The greenback is near the bottom of the relative strength charts for the third day in a row as traders rush to (re)price in the potential for multiple interest rate cuts from the Federal Reserve this year. Meanwhile, the loonie has maintained its strength from the first half of the year, despite BoC Governor Poloz striking a slightly cautious tone on the Canadian economy earlier this week. One factor supporting Canada’s currency has been the recovery of the country’s most important export, with WTI crude oil trading at a 7-week high above $60.

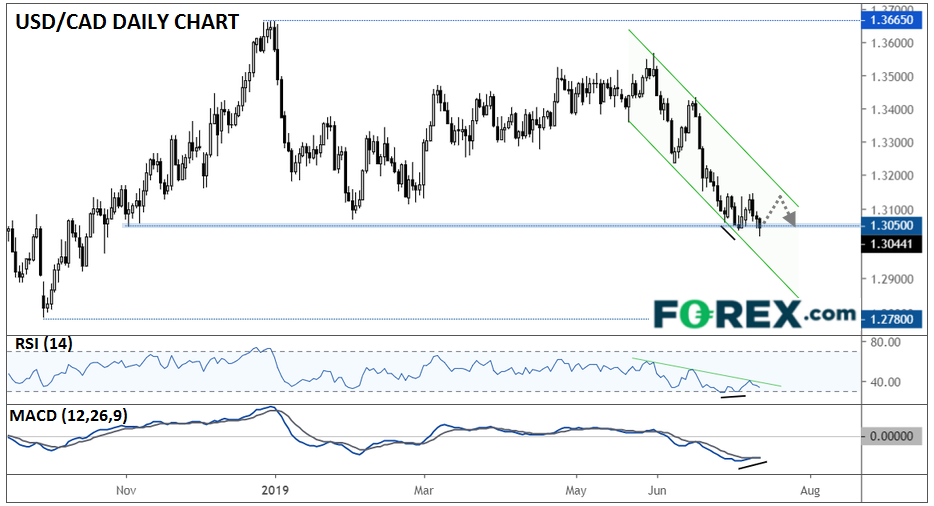

Technically speaking, USD/CAD continues to trend lower within a bearish channel, though there are some signs that the pair may see a short-term bounce. For one, rates are testing a key support zone near 1.3050, an area that USD/CAD hasn’t traded below since October. At the same time, the secondary indicators (RSI and MACD) are both showing possible bullish divergences, signaling that the selling pressure may be waning as rates test support.

Source: TradingView, FOREX.com

While the technical setup suggests an elevated risk of a short-term bounce next week, the fundamental factors (and longer-term technical downtrend) both continue to point lower for now. Therefore, bulls looking to play a potential bounce should be nimble as bearish traders may look at rallies toward the top of the channel as an opportunity to join the downtrend at a favorable price.

At this point, a break and close below the 1.3050 zone could open the door for a continuation toward 1.2900, if not lower, next.