput Margins

Refining margin per barrel of throughput increased to $8.36 per barrel from the year-ago quarter’s level of $8.14 per barrel but missed the Zacks Consensus Estimate of $8.8 per barrel.

Refining operating expense per barrel was $3.78 compared with $3.87 in the year-ago quarter. Depreciation and amortization expenses declined year over year to $1.69 a barrel from $1.76.

Capital Expenditure & Balance Sheet

First-quarter capital expenditure totaled $631.0 million, including $448 million for turnarounds and catalyst expenditures. At the end of the completed quarter, the company had cash and temporary cash investments of $4.7 billion and debt of $9 billion. Valero Energy returned shareholders $665 million, of which $320 million was used to repurchase 3.5 million of its common stock and award shareholders with dividends worth $345 million.

For 2018, the company expects capital expenditures of $2.7 billion, which is in line with 2017 levels.

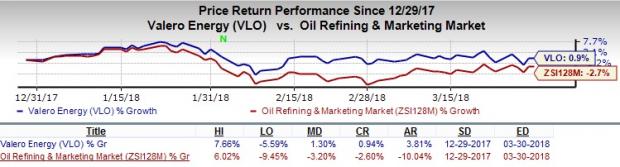

Q1 Price Performance

During the January-to-March quarter, Valero Energy’s shares inched up 0.9% versus the industry’s 2.7% decline.

Zacks Rank & Key Picks

Valero Energy currently carries a Zacks Rank #3 (Hold).

A few better-ranked players in the same sector are Nine Energy Service, Inc (NINE), Baytex Energy Corp (TO:BTE) and SunCoke Energy Inc (NYSE:SXC) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nine Energy Serviceis engaged in delivering onshore completion and production services to unconventional oil and gas resource development. The company posted a positive earnings surprise of 6.25% in the preceding quarter.

Baytex Energy is a conventional oil and gas income trust focused on maintaining its production and asset base through internal property development and delivering consistent returns to its unitholders. It pulled off an average positive earnings surprise of 77.3% over the last three quarters.

SunCoke Energy produces metallurgical coke in the United States. The company delivered an average positive earnings surprise of 130.6% in the last four quarters.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

SunCoke Energy, Inc. (SXC): Free Stock Analysis Report

Valero Energy Corporation (VLO): Free Stock Analysis Report

Baytex Energy Corp (BTE): Free Stock Analysis Report

Original post

Zacks Investment Research