Another clamourous weekend in the United Kingdom as London bore witness to yet another terrorist atrocity. The markets impact has been mute as dealers are becoming desensitised to the shocks knowing that whatever market impact occurs it diminishes quickly.

While campaigning suspended briefly, the UK election will go on as planned. Election polls have been narrowing significantly, with weekend Survation poll showing Mays lead cut to just one point over Labour. But there is a growing sense amongst traders that this could be UK election 2015 “deja vu all over again .“ Despite the narrowing in the polls, Labour continues to perform poorly outside of big centres like Manchester and London, which suggest May can still achieve a generous majority despite the polls. The pound is only trading 25-30 pips lower than Friday’s close despite the stormy weekend headlines.

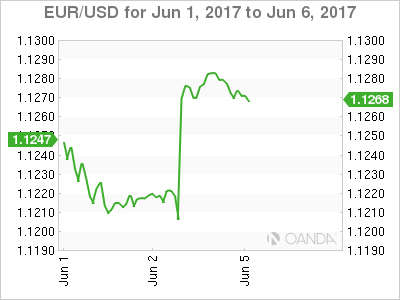

In addition to this week’s UK election focus will be squarely on ECB meeting.The market is pricing in a chance the ECB will remove their easing bias as we near the critical 1.1300 levels ( Nov high) And while catching this policy turn is too juicy for the market to ignore, it could also produce a setup for near-term disappointment on a buy the rumour sell the fact type scenario.

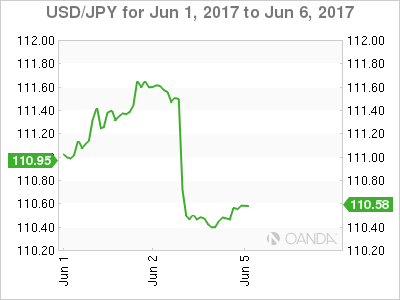

Ugly best describes Friday’s US employment report as the headline miss was compounded by revisions lower to the previous two months data which sent the dollar reeling. Despite the unemployment rate falling and while AHE was in line in a month on month basis, wage growth missed the one-year consensus leaving dealers mulling the lack of inflationary pressure despite low unemployment. And while June hike expectations remain on track, continuance through 2017 remains a question mark as the lack of inflation should dismiss any thought of a paradigm shift in the US monetary system.

Without the support from an active sequencing in US interest rates through the remainder of 2017, the USD will remain vulnerable without its interest rate buffer, even more so as the prospects of US tax reform in 2017 grows dimmer by the day.

Big week for the EURO that continues to trade in an extremely resilient fashion offering few if any buy on dip opportunities. Even last week’s blockbuster ADP report produced little more than a ten pips drop to 1.1200 before buyers snapped up the bargain. But let’s face it positioning for a central bank event is never a walk in the park and as we near the 1.1300 level the risk rewards look less appealing on the assumption that the market has all but priced in a less dovish ECB message. While the market favours long EURUSD, traders will likely lighten inventory ahead of the ECB meeting and UK elections.

Japanese Yen

USD/JPY had the sharpest reaction to Fridays appalling NFP as the pair was “bulled” up after Thursday’s blockbuster ADP report and the healthy risk appetite that ensued. While the softer Fed scenario should be risk supportive, I suspect the USD/JPY will be highly sensitive to US yields this week. Initial support sits at 110.00 but if US yields fail to find some grip we could be viewing a return to the 108 handle.

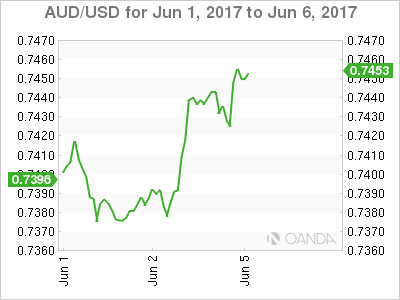

Australian Dollar

The Australian dollar bounced to .7445 post NFP as weak near-term stops triggered above .7415 on the print. But the June US rate hike is still on as employment growing at an average of ~150K is not necessarily bad for an economy running at near full employment. Given this means interest rate differential are paper thin, that interplay for supporting the Aussie is far less significant than in the past and even more so given the RBA anticipated on hold and neutral policy guidance.

I suspect external drivers will remain dominant as in addition to the ECB and UK election highlights; regional focus should fall back on China this week as China’s May trade and export data on Wednesday and its consumer price index release on Friday both of which have the potential to move markets big time.

Also, does the weaker US dollar see further CNH appreciation? While I would view a stronger Yuan providing greater purchasing power and supporting trade, but the notion of tighter financial conditions and PMI’s in the dreaded contraction zone suggests a struggle on the horizon for the Aussie dollar bulls.