USD/SGD has posted slight gains on Monday, following sharp losses in the Friday session. On the release front, it’s a busy day in Singapore, which releases the Unemployment Rate and Retail Sales. There are no US releases on Monday, but on Tuesday we’ll get a look at Retail Sales and PPI reports, with the markets bracing for small declines from these indicators.

As the pair trades just below the 1.38 line in the North American session. In economic news, Singapore Foreign Reserves dipped in February, coming in at S$244.00 billion, compared to S$244.86 billion a month earlier. In the US, it was a quiet start to the week, with two minor indicators on the schedule. The Labor Market Conditions Index came in at -2.4 points, its first decline since April 2015. Consumer Credit will be released later in the day.

Weak global conditions in early 2016 have not brought good tidings for Singapore. GDP dropped in 2015 to 2.0%, down sharply from 3.3% in 2014. CPI, the primary gauge of consumer inflation, has dropped for 15 straight months, prompting the Monetary Authority of Singapore to lower its inflation forecast for 2016. Like developed economies across the globe, Singapore is grappling with weak inflation levels, and the inflation picture has worsened with the collapse in oil prices. Weaker Chinese demand has resulted in softer growth for the tiny island-state, as the Asian giant is Singapore’s largest export market. Still the Singapore dollar has been a bright spot, jumping 3.1% since February 1 against its US counterpart. The Sing is currently trading close to 7-month highs, as investors appear to have become more comfortable holding risk assets such as the Singapore dollar.

US Nonfarm Payrolls surged to 242 thousand in January, much higher than the estimate of 195 thousand. This marked an impressive jump from the previous reading of 171 thousand. The US economy has added an average of 225,000 jobs per month since December, an impressive number considering that the economy has softened in the early part of 2016. Still, employment news was mixed, as wage growth declined by 0.1%, shy of the estimate of a 0.2% gain. This marked the first drop in wages since December 2014. This indicator is closely linked to inflation, since an increase in wages means workers have more money to spend. The indicator’s decline underscores that the Federal Reserve’s inflation target of about 2.0% remains far off, so the Fed, which is keeping a close eye on the weak inflation picture, is unlikely to raise rates at its policy meeting later this month.

USD/SGD Fundamentals

Monday (March 7)

- 4:00 Singapore Foreign Reserves. Actual S$244.00B

- 10:00 US Labor Market Conditions Index. Actual -2.4 points

- 13:00 US FOMC Member Lael Brainard Speaks

- 13:00 US FOMC Member Stanley Fischer Speaks

- 15:00 US Consumer Credit. Estimate 16.8B

*Key events are in bold

*All release times are EST

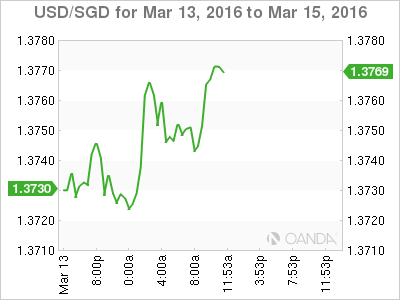

USD/SGD for Monday, March 14, 2016

USD/SGD March 14 at 11:10 EST

Open: 1.3739 Low: 1.3705 High: 1.3769 Close: 1.3768

USD/SGD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3535 | 1.3639 | 1.3721 | 1.3810 | 1.3927 | 1.4016 |

- 1.3810 was tested earlier in resistance and is under pressure

- 1.3721 is providing support

- Current range: 1.3721 to 1.3810

Further levels in both directions:

- Below: 1.3721, 1.3639 and 1.3535

- Above: 1.3810, 1.3927 and 1.4016