Utilities and Natural Gas

The Test

We will make this as simple as possible:

- If the current month is January, February or December, hold Utilities.

- If the current month is March or April, hold natural gas.

- For all other months, hold a money-market fund.

The Funds

- For Utilities, we will use ticker FSUTX

- For natural gas, we will use ticker FSNGX

- For money market, we will use ticker VMMXX

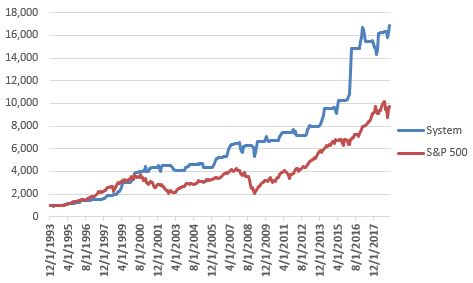

Figure 1 – “System” Calendar

The Results

Figure 2 displays the growth of $1,000 invested using the rules above (utilities held Dec through Feb, natural gas held March and April, money-market held May through November) versus buying and holding the S&P 500 Index starting in Jan 1993.

Figure 2 – Growth of $1,000 invested using our Utility/Natural Gas strategy

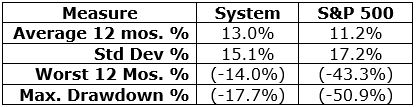

Figure 3 displays some comparative numbers.

Figure 3 – Comparative Results

Summary

So, is this really a viable “system?” That’s not for me to say. The “system” has certain favorable qualities: simple, beat the S&P over time, much less volatile and with lower drawdowns than the overall market. However, there are also certain negatives: out of the market seven months of a year, can get left behind in a strong bull market, 100% focused in one sector five months a year.

Still, the results do generate some interesting food for thought.

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.