A full six weeks ago, we highlighted how the combination of a bearish candlestick formation and a clear divergence in the RSI indicator suggested that USD/CHF could be topping.

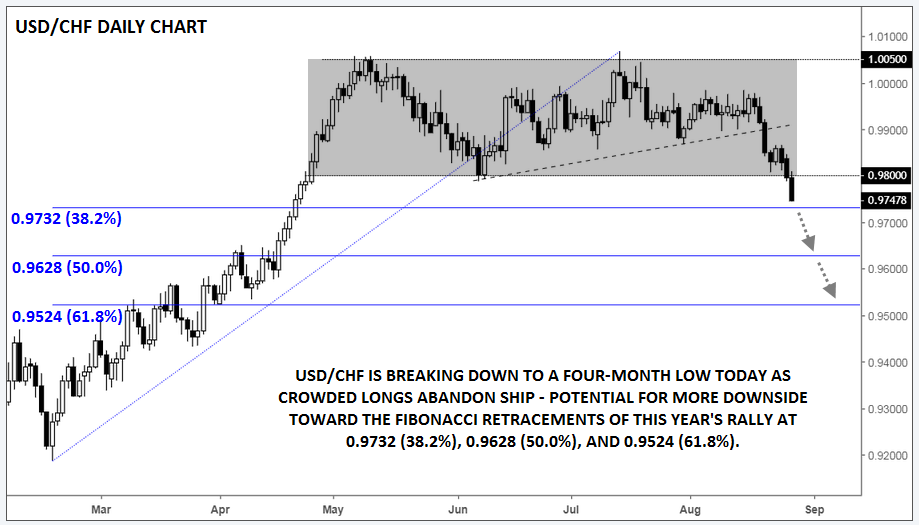

While it has certainly taken longer than expected, USD/CHF has indeed drifted lower since that fateful day, with rates hitting a fresh four-month low under 0.9800 today. With rates now breaking convincingly below the early June support level near 0.9800, the pair could see more downside in the coming weeks.

One big factor that prevented buyers from stepping in to support USD/CHF is that, put simply, there aren’t many large-scale buyers (CHF sellers) left. According to the most recent CFTC Commitment of Trader report, speculators have accumulated a net short position in the Swiss franc to the tune of 65,000 contracts, the largest short position in 11 years! At last check, speculators held nine contracts short for every long contract.

With the bullish USD/CHF trade more crowded than it’s been in over a decade, USD/CHF has struggled to find any fresh fuel to propel it higher. Like a person yelling “fire!” in a crowded theatre, today’s break below support could serve as the catalyst for USD/CHF longs to start panicking and selling aggressively, with little regard for getting out at a favorable price.

Of course, the cross is already trading down by nearly 200 pips from last week’s open, so a short-term bounce is still possible. That said, previous support near 0.9800 may put a ceiling on any near-term bounces, with bears looking to target the Fibonacci retracements of this year’s rally at 0.9732 (38.2%), 0.9628 (50.0%), 0.9524 (61.8%) next. While a break back above 0.9800 could alleviate the near-term bearish bias, it’s hard to see traders growing fully bullish unless rates can break out to new 2018 highs above 1.0070.

Source: TradingView, FOREX.com

Cheers