Improved foreign environment makes USD/RUB more likely to go back into the trading range of 61-65

What can be better than a fresh breath of air for someone, who has been imprisoned for a long time? The stabilization of the U.S. stock market, low risks of more economic sanctions ahead the U.S. midterm election and the bullish state of oil market. However, USD/RUB price would hardly be corrected if the Russian officials hadn’t done some groundwork. The Bank of Russia raised the key rate, abandoned foreign currency purchases and temporarily halted bonds actions; and so the ruble stabilized.

According to 26 Bloomberg experts, the key drivers for the emerging markets’ currencies are the Fed monetary policy, the China’s economy state, local central banks’ activities, political risks, the situation in the commodity markets, the risks of facing the turmoil, like in the other emerging markets, monetary policies of the ECB, The Bank of Japan, and the geopolitical situation as well. In fact, the federal funds rate hike and the concerns about a decline in the Chinese GDP rate, resulted from the U.S.-China trade battle, drew the ruble price to the dollar 14% down in the August-September period. The situation has grown stable in October. As the U.S. inflation fails to grow above its 2% target lowers down the probability of the Fed monetary restriction. Besides, Barclays (LON:BARC) claims the continuous rally of 10-year Treasury yield to be not that dangerous.

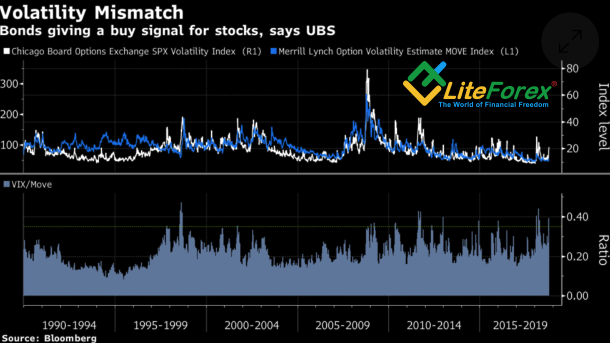

UBS notes that the volatility ratio between the U.S. stocks and the U.S. bonds is up at the critical level. Each time when the indicator was more than 0.35, the S&P 500, in 3 and 6 months, was increasing on average by 6.5% and 16%, respectively. If the same situation repeats, the increased global risk appetite will support all emerging markets’ assets, including the ruble. However, if the stock indexes go deeper, the USD/RUB bears won’t be that happy. If so, the greenback will suffer the most, because of the foreign capitals outflow.

Dynamics of volatility of the U.S. stocks and bonds

Source: Bloomberg

The situation with China is not as bad as it may seem. At present, investors worry that Washington may officially announce China to be currency manipulator; it may result in the China’s lower GDP rate in the third quarter. I believe both issues will be settled down positively for the Asian, and so, the principle “sell on rumours, buy on facts” will work out.

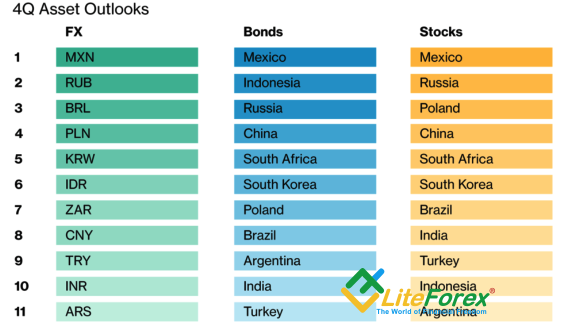

Positive forecasts of the Bloomberg experts for the Russian economy, stable monetary policy of the Bank of Russia and improved international environment suggest that the ruble should outperform the other emerging markets’ currencies, being behind only the Mexican peso.

Forecasts for emerging markets’ currencies

Source: Bloomberg

In my opinion, as the U.S. net long dollar bets, highest since 2017, go gradually down, the USD/RUB bears will be able to draw the Dollar/Ruble rate back into the trading range of 61-65.