An interesting shift has occurred in recent months that we have covered on a handful of occasions, but given today’s atmosphere and trading conditions, it is worth revisiting again today.

For years, the largest “volatility” product in the marketplace was the “Long” structured VXX (Expense Ratio 0.89%, $1.1 billion in AUM). Recently, VXX has been overtaken by two “Bear” Volatility funds, SVXY (Expense Ratio 0.83%, $1.4 billion in AUM) and XIV (Expense Ratio 1.35%, $1.3 billion in AUM) in terms of asset supremacy.

This has been more of a function of notable inflows into both SVXY and XIV in 2017, rather than outflows in VXX. These two “Short Volatility” funds have reeled in $840 million and $340 million respectively via creations, while VXX, in spite of punishing performance, has managed to attract more than $700 million year-to-date.

As we pointed out in today’s ETF Fund Flows recap, the latest move in Long Volatility ETPs is a bit perplexing. In instances like today, the VIX itself is actually up small to flat and at approximately $10.57, well above its lows back in late July where it actually traded below $9 very briefly (before soaring to as high as $17 in early August only to spiral back to current levels).

Meanwhile, Long Volatility ETPs such as VXX and the levered long UVXY (Expense Ratio 0.86%, $536 million in AUM) and TVIX (Expense Ratio 1.65%, $252 million in AUM) are literally cratering day after day lately, with UVXY trading at a new all-time product low this morning, and VXX, which recently underwent a reverse split, in danger of creating a new all-time low as well if this trend does not reverse.

While we have not seen a ton of redemption pressure this month in either of these long products (VXX -$14 million and UVXY actually has pulled in an impressive $183 million month-to-date), contango in the VIX futures markets are clearly hampering short-term performance, as it typically does, for these funds.

Thus, given this atmosphere that does not appear to be changing anytime soon, for in spite of a few “Flash Rallies” higher in the VIX the equity markets continue to march higher on relatively lower volatility levels from month-to-month, it is no wonder that investors have been flocking to “Short Volatility” products like SVXY and XIV and capitalizing on the contango situation.

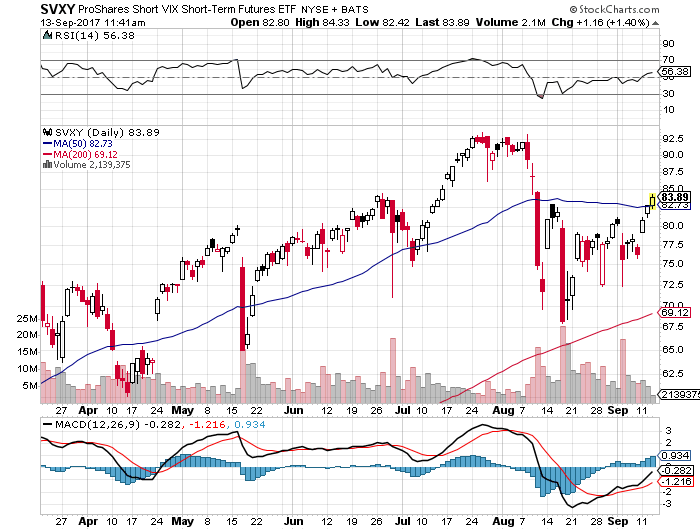

The ProShares Short VIX Short-Term Futures ETF was trading at $84.15 per share on Wednesday morning, up $1.42 (+1.72%). Year-to-date, SVXY has gained 84.99%, versus a 12.87% rise in the benchmark S&P 500 index during the same period.

SVXY currently has an ETF Daily News SMART Grade of B (Buy), and is ranked #1 of 6 ETFs in the Inverse Volatility ETFs category.