- Trade talks with China are “back on track” according to Donald Trump, over the weekend. Improved sentiment currently sees gold amid its most bearish session since March and the S&P 500 gap to a record high.

- A weak set of PMI data across Asia weighed on AUD. South Korea’s manufacturing PMI contracted for a 2nd consecutive month and, at 47.5, is its 2nd fastest contraction in four years. China’s manufacturing PMI contracted for a 2nd consecutive month. Neither of these reads bode well for global growth. Australia’s manufacturing PMI contracted for the first time since August 2016, at 49.4 versus 52.7 prior. Japan’s Tankan index also missed expectations.

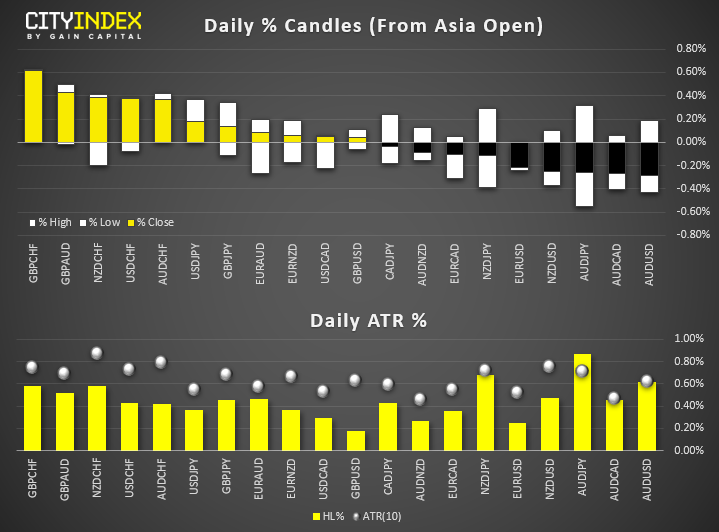

- AUD/JPY is the biggest mover of the Asian session, hitting an intraday low of -0.55% and exceeding its typical daily range.

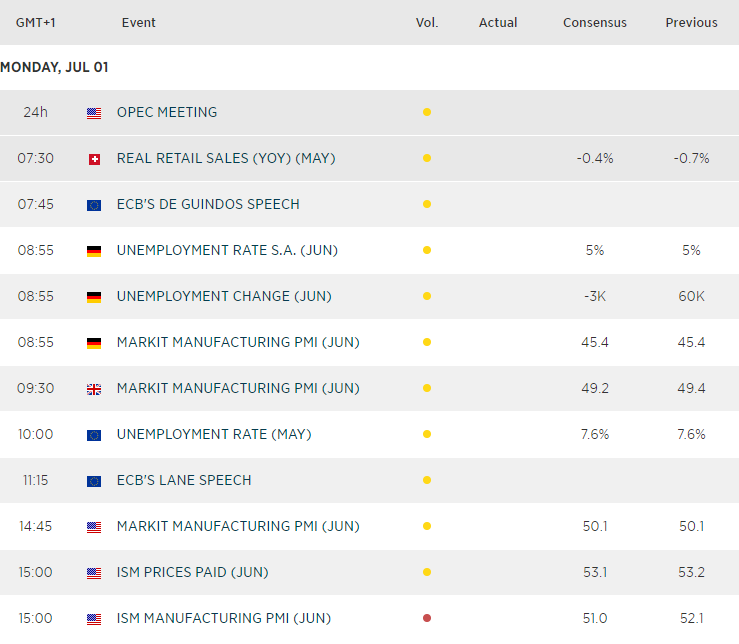

Up Next:

Being the start of the month, traders will be keeping an eye on global PMI data, which can give a forward look for growth and company earnings. Today sees flash manufacturing PMI data released for Germany, France, Europe, UK and US.