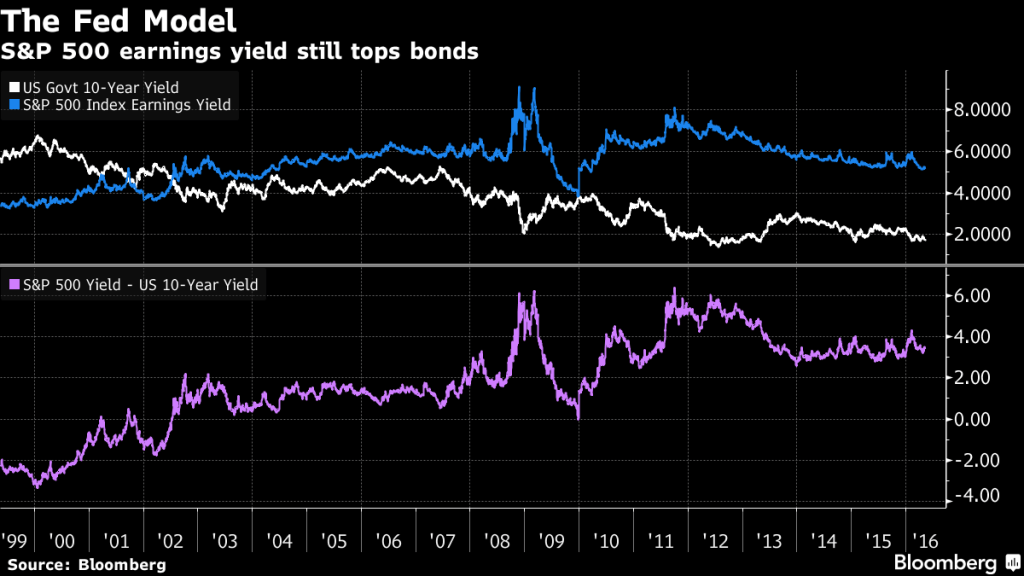

Many investors are pointing to low interest rates today as a way to justify soaring equity valuations. Certainly, investors have felt the need to go out on the risk curve to generate greater return when the lowest risk investments offer none.

However, the fact that investors have done this, and to an incredible degree already, does not make it a valid investment thesis.

In fact, it’s just the opposite. I feel like a broken record referring time and time again to Cliff Asness’ paper, “Fight The Fed Model,” but it seems there are still a lot of folks, and many professionals even, who haven’t yet read it.

One of the points Cliff makes in debunking the idea that low interest rates should justify high S&P 500 valuations is that earnings growth is very highly correlated to interest rates and inflation. When the latter two are low, earnings growth is low, as well. This is important because in order for low interest rates to actually justify higher valuations then this relationship must not hold.

In other words, those who would like to reduce the discount rate in valuing future cash flows must also reduce the growth rate of those earnings. Not doing so is, at best, historically very naive and, at worst, intellectually dishonest.

Right now this is an even bigger deal than ever before simply because rates are so extremely low and valuations so extremely high. If using the Fed Model during “normal” times is a problem, then to assume that interest rates will remain as low as they are today and that earnings growth will be anywhere near historical averages over the next decade is exponentially more troublesome.

Relying on the Fed Model is essentially betting that the relationship between earnings growth and inflation will not hold going forward, despite over a century of evidence to the contrary. Either that, or you’re just relying on TINA (“There Is No Alternative” – to owning stocks) to prove the “greater fool theory.” And to me, those both sound like very dangerous propositions for long-term investors.