Risk appetite improved yesterday following a cocktail of developments, including news that a vaccine trial from a US company showed promising results. As for the data, today, we already got the UK jobs report for March, which came in better than expected. However, we doubt that this set could alter expectations around the BoE’s monetary policy plans.

RISK APPETITE IMPROVES ON VACCINE HOPES

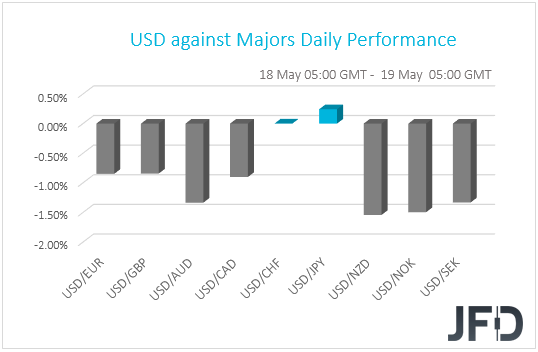

The dollar traded lower against all but two of the other G10 currencies on Monday and during the Asian morning Tuesday. It underperformed the most against NZD, NOK, SEK and AUD, while it gained only versus JPY. The greenback was found virtually unchanged against CHF.

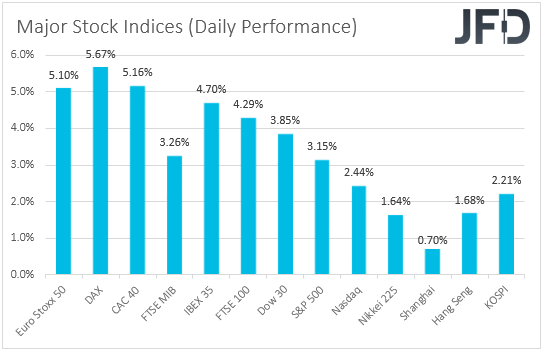

The strengthening of the risk-linked currencies, combined with the weakening of the dollar and the traditional safe havens yen and franc, suggests that risk appetite was boosted yesterday. Indeed, major EU and US indices were a sea of green, with the positive investor morale rolling into the Asian session today.

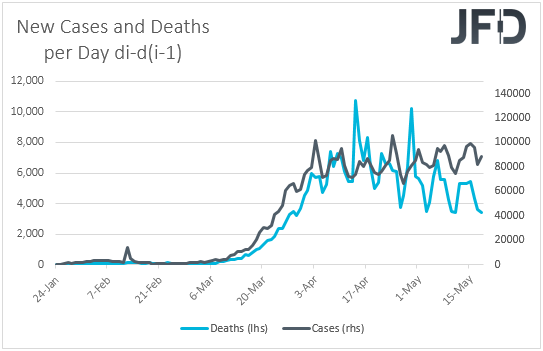

There was not a single catalyst behind the rebound in market sentiment. It was rather a cocktail of developments. Firstly, over the weekend, Fed Chair Powell reaffirmed the Committee’s commitment that more monetary stimulus could be introduced if deemed necessary, adding that they have not run out of ammunition, even if they prefer to avoid cutting interest rates into negative waters. Powell is scheduled to testify before the Senate Banking Committee today on how the current rescue efforts are working. Second, Germany and France called for the creation of a European Recovery Fund worth of EUR 500bn aiming at helping the Union exiting the crisis the quickest possible. Last and most important, drug-maker Moderna (NASDAQ:MRNA) Inc. said that its Covid-19 vaccine trial showed encouraging results.

On Friday, we noted that lately, it seems there is a battle between those who are afraid that easing the restrictions too soon will result in another wave of exponential spreading of the virus, and those who believe that the peak is behind us and that economies around the globe have entered the road to recovery. Although this pushed us to the sidelines for a while, the latest developments tip the scale towards more upside. In other words, more monetary and fiscal stimulus, combined with speculation that a vaccine could be ready earlier than previously anticipated and a flattening curve of the virus spreading, may allow equities and risk-linked currencies to drift north, as investors abandon safer assets, like bonds, the dollar, the yen and the franc.

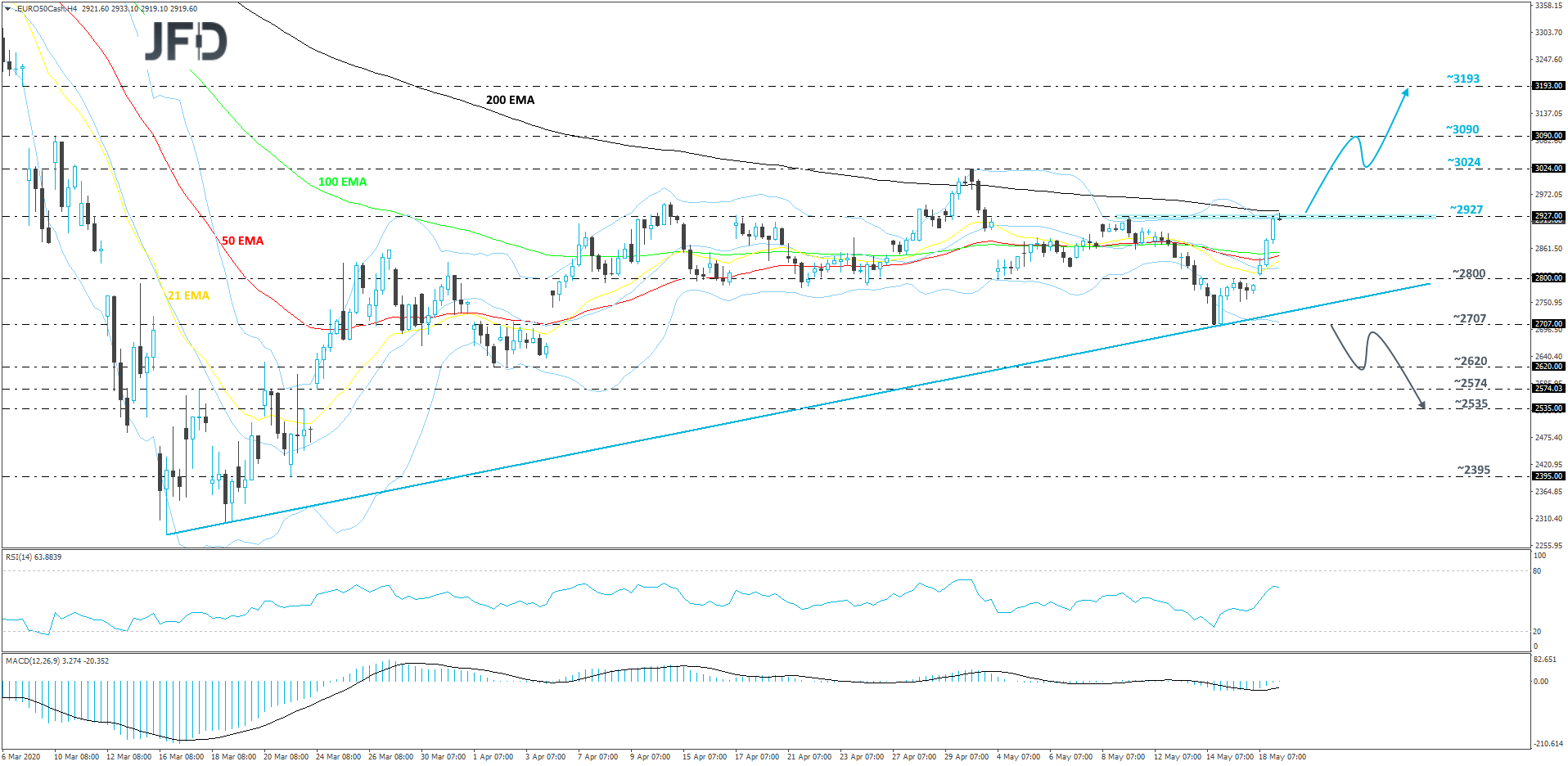

EURO STOXX 50 – TECHNICAL OUTLOOK

Last week, Euro Stoxx 50 drifted lower, but got held near a short-term tentative upside support line, from which it then rebounded and is now trying to make its way back up again. Looking at our cash index at the time of writing, the price is getting a hold-up near the high of last week, at 2927, which is also near the 200 EMA on the 4-hour chart. We will remain bullish with the near-term outlook, but to get a bit more comfortable with higher areas, we would like to see a strong push above last week’s high and the 200 EMA.

A strong move above the previously-mentioned 2927 barrier and the 200 EMA, may give hope to more bulls and could increase the chances of the index to drift higher. That’s when we will aim for the April high, at 3024, a break of which might set the stage for a test of the 3090 hurdle, which is the high of March 10th. The price might stall there for a bit, or even correct a bit lower. However, if the bulls are still feeling more comfortable, they could give Euro Stoxx 50 another push. If this time the 3090 hurdle surrenders, the next potential resistance level to consider may be the low of March 6th, at 3193.

Alternatively, in order to shift our attention to downside, we will wait for a violation of the aforementioned upside line and a price-drop below the 2707 hurdle, which is the current lowest point of May. If such a move occurs, this would confirm a forthcoming lower low and more sellers may jump into the action. Euro Stoxx 50 could then drift to the 2620 zone, which is the lowest point of April. That area might temporarily stall the index, however, if eventually that area breaks, this could lead to another decline. The price may then travel to the 2574 obstacle, or even the 2535 hurdle, which are marked by the low of March 24th and by an intraday swing high of March 23rd respectively.

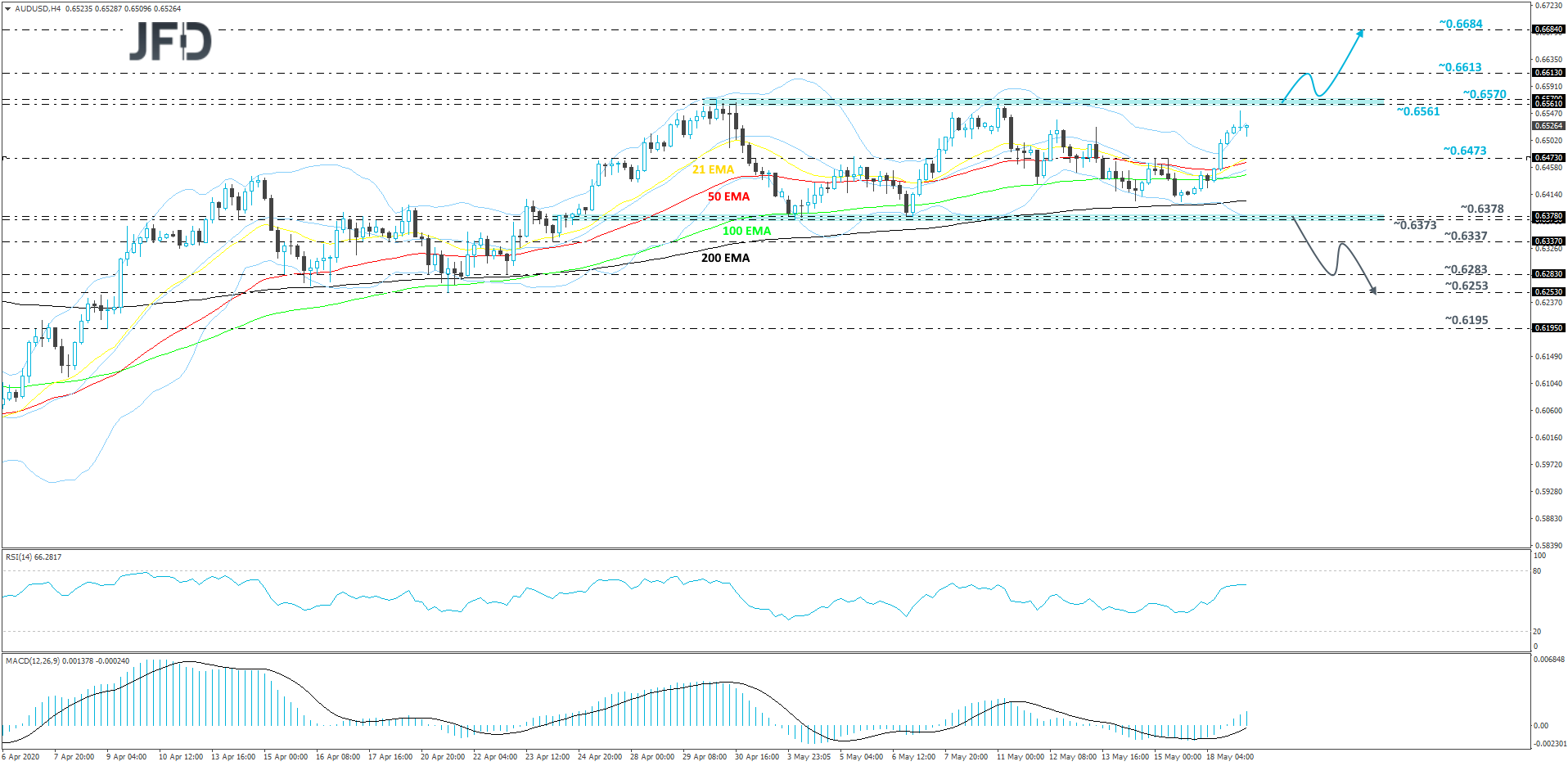

AUD/USD – TECHNICAL OUTLOOK

From around the end of April, AUD/USD is moving sideways, roughly between the 0.6373 and 0.6570 levels. The pair is currently declining, however, we will take a neutral stance, as long as the rate remains inside that range. We need to see a clear breakthrough one of the sides of the range first, before considering the next directional move.

To consider higher levels, we will wait for the upper side of the range to get violated first. If the rate manages to climb above the 0.6570 barrier, such a move will confirm a forthcoming higher high, potentially allowing more bulls to run into the field. AUD/USD could then travel to the 0.6613 obstacle, a break of which might clear the way to the 0.6684 level, marked by the highest point of March.

A drop below the 0.6373 hurdle, which is the lower side of the aforementioned range, would confirm a forthcoming lower low and more sellers could join in. If so, the rate may slide further south, possibly overcoming the 0.6337 obstacle and targeting the 0.6283 zone, marked by the low of April 23rd. Initially, if that area provides some good support, AUD/USD might rebound slightly. That said, if the pair remains below the lower bound of the range, this may attract the sellers, who could take advantage of the higher rate and drag AUD/USD down again. The rate might drop to the 0.6283 obstacle again, a break of which may set the stage for a move to the 0.6253 level, marked by the low of April 21st.

UK JOBS DATA BEAT ESTIMATES, BUT POUND GAINS LITTLE

During the European morning today, we already got the UK’s employment data for March. The unemployment rate ticked down to +3.9% from 4.0%, instead of rising to 4.4% as the forecast suggested, while average earnings including bonuses slowed more than anticipated. However, although the excluding bonuses rate slid as well, it declined less than its own forecast pointed to.

At its latest meeting, the BoE said that the current QE is set to reach its target at the beginning of July, which combined with officials’ readiness to take further action if needed, suggests that a QE expansion may be on the card at the June meeting, even if data continue to come in better than anticipated. Maybe that’s why the poundgained only around 20 pips at the time the employment report was out.

The British currency tumbled on Friday after negotiations between the EU and the UK led nowhere and after the BoE’s Chief Economist Andy Haldane said that the Bank is looking more urgently at negative interest rates. Thus, with the UK PM Johnson insisting that the Brexit transition period should last until December 31st, the prospect of a no-deal exit then, combined with expectations over further easing by the BoE are likely to weigh on the pound, keeping it among the worst-performing G10 currencies.

As for the Rest of Today’s Events

From Germany, we have the ZEW survey for May. The current conditions index is expected to have improved somewhat, but to have remained in negative waters. Specifically, it is expected to have increased to -87.8 from -91.5. The economic sentiment index is also expected to have risen, to 33.5 from 28.2. The overall picture with regards to the coronavirus suggests a flattening curve since early April and thus, a somewhat more optimistic view by analysts appears more than normal to us.

In the US, building permits and housing starts, both for April, are due to be released. Expectations are for both permits and starts to have declined to 1.0mn and 0.950mn from 1.35mn and 1.22mn respectively.

As for the speakers, apart from Fed Chair Powell, we have two more Fed officials on today’s agenda and those are Minneapolis President Neel Kashkari and Boston President Eric Rosengren.