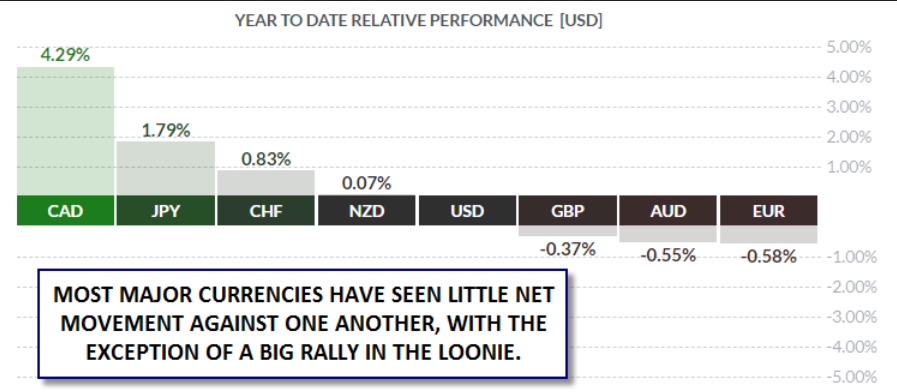

It’s the final trading day of the month, quarter and first half of the year, so we wanted to reset the performance of the major FX pairs so far in 2019. As the below relative performance chart shows, most major currencies have seen relatively little movement against one another, with the major exception of the Canadian dollar’s strength:

Source: FinViz.

In our view, there are two main takeaways from this chart:

1) Political turmoil does not necessarily equate to FX market moves.

If you had told traders six months ago that the UK would have made essentially zero progress on Brexit and was in the process of electing a new PM (and even that PM could be vulnerable in a potential early election in the coming months), they likely would have expected sterling to fall sharply against its major rivals.

Likewise, the escalating trade war, geopolitical tensions in the Middle East, domestic political turmoil and about-face from the Federal Reserve surely would have been expected to have a dramatic impact on the U.S. dollar one way or another. Instead, the currency has moved by less than 1% against the majority of its major rivals so far this year.

Indeed, what’s most remarkable about most of the major currencies so far this year is how unremarkable they’ve been. The year-to-date performance serves as a reminder that traders should not let political issues cloud their analysis; focusing on proven technical methods and fundamental economic drivers tends to be far more reliable than political prognostication.

2) The loonie is off to a blazing start to 2019.

Speaking of fundamental economic drivers, the loonie has been far and away the strongest major currency year-to-date. After a dip in the first two months of the year, Canada’s Ivey PMI has recovered sharply back to the mid-50s, indicating solid economic growth while the rest of the world slows down. Another fundamental factor driving the Canadian dollar higher this year is the rally in oil prices, which have gained around 20% since New Year’s Day, albeit with plenty of volatility along the way.

Perhaps the most important factor driving the loonie’s outperformance this year has been the Bank of Canada’s stance. After hiking rates five times through 2017 and 2018, the central bank has now shifted to a neutral posture. While not a bullish catalyst in itself, in the current environment, “neutral is the new hawkish” when it comes to central bank policy. The BOC could still cut interest rates in Q4 of this year or Q1 2020, but compared to other major central banks such as the Federal Reserve or ECB, the Bank of Canada’s interest-rate outlook is still relatively compelling.

As we flip our calendars into the second half of the year, the year-to-date FX performance serves as a reminder to focus on fundamentals and central-bank policy most of all.

Cheers