If you were to look at the where the major currencies are trading relative to Thursday’s US close, you’d think it’s been a pretty quiet day – after all, none of the majors is trading more than 0.3% from the day’s open as of writing. However, that apparent tranquility is masking some big moves (and subsequent reversals) over the last 20 hours.

Pound sterling has gone on a wild ride after US President Trump condemned UK PM May’s Brexit strategy and stated that Boris Johnson would make a great Prime Minister in an interview with The Sun, only to change his tune completely in his recently completed joint press conference with May. After dropping to test 1.3100 at the European session open, GBP/USD rallied back to trade above 1.3200.

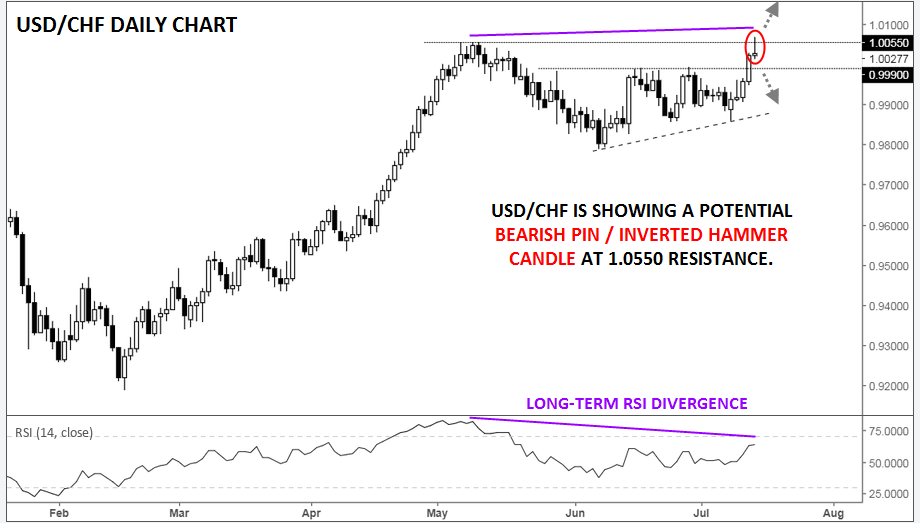

USD/CHF has seen a similar rollercoaster ride, admittedly without a clear fundamental flip-flop to drive the price action. The greenback hit a peak near 1.0070, its highest level in 14 months against the Swiss franc and a 200+ pip rally off Monday’s lows.

That said, the pair has seen a sharp reversal, with rates now trading lower, back near the parity (1.00) level. If we close near current levels, the daily chart would show a clear “bearish pin” or “inverted hammer” candle at 1.0055 resistance. Combined with the big divergence in the daily RSI indicator, this price action could signal a near-term top for the pair.

To The Downside

The next level to watch will be previous-resistance-turned-support at 0.9990, followed by the rising bullish trend line near 0.9900. The only development that would alleviate the bulls’ near-term caution would be a break and close back above Friday's high near 1.0070.

Source: TradingView, FOREX.com

Cheers