- When global stock indices tank, the Japanese yen is usually a big beneficiary of the risk-off trade.

- The weaker-than-expected JOLTS Job Openings survey is weighing on the US dollar.

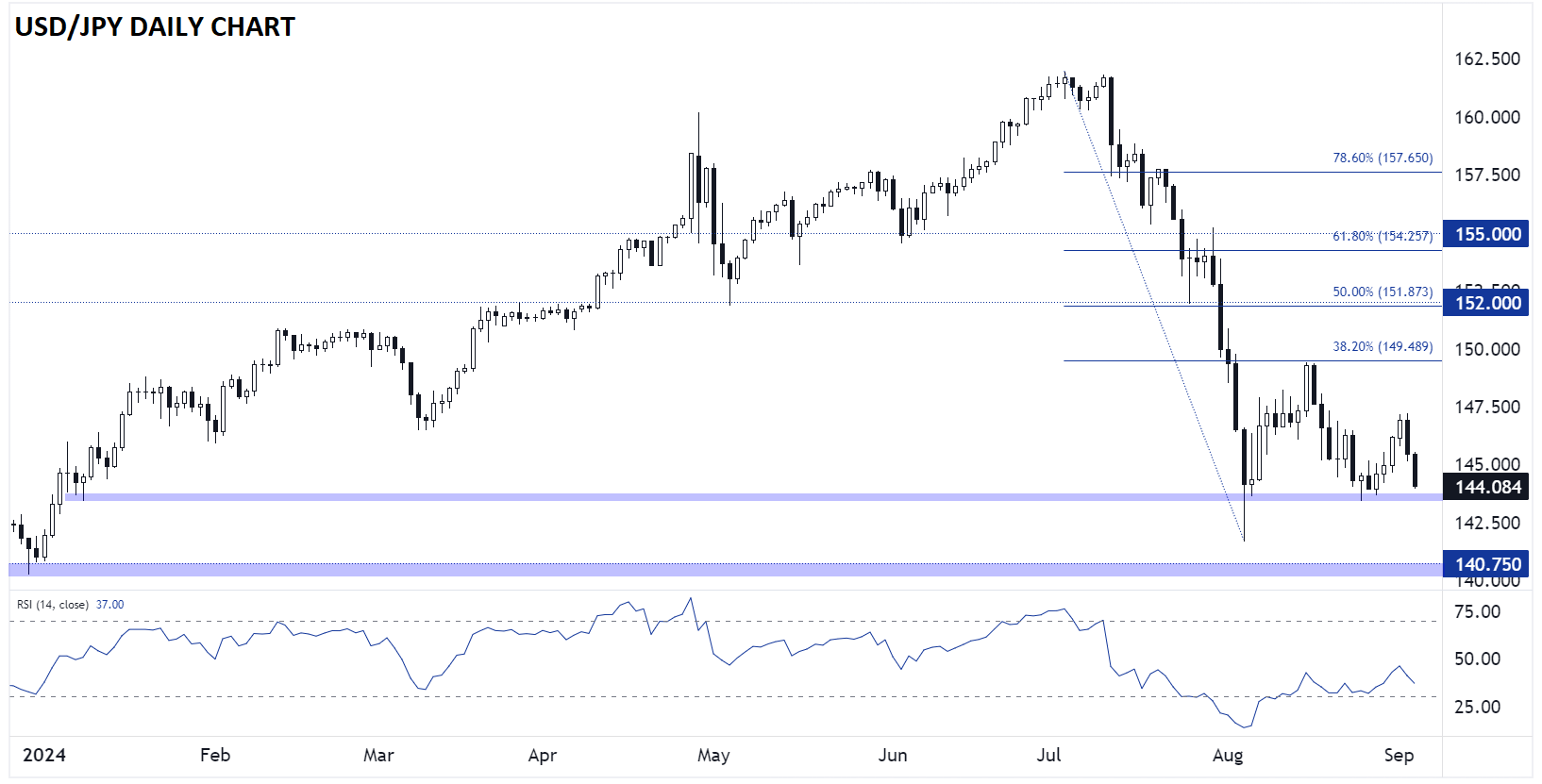

- If 143.50 gives way, a continuation toward the 13-month low around 140.75 could be next for USD/JPY.

It’s a tale as old as time for experienced FX traders: When global stock indices tank, the Japanese yen is usually a big beneficiary of the risk-off trade. After the S&P 500 saw its third-worst day since the start of 2023 day before yesterday (-2.1%), Asian indices saw even larger drops and European bourses saw a second straight day of selling as well.

Keying in on USD/JPY, the weaker-than-expected JOLTS Job Openings survey (7.7M vs. 8.1M expected, lowest reading since April 2021) weighed on the US dollar specifically; after Fed Chairman Powell specifically noted that the Fed would be on high alert for any further deterioration in the job market in Jackson Hole last month, this report has traders on edge ahead of the marquee NFP report.

As it stands, traders are pricing in nearly coin-flip odds (53%/47%) of a 25bps or 50bps rate cut from the US central bank later this month, so tomorrow’s jobs report may be even more market-moving than usual.

Japanese Yen Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX

From a technical perspective, USD/JPY has nearly reversed all of last week’s gains in just the last two days alone. The pair is currently testing previous support near the 143.50 level – if the pair finishes today under that level, it would mark the lowest closing price for USD/JPY since early January.

If 143.00 gives way, a continuation toward the 13-month low around 140.75 could be next, whereas only a big bullish reversal back above 147.00 would end the recent pattern of lower highs and lower lows and flip the near-term bias back to neutral.