The US dollar extended its gains on Monday after a strong ISM services PMI report only added to the view that the Fed would not be in a hurry to ease policy following Friday’s robust jobs data.

The economic data calendar will be a bit light this week, but as the markets continue to reprice US interest rates, this should keep the greenback supported on any short-term dips until something changes fundamentally.

This week, the USD/CAD is among the major currency pairs to watch.

As well as a rising US dollar, the USD/CAD has been supported by the sharp sell-off in crude oil we saw last week, with the US dollar likely to remain in sharp focus after Friday’s strong US jobs report.

The Canadian dollar will remain in focus ahead of the nation’s employment report on Friday.

Powell, FOMC, and Data All Paint a Bullish US Dollar Story

There is little justification for investors to start selling the US dollar at this early stage following a robust jobs report on Friday and a stronger-than-expected ISM services PMI report on Monday.

The jobs report in particular has practically put an end to discussions about an early rate cut.

The greenback’s strong performance over the past couple of days follows its rather bizarre reaction last week following the FOMC meeting.

Despite expectations that investors would refrain from selling the dollar after a hawkish Fed meeting, they did so.

But they couldn’t justify doing so this time as the strong jobs report meant there was a commitment from dollar bulls on this occasion, especially with Powell admitting on Sunday that the Fed is wary of cutting interest rates too soon.

In an interview that was aired Sunday evening, Powell said:

“Danger of moving too soon is that the job’s not quite done, and that the really good readings we’ve had for the last six months somehow turn out not to be a true indicator of where inflation’s heading.”

He added that,

“The prudent thing to do is to, is to just give it some time and see that the data continue to confirm that inflation is moving down to 2% in a sustainable way.”

US Jobs Report was Super-Hot and ISM was Stronger

Powell’s interview was conducted a day before the January jobs report was released.

The data demonstrated widespread strength in the labor market, leading investors to shift from bonds to the dollar on Friday as the headline jobs growth came in well above expectations at 335K.

Meanwhile, the average hourly earnings grew at a sharp pace of 0.6% month-over-month.

The bullish dollar trend is unlikely to reverse unless there is a significant deterioration in US data now.

The prevailing belief in an imminent Fed rate cut was dropped as the likelihood of a March trim was reduced to around 20% before falling to around 15% by Tuesday.

This happened following Monday’s release of stronger ISM services PMI data which came in at 53.4 compared to 52. Expected and 50.6 last.

So, fundamentally, there is little reason to stand in the way of the US dollar rally.

Therefore, currency pairs like the USD/CAD and USD/JPY could be in for more gains as we head deeper into the week. The US dollar index was now above the December peak of 104.26.

USD/CAD Analysis: Key Data Highlights to Watch for Loonie

Considering the relatively light economic data calendar week for US data, the renewed strength in the USD is expected to keep dollar bears at bay, keeping the USD/CAD supported.

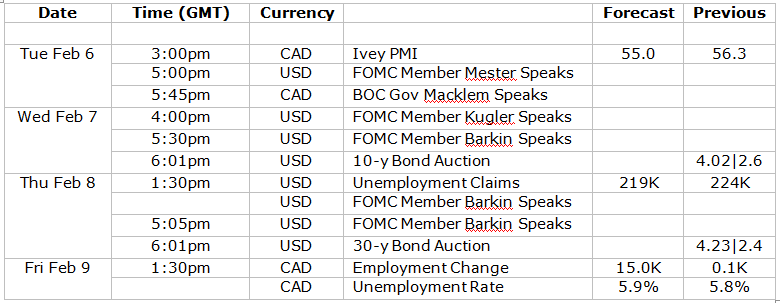

The key data releases relevant to the USD/CAD for this week are listed below, with the key highlight being the monthly jobs report from Canada.

USD/CAD Technical Analysis

The USD/CAD closed Friday’s session with a bullish engulfing candle, similar to many other USD pairs, before showing some follow-through on Monday.

Source: TradingView.com

The rally meant that the USD/CAD would now break through the previous resistance area around 1.3500, or more specifically in the range between 1.3480 to 1.3500.

Here, prior support and resistance meet the 200-day average and a bearish trend line, all of which are now broken following Monday’s extension of the rally.

In light of the two-day rally and a bullish breakout, more upside looks the more likely outcome from here than a bearish reversal. I reckon the stage is set for a continuation of the rally to the December high of 1.3620, and potentially beyond.

In terms of support, the 1.3480-1.3500 area is now the first line of defense for the Bulls. However, even if rates were to dip a little below this area, this wouldn’t trouble the bulls too much.

But in the event of a breakdown below the most recent low at around the 1.3380 support area, then that would be a bearish development. So, the line in the sand for me is around 1.3380.